Selling Medallion Metals (ASX: MM8)

I bought Medallion on the basis that it was trading for a massive discount to NPV, and that the scarcity in quality gold projects would end in a takeover of Medallion, as the cycle progressed. However, the company has decided to take a shot at building the mine, a strategy with which I do not agree. The company´s rationale is that in the process of financing and building a mine, someone will take them over. I would much rather have the company use of proceeds from the camp lease, to do some exploration and decrease G&A expenses.

Instead, Medallion has reached a deal with IGO Ltd (ASX: IGO) which I think will be expensive for shareholders, in terms of dilution and it will decrease their leverage to gold prices. To finance the project the firm might get a royalty or stream deal on the gold from the project. This deal will decrease the project´s leverage to gold prices. But this will likely not be enough, some more dilution is ahead I believe.

I might be making a mistake selling Medallion and their deal with IGO might result in a lot of shareholder value creation. But financing, building and operating mines is rocket science. And therefore, it is too risky for me.

For those that want to remain shareholders of Medallion:

I believe management at Medallion is legit. I have spoken to Managing Director Paul Bennett in a lengthy Zoom conversation. And I believe he is legitimately thinking in the best interests of shareholders when he makes a decision. He has invested a substantial amount of money into Medallion as well. I just do not agree with his strategy going forward and for that reason I must sell.

Furthermore, IGO is a multibillion-dollar market cap miner. So, its great to see a large miner take an interest in a small firm like Medallion.

Buying Boab Metals (ASX: BML)

A few days ago, the Bowdens Silver mine project in NSW was deemed void, after The NSW Supreme Court of Appeal upheld an appeal against the Bowdens silver mine project near Mudgee. The project is owned by Silver Mines Ltd (ASX:SVL), a company in which a lot of retail investors had shares and are now in pain because the stock is down over 45% in a few days.

Silver Mines Ltd share price. Google finance.

I have been looking for a while for some quality silver exposure. And just last week a friend brought to my attention Boab Metals. I will go into more details about Boab now, but considering a lot of investors feel now disgruntled with silver stocks in Australia, I thought it was a good opportunity to buy a quality name being sold off for no good reason.

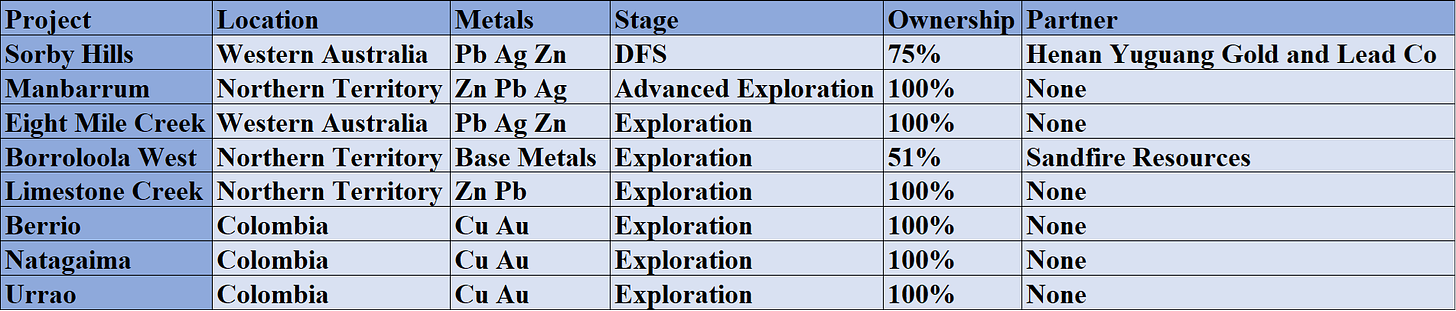

Boab projects. Company reports.

Boab owns eight projects, of which the bottom five (in the table) are noncore assets, and are therefore on hold. The company is seeking JV partners to advance these projects. The flagship project of Boab is Sorby Hills, of which it owns 75%. The other 25% is owned by Henan Yuguang Gold and Lead Co, China’s largest lead smelting company and silver producer.

