Update on AMRK and Manolete Partners

Summary

In this report I will briefly go through the results of A-Mark Precious Metals (NASDAQ: AMRK) and Manolete Partners (LON: MANO). For those of you new to the blog or unfamiliar with these names, I recommend first reading my report on each of them on these links: of A-Mark Precious Metals and Manolete. Nevertheless, here is a brief explanation of both businesses: of A-Mark Precious Metals is a firm that sells gold, silver, platinum, and palladium bullion numismatic coins and related products. Manolete Partners is a specialist insolvency litigation financing company. They fund or buy insolvency claims.

I wrote a report on every medium sized gold company worldwide & AMRK on June the 11th of this year. Since then, AMRK has delivered just over 22% in shareholder returns plus $0.20/share in dividends and $22.4 million in share buy backs. Manolete has not fared so well, since I wrote my report on March the 27th it has gone up just over 4% and since I write my last update on April the 19th its down 15.25%. As of today (3rd of March) I am down 5%. Both are top picks of mine, meaning they offer large upside potential with plenty of downside protections. Manolete is a particularly good opportunity, and it is my largest investment.

Manolete has reported a profit for the first time since 2022. And A-Mark Precious Metals has reported a record high revenue.

A-Mark Precious results:

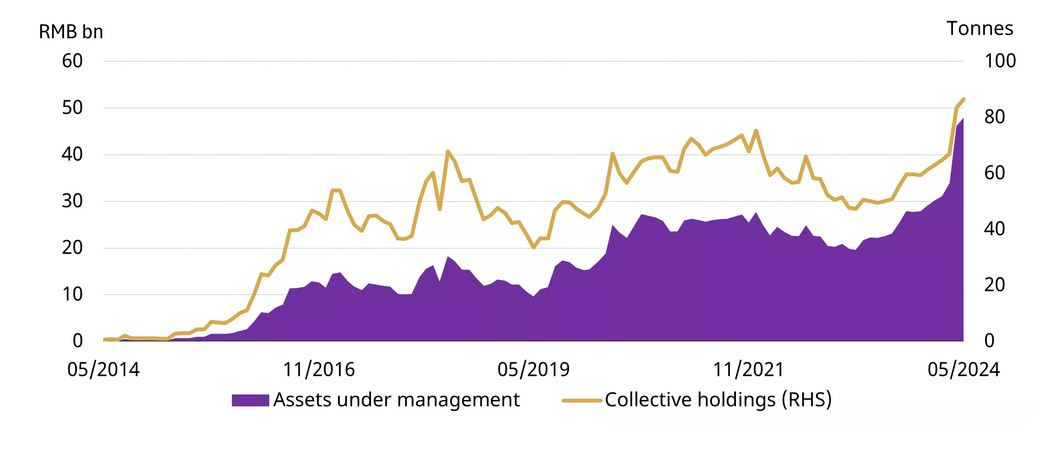

Chinese gold ETF AUM and holdings. ETF providers, Shanghai Gold Exchange, World Gold Council.

AMRK continues to deliver on the strategy they have been doing for years: growth through M&A. They have taken over LPM Group Limited, a precious metals dealer in Asia and they have increased their investment in SGB, an online precious metals retailer in Canada. The first transaction is particularly intelligent as demand for gold and silver in Asia is booming. Both China and India, which are the main economic drivers in the region, are demanding more previous metals.

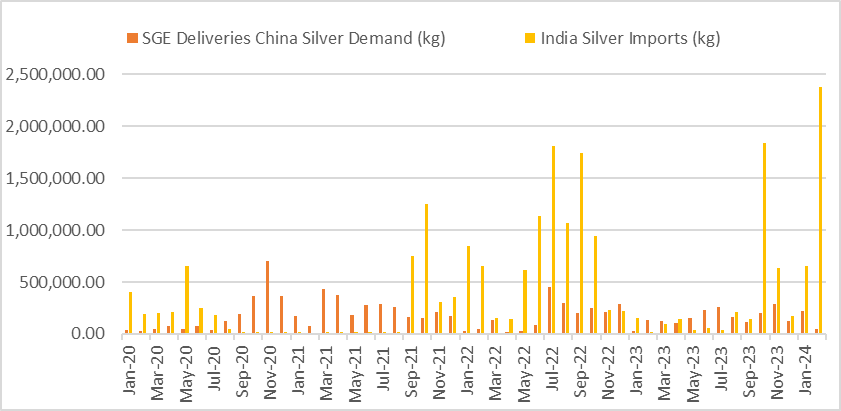

India silver imports.

