The Big Short-UK corporate bankruptcies at 40 year highs

Deep dive into a firm that can profit from this situation

Summary

· Corporate bankruptcies in the UK are at a 40-year high, the only time they got anywhere close was in 1992. This occurred in sync with the Savings and Loans crisis in the 1980s and 1990s in the USA, and the oil price shock of 1990.

· Personal insolvencies are also near all-time highs, although still 25% lower than its peak in 2009 and 2010.

· Local governments in the UK are issuing warnings as one in 10 councils in England have warned they will go bust in the next 12 months.

· 22% of all corporate bonds and leveraged loans in the UK will be maturing in 2025. Considering the Sterling corporate index is almost at 7 year highs, this will stress the financial situation of corporations, exacerbating the insolvency situation.

· Manolete Partners is the UK’s leading insolvency litigation financing company, which I believe will benefit the most from current macroeconomic and corporate conditions in the UK at the moment.

· At current stock pricing, I believe Manolete Partners is an asymmetrical bet with significant upside potential if the corporate bankruptcies in the UK continue on their current trend. The stock has limited downside as the business has delivered good and stable returns since its inception.

Manolete investor presentation. Litigation awards.

Introduction

Manolete Partners is a UK insolvency litigation financing company. Often litigation funders will fund a portion of a lawsuit to obtain a proportionate reward if the case evolves the way the funder expects. However, Manolete takes on all the risk in every case and works with insolvency practitioners (IP) and their lawyers to ensure claims are pursued and resolved. They pay up-front cash payments to relieve the pressure of unpaid work in progress and to finance crucial further investigative work. Manolete then receives up to 50% of the net return, the other 50% going to the Creditor Estates. However, on eleven of their invested cases they have paid a single large one-off amount upfront, in return for 100% of the recovery.

Insolvency is only area of the law where a third party can buy claims in the UK. When it comes to third party funders Manolete has a 67% share of the segment. The funder with the second highest share has 5%. Pre COVID there were 2,000 claims in the UK with recoveries of £750m, Manolete was doing 200 claims (10% market share). It is the number one competitor in the third party funders segment.

Manolete Partners at a Glimpse

The Insolvency Service. Own definitions. Glossary of terms to better understand this report.

Due to the COVID-19 pandemic, the government of the UK temporarily suspended insolvency laws (Corporate Insolvency and Governance Act 2020). This suspension remained active from June of 2020 until April of 2022. This caused firms like Manolete Partners to go through a period in which their business activity dropped precipitously. This can be seen in their stock price, in the chart below. In the period the insolvency suspension was active, the stock price dropped almost 60%. However, since June 2020 the stock has dropped 80%.

Google finance. Manolete stock price.

Manolete could be classified as a countercyclical firm, one that benefits from periods of low economic activity and suffers when the economy is booming. However, the firm has delivered strong margins since its inception. In fact, it has averaged a 16% net margin even after including the years in which the insolvency suspension was active. Therefore, I believe Manolete is a high-quality firm that can return value to shareholders in almost any point of the economic cycle. However, the government of the UK temporarily hampered the insolvency litigation industry, creating a downturn in Manolete´s business. I see this as an opportunity for investors to buy a stable company that is now recovering from inefficient government action brought against its industry.

Manolete Partners financial statements. Own estimates.

The chart below shows the performance of Manolete since 2010. Since then, the firm has invested £31.2M into now completed insolvency claims, from which a £37.8M gain was obtained. However, I don’t believe this is representative of the real profitability of Manolete. In fact, average return on investment is a staggering 121% and IRR is 131% (all lifetime averages). The decrease in profitability was because the suspension in 2020, caused the percentage of completed cases to drop significantly. They have dropped from 100% in 2019 and every year before that, to 6% in the first half of the financial year of 2024. However, this is not the new norm for the business, as the government ended the insolvency suspension in April 2022. Insolvency litigations are now returning to their normal course of action.

Manolete Partners. Investor presentation. Own estimates.

Market Trends

As the chart below shows, total bankruptcies in the UK are at an all-time high as far as the record shows (1984). It is especially significant that the creditor´s voluntary liquidations are also at an all-time high, over 30% higher than the previous peak in 1992. This type of liquidation is unique to companies that don’t have enough assets to pay creditors in full. This indicates that the corporate environment in the UK is highly indebted. This surge in bankruptcies is a significant opportunity for Manolete since the number of investing opportunities is increasing rapidly.