My focus for Boab is the Sorby Hills project. Which I think is one of the cheapest silver projects out there. And I do not think the market is recognizing the value of that project, more so now that sentiment with silver stocks in Australia is poor.

The project now has a Definitive Feasibility Study, done in 2023. This is a positive as the DFS is often more strict than previous studies, and it is also good that the study has been done recently.

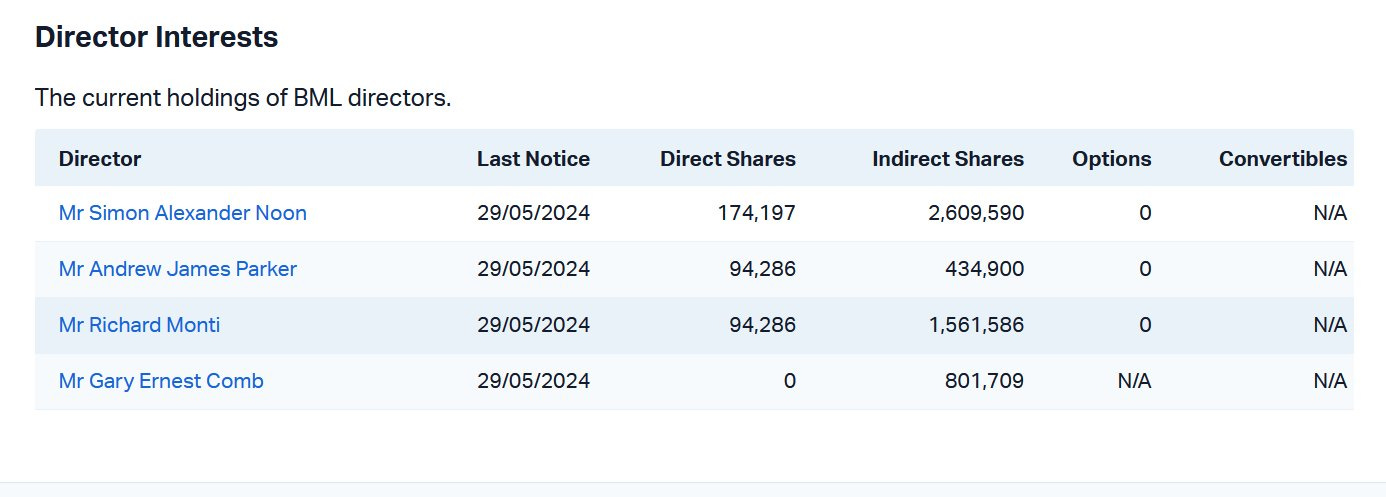

Insider ownership at Boab.

Insiders own around 2.5% of the company. Which is not much but its great to see they have skin in the game.

Simon Alexander grew Groote Resources from a market cap of A$10m to A$200m in a challenging market. He understands the importance of maintaining Boab´s status as a silver mine not lead. So, it is great to see experienced management that has delivered good returns before, and understands the situation of the project.

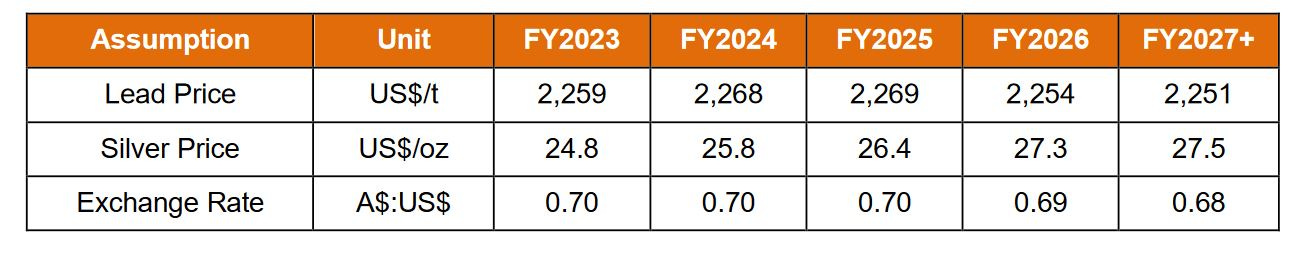

Sorby Hills project assumptions. DFS report.