The bad news is that the company reported lower volume of sales in terms of ounces, but this was offset by higher precious metals prices. This is primarily due to the company´s dependence on the United States, Europe, and Canada, which have recently been consuming less gold. However, with the new acquisition of LPM and the creation of a trading hub in Singapore, I believe the firm can reap the benefits of increased gold demand in Asia while Western demand recovers.

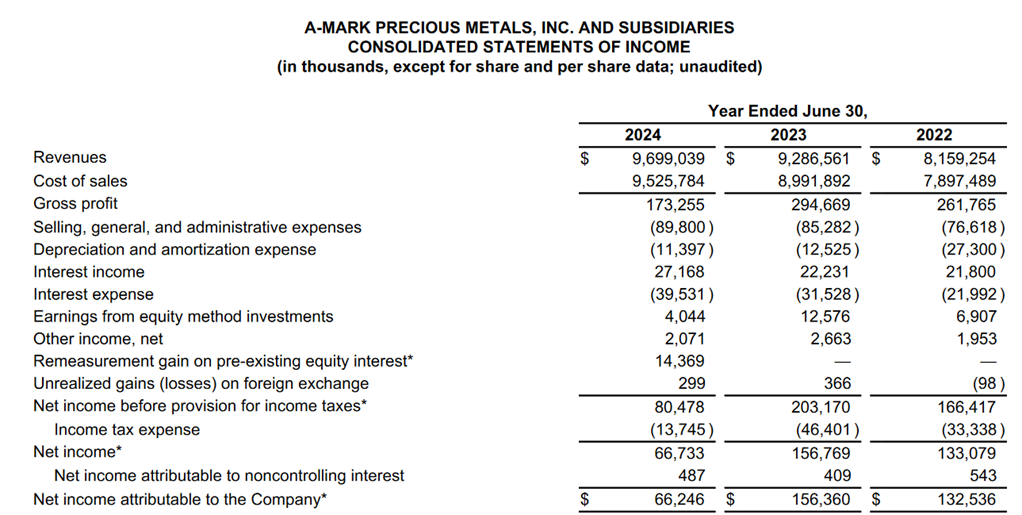

AMRK income statement. Financial report.

However, the company has delivered a profit of $66M, more than enough to cover the payment of dividends as they stand. The decrease in gross profit was due to lower gross profits earned from both the wholesale sales and ancillary services and DTC segments.