The Insolvency Service. Own Estimates.

Individual insolvencies don’t concern Manolete´s business directly as they deal with corporate bankruptcies. However, the finances of individuals do reflect the health of consumers, which does affect the corporate world. The chart below shows individual insolvencies going back to 1984. Even though insolvencies for individuals aren´t at all-time highs, they are at the same level as they were in 2008, right at the beginning of the 2008 financial crisis. It is worth noting that debt relief orders, which are related to low-income individuals, are at all-time highs. This reflects the severity of the situation for those consumers with lower incomes.

The Insolvency Service. Own Estimates.

The chart below shows that 22% of all outstanding bonds and leveraged loans in UK corporations are due in 2025. This is particularly alarming if one considers that interest rates are at the highest since 2007 in the UK. Therefore, some businesses will have trouble refinancing their debt at an attractive rate when the maturity date comes. All this adds up to more stress for highly indebted businesses, that may soon find themselves in higher insolvency risk. Creditor´s voluntary liquidations often represent the bankruptcy of small to medium sized companies. These are at all time high as I have mentioned beforehand. Administrations however tend to apply to larger firms, and this just reached pre COVID levels. I believe with the current maturity of bonds and leveraged loans, administration insolvency levels will rise, offering more opportunities for Manolete to invest for larger settlements.

Refinitiv, Bloomberg.

The last time corporate bankruptcies reached these levels was in 1992. As the chart below shows this coincided with a sharp fall in the number of companies publicly traded in the UK. Therefore, we can expect similar behavior shortly as insolvencies are now higher than in 1992.

Fred.