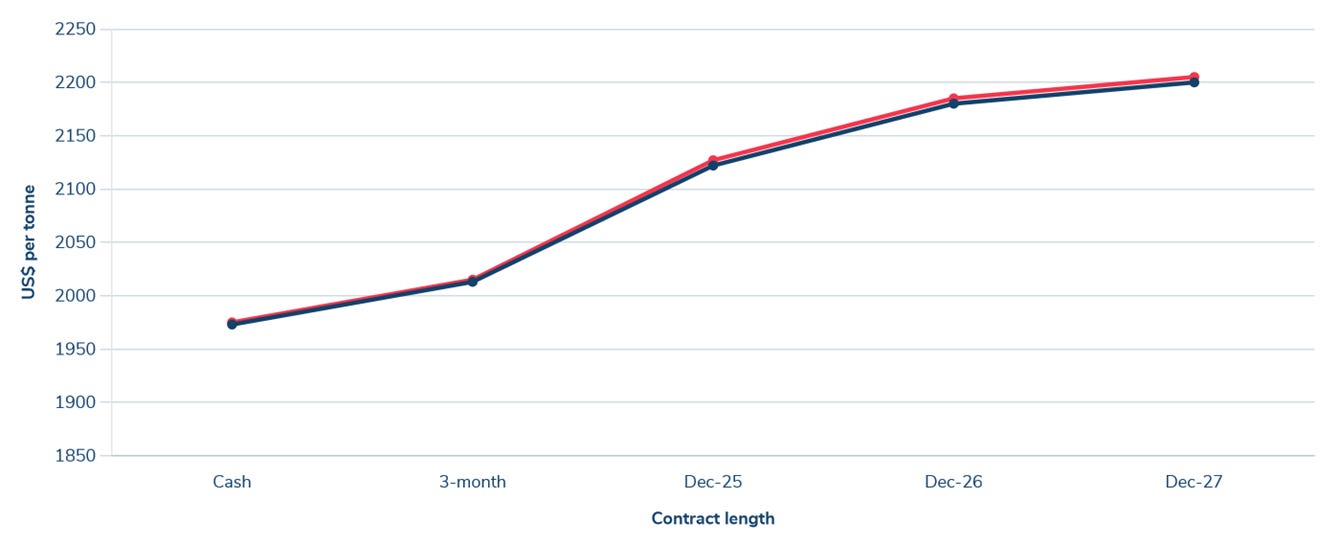

Starting with the assumptions of the DFS, lead prices assumed are slightly above current spot prices.

Lead prices. Trading Economics.

However, data from the London Metals Exchange indicates that lead prices are headed for the direction the assumptions indicate.

Lead contract price curve. LME.

With regards to silver, assumptions are well under current spot price ($29/oz). Therefore, I am very comfortable with the assumptions taken in the economic study.

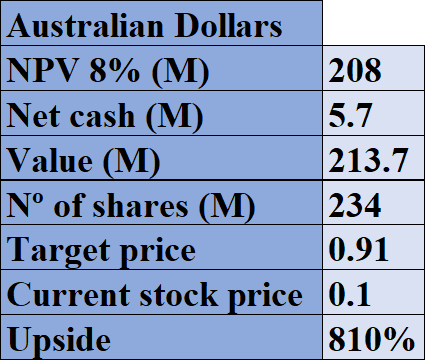

Something I do not like about the company is that they post the NPV number in a pretax fashion. But even if we discount taxes to the NPV, the valuation still makes no sense as you can see below.

Valuation of Boab. Own estimates.

So, the pretax NPV at 8% of Boab is A$370M. After we take away 25% of corporate tax and another 25% that belongs to their JV partner, we are left with just over A$208M. The company has a lot of cash in hand, which is also great. I estimate around 800% upside. I like to see this level of upside as it also indicates me that the level of downside is very limited and the chances of losing money (risk) are low.