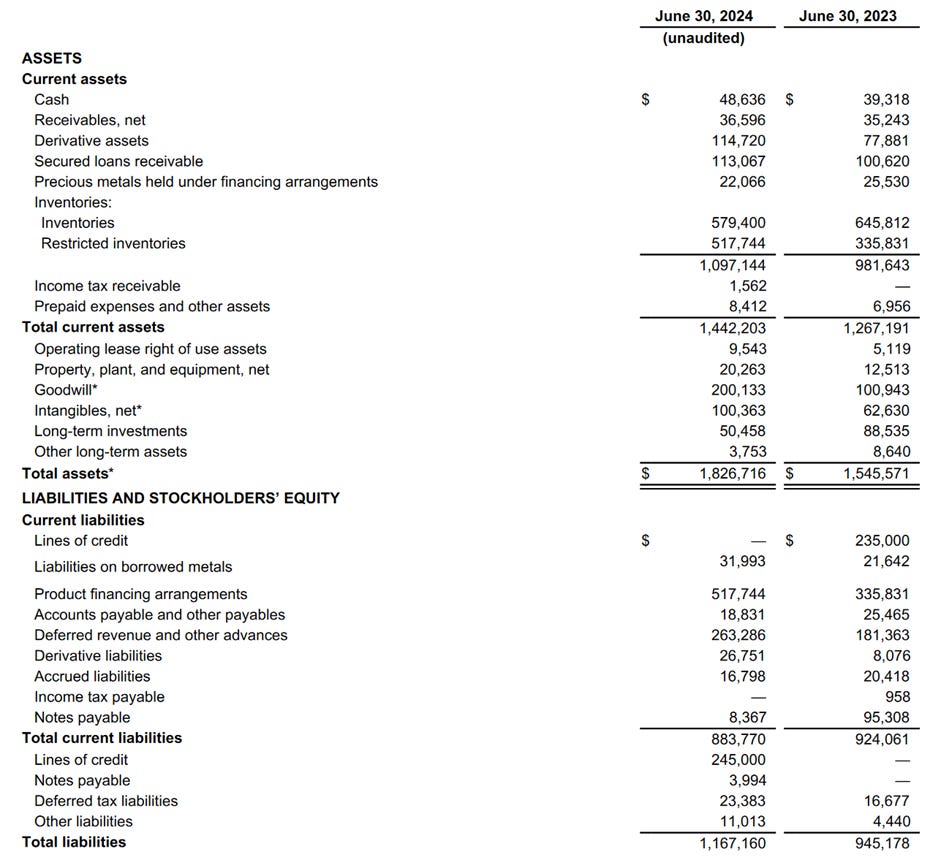

AMRK balance sheet. Financial report.

On the balance sheet side, the firm has “repaid the Notes Payable from their $100 million Asset Backed Securitization and amended their Trading Credit Facility resulting in increased liquidity”. Thus, Net Current Asset value has increased to $275M from $267M. Since this increase is not significant. However, as the share price has increased, the upside has decreased.

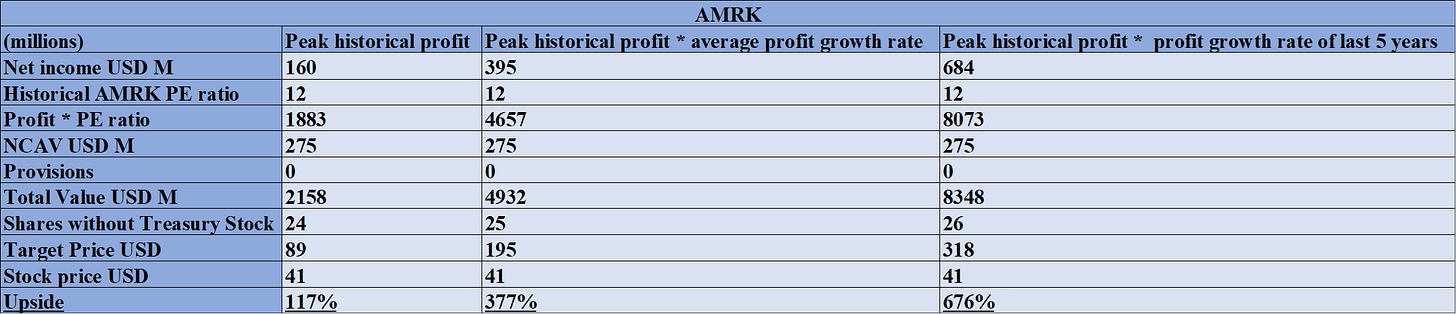

AMRK upside. Own estimates.