Growth for Manolete

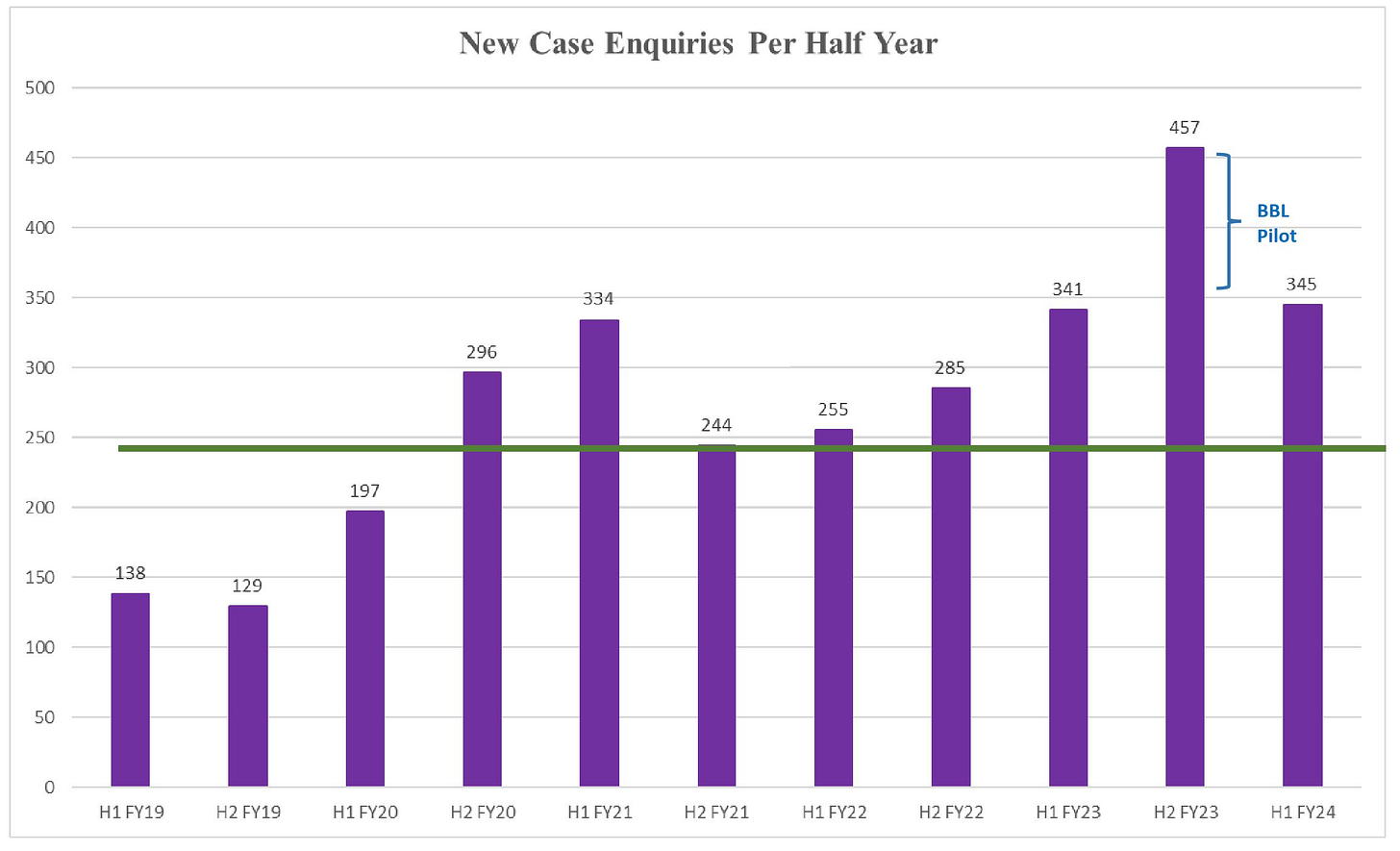

The chart below shows the number of enquiries received by Manolete per half year since 2019. The number of enquiries has risen sharply and is already above pre COVID levels. It is worth noting that in January 2023 Barclays Bank joined forces with Manolete. The joint effort is aimed at trying to recover millions of pounds of misappropriated loans, advanced under the UK government’s COVID-19 bounce back scheme. Barclays was the largest bank lender in the bounce back loan scheme, advancing £10.8 billion. This represents a good opportunity for Manolete to increase its volume of business, especially considering the size of Barclays. There is also the fact that it is the only insolvency specialist Barclays has announced it will work with. In fact, as the chart below shows around 22% of the enquiries in the H2 2023 were from the Barclays bounce back loan scheme. The firm only spends around £300 thousand on marketing per year. Yet most of its business is done through enquiries it receives from insolvency practitioners and others. This speaks volumes about the good reputation of Manolete in the insolvency litigation business. As the firm itself states: “Every insolvency practitioner who has ever received financing from Manolete has always returned with new case investment opportunities”.

Manolete Partners corporate presentation.