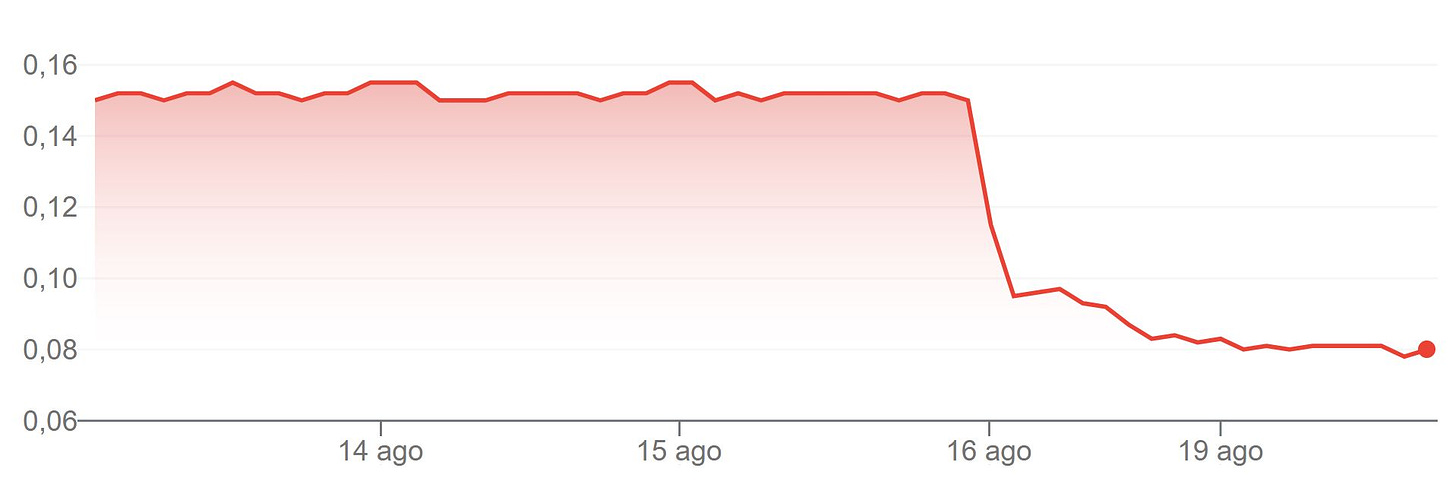

Boab stock price. Google finance.

Boab stock price is down over 50% in the past 5 years. And previous shareholders such as Regal have been selling millions of shares recently, which has pushed stock prices even further down.

I think this has created a great opportunity to buy a quality silver stock at near all time lows.

Furthermore, the Sorby Hills project is primarily a lead project and I believe management is going to make an offtake agreement on the lead production to finance the project. This will leave all the silver leverage intact, and it will limit the dilution of the shareholders in the financing of the project. There is also a 1,600m drill program underway at Sorby. Therefore, even if silver prices do not move up, there are plenty of catalysts for Boab to deliver returns to shareholders.

Also notice that lead and silver are metals that are commonly used in the military. Therefore, if you believe (as I do), that military conflicts around the world will continue to escalate in size and number, lead and silver prices should go much higher. Therefore, projects like Sorby will be much more valuable.

Conclusion

Boab Metals is a well-capitalized lead and silver developer in one of the best mining jurisdictions in the world, Western Australia. The company has already delivered a Definitive Feasibility study that proves the economics of their flagship project and has a drill program underway. In the coming months I expect news from either an offtake agreement or a royalty/stream agreement on their lead production which will clear the way for financing without the need to dilute shareholders. I believe this will create a good opportunity for miners to take over Boab at a much higher price than it is trading for right now.

Any feedback is more than welcome in the comments, or you can send me a message on Substack or through my twitter (X) account @AAGresearch.

As always, I want to thank my girlfriend Yeimy, who has helped me a lot while I was writing this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Congratulations!!!

Hola Alberto, sobre Boab ¿que catalizadores ves para destapar el potencial que mencionas? / Hi Alberto, regarding Boab, what catalysts do you see for unlocking the potential you mention?