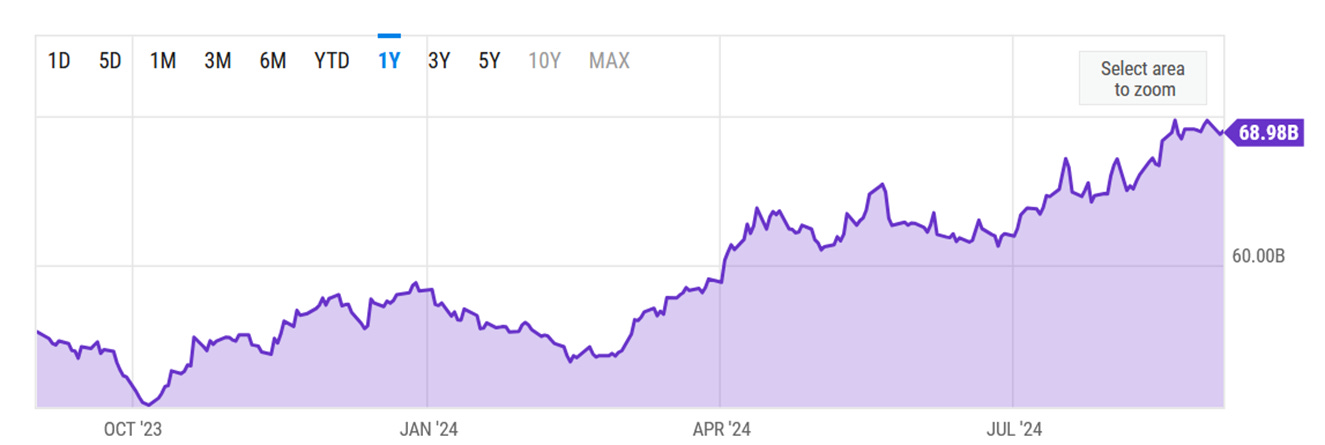

Even though demand for gold bars and coins has been somewhat weak recently, I believe this trend is changing. The assets under management for the largest ETF backed by physical gold has moved from $55B to over $68B.

AUM for SPDR® Gold Shares (GLD). Ycharts.

Manolete Partners results:

Manolete delivered an update in April saying they expected a PBIT of around £2.5m for FY24. And they have delivered exactly what they anticipated: a PBIT of £2.5m. Although I expected stronger results, I believe this comes to show how well management knows its own business.

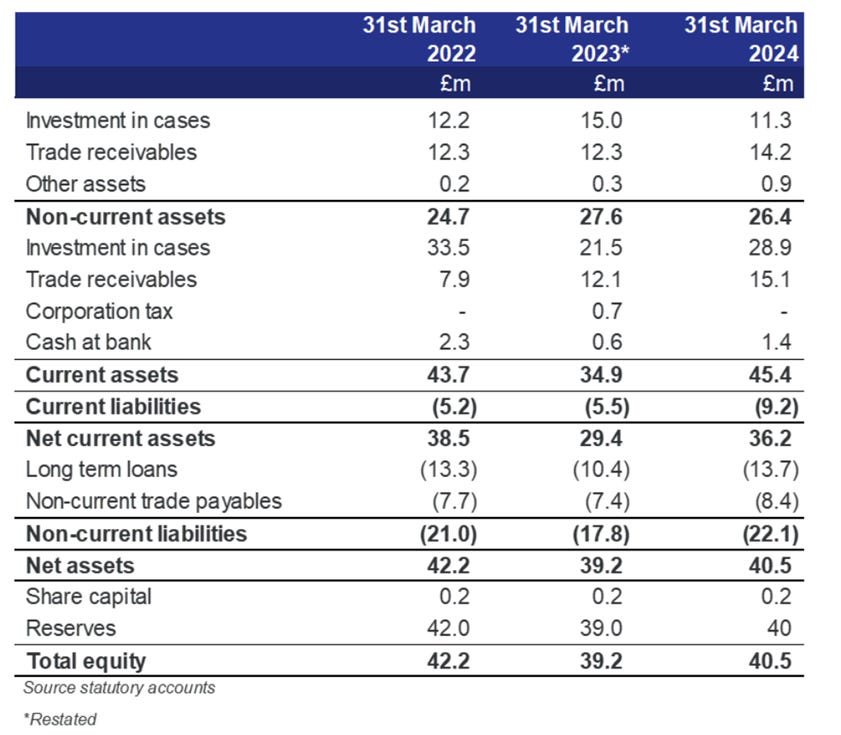

Manolete balance sheet. Investor presentation.

The balance sheet remains essentially the same. The main change has been in long term debt, here is what the CFO said in the report: “The maximum loan has been reduced to £17.5m from £25.0m and the interest charges are 4.7% margin above SONIA. The amended agreement came into force before the 31 March 2024.” Which I think is a positive change given that interest rates have risen, and I do not want Manolete depending too much on term debt.

The firm has increased Trade and other payables (in current liabilities), which is a form of debt I like a business using as it often carries no interest. Furthermore, suppliers know Manolete very well and if they are increasing their “financing” to Manolete, it means that they trust the business.