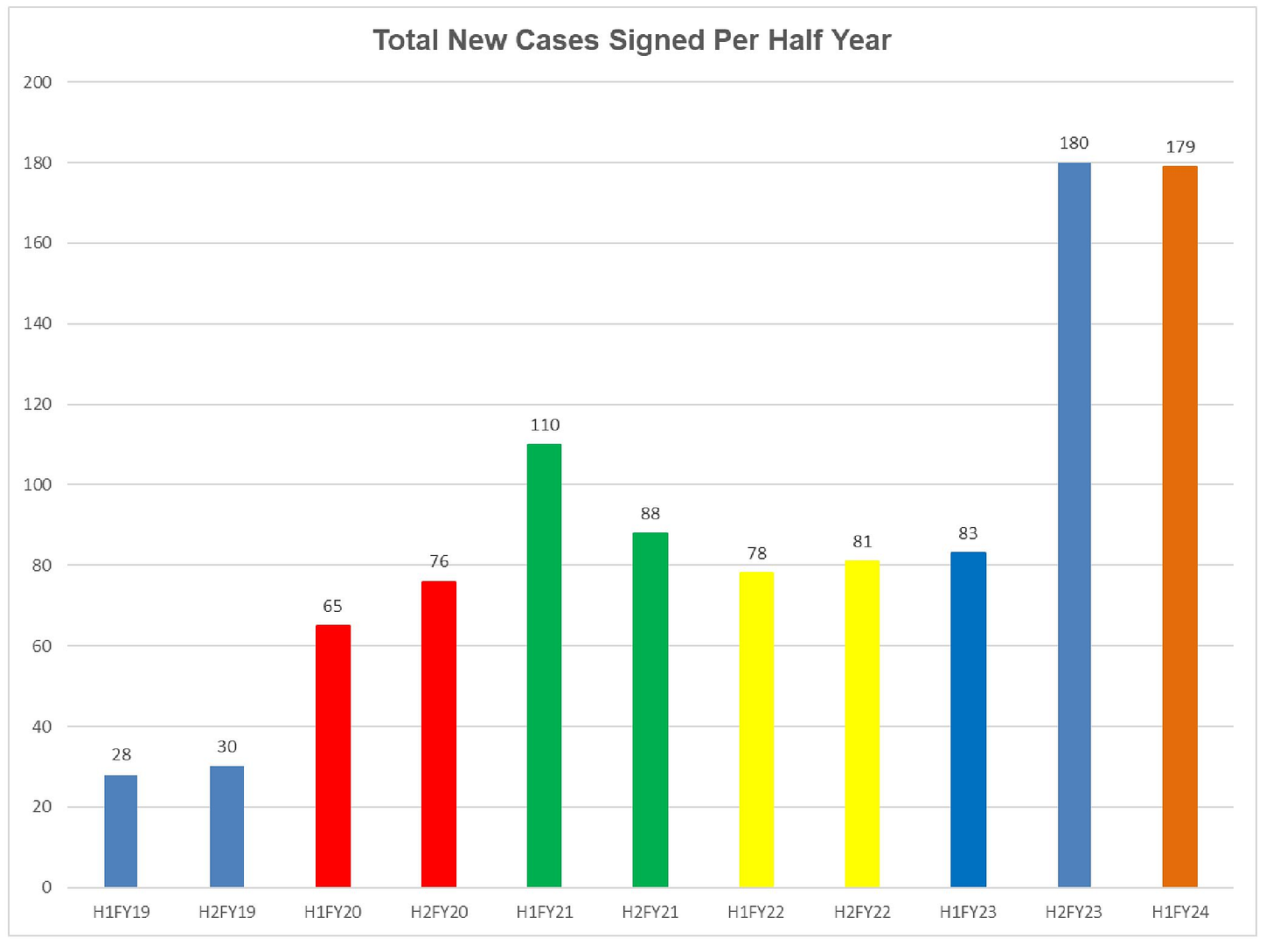

The number of new cases signed by Manolete has also risen as the chart below shows. In fact, in H2 2023 and H1 2024 the number of new cases signed was 6 times higher than in the H1 and H2 of 2019. I have projected these new cases into my valuation, as I expect Manolete will deliver record results over the next few years.

Manolete Partners corporate presentation.