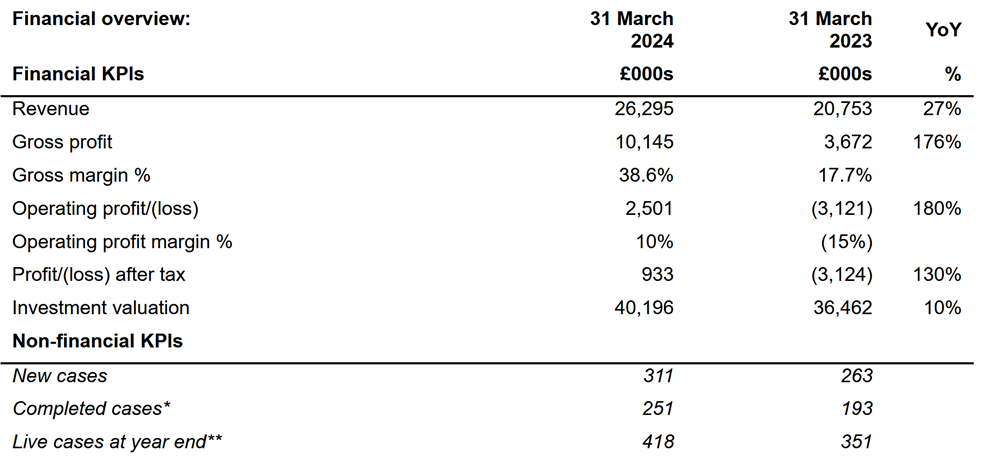

Manolete income statement and KPIs. Manolete Partners financial statements.

Furthermore, they have again reported a profit, proving that they are fully profitable. Gross profit for FY24 is up 176% and margins have improved substantially. Completed cases stand at a record high of 251 cases. The only year this came even close was in 2021 with 166 cases. So why are profits so far from its record? Simply put: The record levels of insolvencies are from “smaller and weaker "zombie" companies” as the company puts it. This has yielded an average revenue of £96k per case. Therefore, for profits to fully recover we need larger insolvencies. This is when the good news arrives.

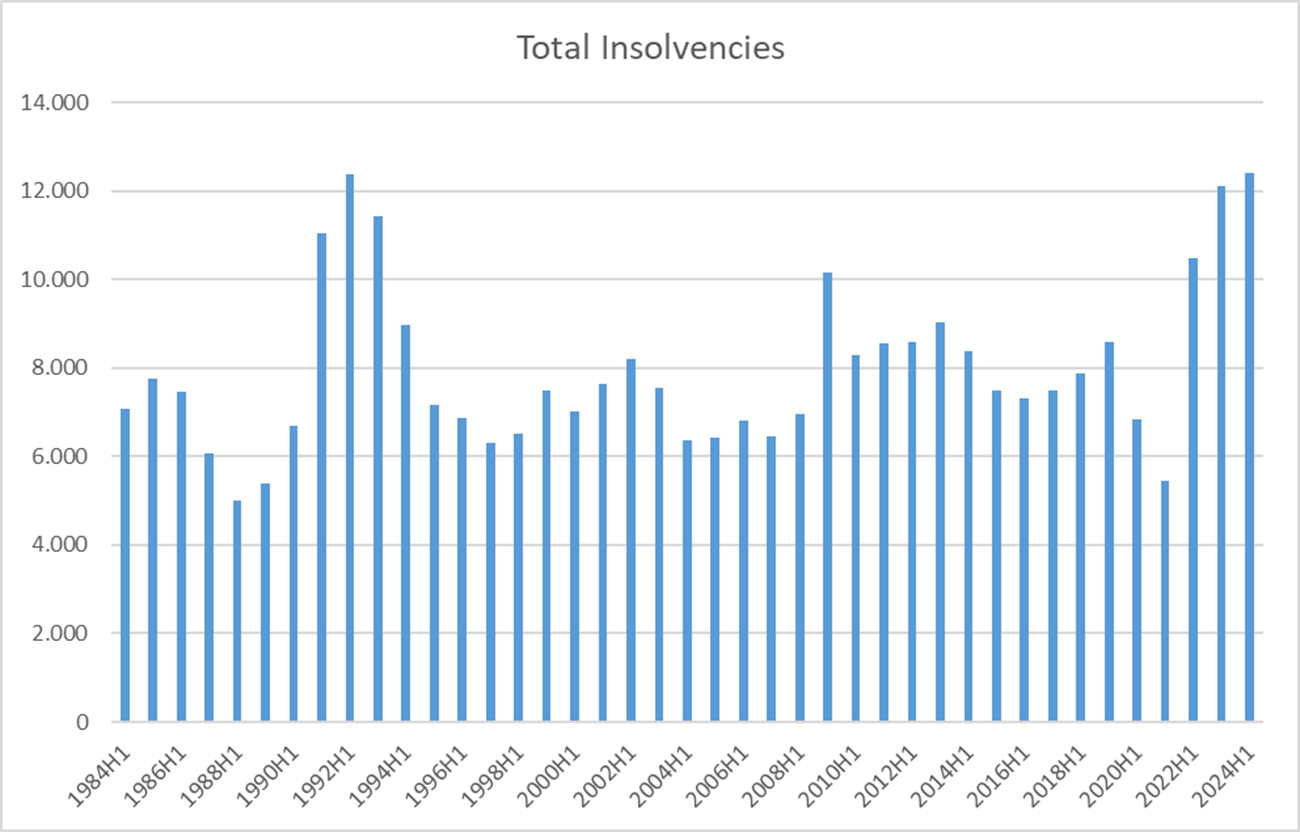

Total company bankruptcies. Insolvency service.

First, insolvencies in the first half of 2024 have been at record highs at 12424 insolvencies. This figure is slightly higher than the previous record in the first half of 1992.