Balance sheet and earnings

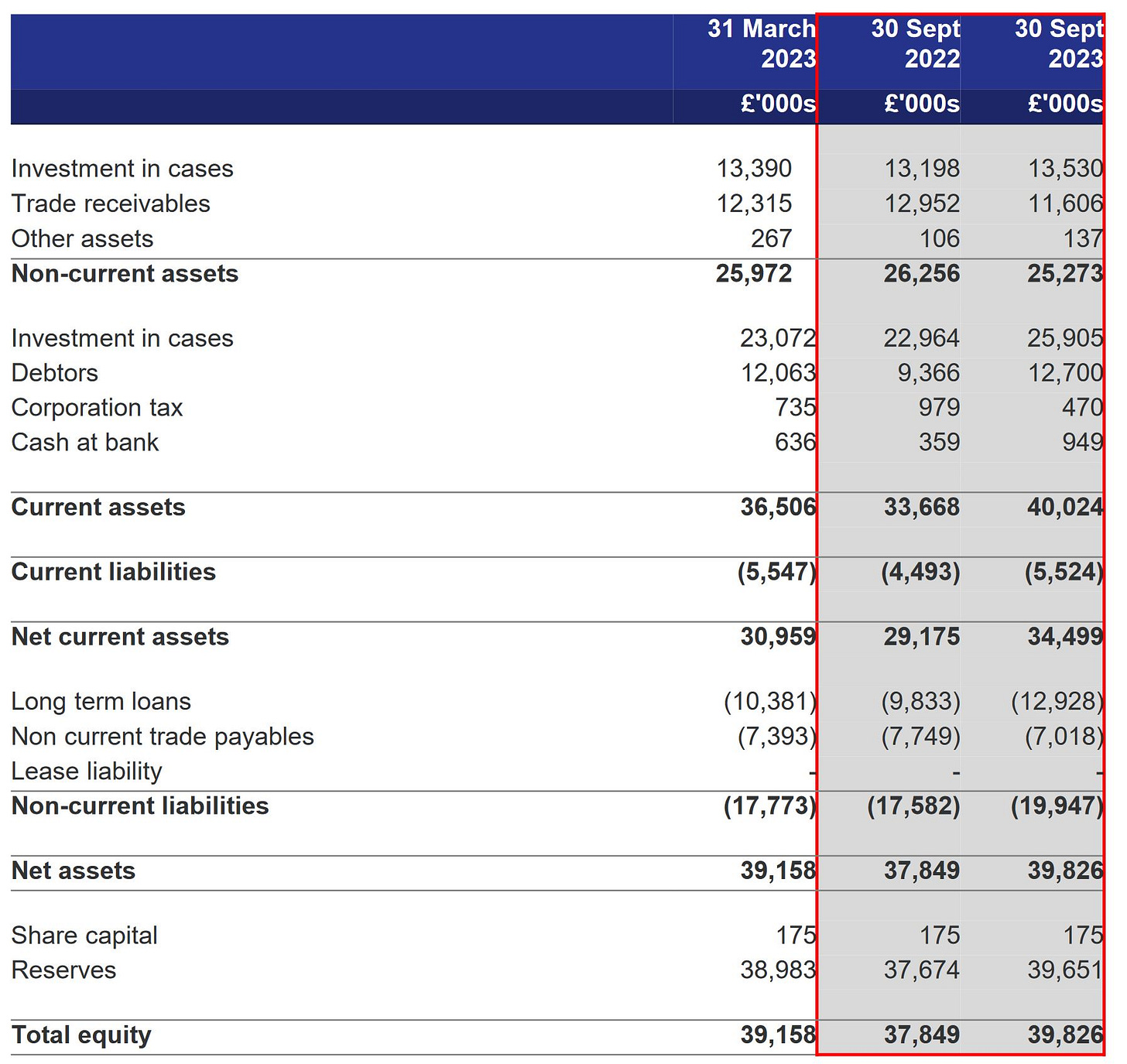

The majority of current assets in the balance sheet of the firm are comprised of investments in cases and receivables. Manolete has an 80% average rate of completion in its cases, and if the years where the insolvency laws were suppressed aren’t considered, their completion rate is 100%. Therefore, I believe its investments in cases are to be taken into account when considering the solvency of the firm. Debtors, also known as current trade receivables, are amounts due from settled cases in the ordinary course of business. Debtors and investment in cases both are valued at £38M in current assets. Manolete assigns a 2% expected loss rate in its current settlement agreements, therefore I believe it is safe to take the debtors account at face value: £12.7M.

Manolete Partners corporate presentation.

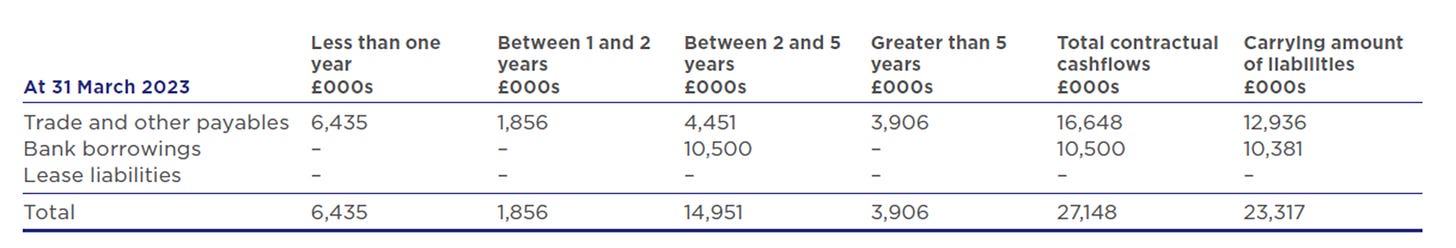

When it comes to debt Manolete has £25M in total liabilities of which £20M are in non-current liabilities. More specifically £13M are in long term loans, which mature in June 2025. These loans have an interest rate set at a maximum of 3.7% above SONIA (Sterling Overnight Index Average). However, the firm still has £12m of undrawn debt available for use, totaling a £25M long term loan with HSBC.