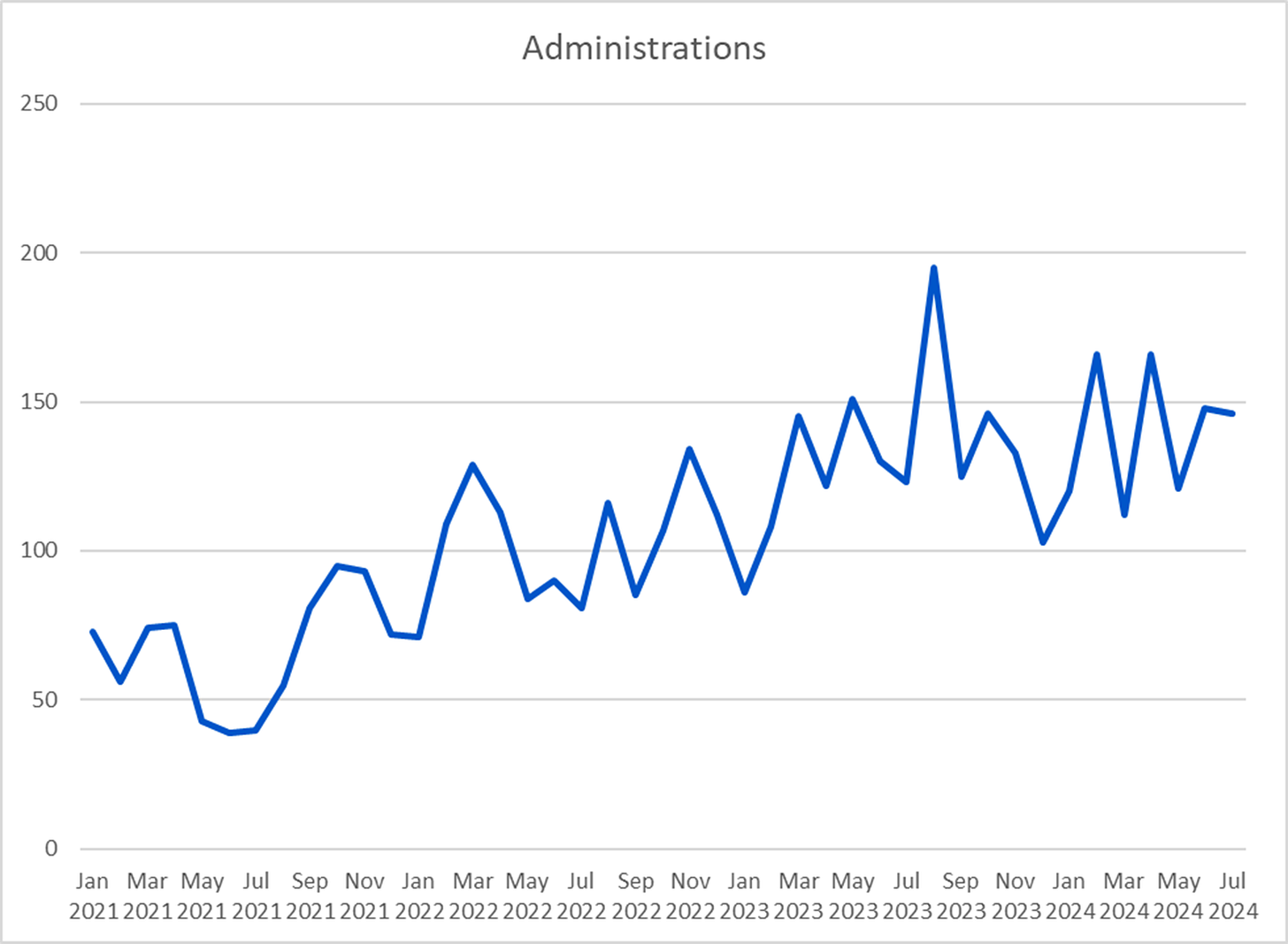

Administrations. Insolvency service.

Secondly, administrations (larger firm insolvencies in technical lingo) have picked up pace rapidly. Therefore, we can expect average revenue per case to increase looking forward. Administrations are nowhere near their all-time high from 2008, but its clearly in an uptrend.

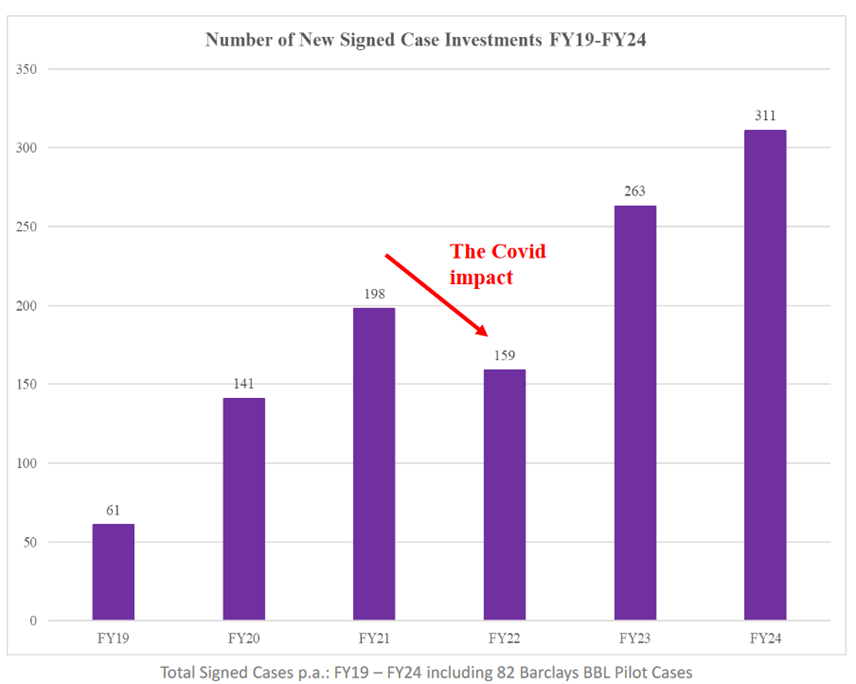

The number of new signed cases stand at all time highs. This reflects the strength in the business of Manolete and its moat as a business in general.

Conclusion

The market dynamics for both Manolete Partners and A-Mark Precious Metals are getting stronger. This is reflected in non KPI measures: Higher demand for precious metals in the case of AMRK and higher bankruptcy levels for Manolete Partners. The poor performance in the stock price for Manolete has presented me with the opportunity to buy even more stock. I have not bought more shares in AMRK.

Any feedback is more than welcome in the comments, or you can send me a message on Substack or through my twitter (X) account @AAGresearch.

As always, I want to thank my girlfriend Yeimy, who has helped me a lot while I was writing this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Alberto, another thing...

something that is missing in your study, is about CAPITAL ALLOCATION.

They have 30M in Cash&ShInv. Too huge!! if they continue well performing, what they are going to do with all the cash??

- Increase dividends? (very tipical in UK, but not the most interesting for investors...)

- Reduce debt (ok, but is not worring the debt situation)

- Reduce shares (sounds good!!)

- Or maybe M&A??? it's possible to M&A in this industry in UK? (or in Austalia/USA...)

What do you thing about M&A?

Many thanks!

Hi Alberto,

what % represents MANO in your portfolio?

Many thanks for your great job!!