Manolete Partners annual report. Maturity of debt.

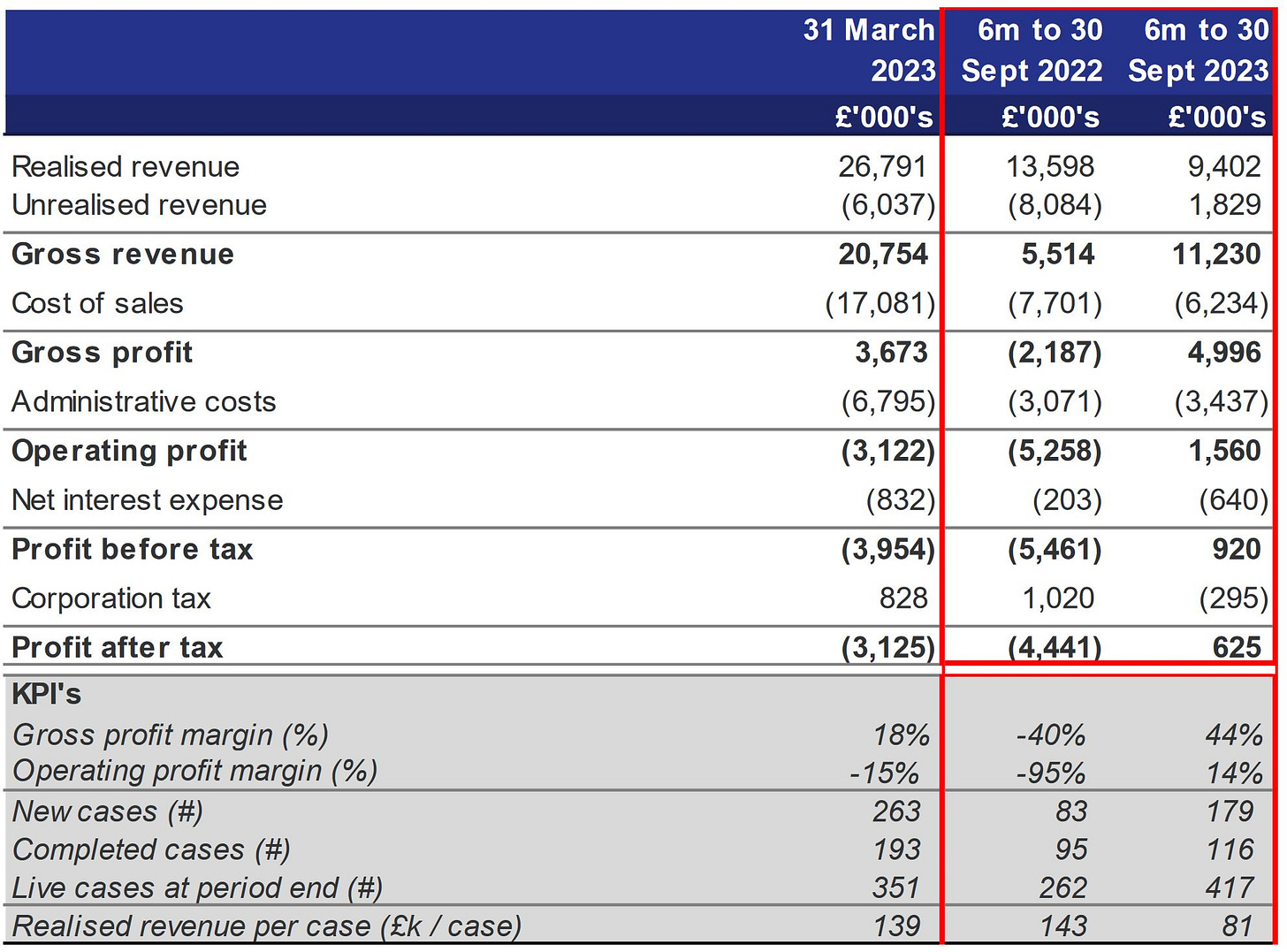

Considering the firm has £38M in current assets which are liquid enough to be turned into cash within one year and its total liabilities equal to £25M, I believe Manolete is highly solvent. More so if we consider that, as the table below shows, the firm is already profitable as of September 2023.

Manolete Partners corporate presentation.

Valuation

For my valuation of Manolete, I have taken three scenarios. The three of them are differentiated by the level of gains (net profit) obtained by the firm. In the first scenario, my base case, I assume that Manolete will return to pre COVID levels. For this I have taken the average gains from 2018 to 2021 and multiplied it by the average PE rate from 2018 to 2021. I have used this average PE ratio as I don’t believe the PE in the years 2022 and 2023 realistically portrayed the company´s normalized performance. I believe this due to the fact that during those years the UK government suppressed insolvencies, making it more difficult for Manolete to do business. In my second scenario, more optimistic, I have taken the gain of the firm at its peak, in 2021. And in my most bullish scenario I have assumed that the current rate of new signed cases (360 per year), will repeat in the future. These number of cases are over double the number of completed cases in 2021, I have however assumed around double the gain from 2021 for the most bullish scenario.

Manolete annual reports. Valuation of Manolete.

A PE ratio of 21 seems appropriate to me given the stable nature of Manolete´s business. They return profits throughout the cycle, because there are always bankruptcies and therefore there are investing opportunities year around. Furthermore, in the lower part of the cycle, when insolvencies rise, they should deliver extraordinary results. This justifies in my opinion this elevated PE ratio, which the market seems to agree with given it’s the average from the actual PE ratios. In all three cases the upside potential has triple digits. The base case offers around 130% upside potential and the most bullish one around 540%. Given the IRR and ROI history of the firm, I think these scenarios are realistic.

Conclusion: significant upside, but the timing may be challenging

When government does not intervene, Manolete is a business with very stable returns and profits. They offer significant protection in case macro or microeconomic activity in the UK deteriorates, and that seems to be happening already with a high inflation rate and high interest rates. Also, insolvencies at corporate, consumer and local government levels are at all time highs or near them. I believe the end of the insolvency suspension ban, and the fact that corporate bankruptcies are at 40 year highs, offer enough tailwinds for Manolete to improve their results going forward.

The business has very high insider ownership with Steven Cooklin, the CEO and founder owning 15.64% of the firm. There are other significant shareholders like Michael Faulkner. He is the former CIO and current head of Macro Strategies at River & Mercantile PLC, a big advisory, investment solutions and services firm. Faulkner owns 12.77% of the firm. The largest shareholder of Manolete is Jon Moulton (through Moulton Goodies Limited), he owns 26.53% of the firm. Moulton is a famous British venture capitalist based in Guernsey who has been a shareholder of Manolete since the IPO.

In conclusion, I believe investing in Manolete offers an asymmetric opportunity, which as some of the readers already know, are my favorite opportunities. In the worst-case scenario, Manolete returns to pre COVID levels and their stock price will return well upwards of 100% according to my valuation. And in the best-case scenario, which assumes that current record high bankruptcies remain happening, Manolete could deliver shareholders upwards of 500% returns and start giving out dividends as it has done in the past. That said, I don’t think Manolete will release new results until June, when they publish results as of March 2024. Therefore, the timing on this stock may be tricky. But I believe at current valuations, it’s worth starting to buy some stock. Unfortunately, the firm trades in the AIM, a part of the London Stock Exchange and it doesn’t have a lot of volume. The fact that the three largest shareholders own over 50% of the firm reduces the liquidity of the stock, that said, Steven Cooklin is highly aligned with shareholder interests.

Any feedback is welcome in the comments, or you can send me a message on Substack or through my twitter account @AAGresearch.

I want to thank my girlfriend Yeimy, who has helped me a lot at home while I was researching this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

“Luxury development in heart of Mayfair falls into insolvency”

Even in luxurious London bankruptcies are emerging.

https://www.standard.co.uk/business/luxury-development-mayfair-insolvency-60-curzon-thierry-despont-interpath-b1135560.html

Thank you for sharing this high-quality article, very interesting company. I do have a question about the dramatic increase in Cost of Sale, for year end Mar 2020, Cost of Sale is 4.3M vs 18.6M Revenue. For H1FY24 cost of sale 6.2M vs 11.2M Revenue. So 23% to 55%. I don't find a lot of details about sale of cost, from FY23 annual reports it mentions "...external legal costs are either capitalized as investments for open cases or recognized as cost of sales on completed cases". So external legal cost per case increases dramatically over past few years?