Palladium and platinum: The dawn of a new bull market

The investment thesis on both metals and a comparison of all palladium and platinum assets worldwide

Summary

Platinum and palladium both are part of the platinum group metals, together with ruthenium, rhodium, osmium and iridium.

The demand for both metals is driven mainly by automotive and industrial uses, although platinum also has a strong demand on the side of bars and coins as investment.

Both palladium and platinum have seen significant drops in prices from their peaks: platinum has fallen 50% since its all time high in 2008 and palladium has fallen 66% since its highs in 2021.

However, both markets have turned a corner in 2023 as they are now facing large deficits, which are forecast to continue as prices have plummeted and producers are reducing production.

Due to current market dynamics, I believe getting exposure to platinum and palladium is an asymmetrical bet with significant upside if deficits continue as expected. Exposure to these metals has limited downside, as demand is very stable and its uses are difficult to substitute.

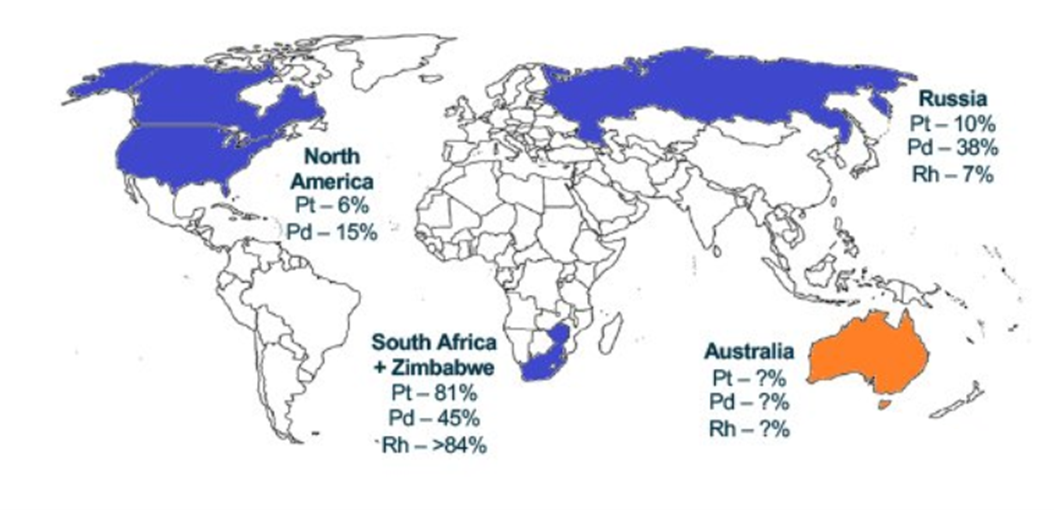

Mining Weekly. Platinum Group Metal production by country.

Introduction

Platinum and palladium both share similar physical properties: highly dense, very high boiling point (especially palladium), silver-white metal colour and they are very resistant to corrosion and to the action of acids. However, the most significant property they have is that they have strong catalytic properties, which means they can trigger a chemical process without themselves being permanently changed or consumed. These metals have a wide variety of uses, which makes them highly versatile. They are mainly used for investments as bars and coins, for electronics as coating, for jewellery, for fuel cells and in cars as catalytic converters.

Platinum group metals are extremely rare in the earth´s surface and considered precious metals. To set an example the world supply of gold (the most famous precious metal) is around 100 million ounces a year. However, platinum and palladium have a combined annual supply of around 16 million ounces including recycling.

Glossary of terms to better understand this report.

Demand dynamics

Demand for palladium sits at just under 10 million ounces per year, with almost 80% of it being used for auto catalysts in cars. The rest of palladium demand comes primarily from industrial uses (around 15%) and 5% being used for jewellery. Given that both platinum and palladium both have catalytic properties, a substitute effect goes into motion every time one of them goes up in price. However, this substitution effect takes time since auto makers can’t change their supply chain easily.

Johnson Matthey, SFA (Oxford), Metals Focus, WPIC research. Palladium demand.

As shown in the chart above, demand for palladium from automakers has decreased recently, this is mainly due to the substitution effect explained in the paragraph above. Even with the fall in demand from auto manufacturers, palladium consumption has remained stable, ranging in between 9 and 10 million ounces per year. This fall in demand for palladium is reflected in an increase in demand for platinum from auto catalysts, as shown in the table below, proving the substitution effect is real. Demand for platinum in the automotive industry has increased almost 50% since 2020, however this has been balanced out by a lower consumer interest in platinum bars and coins.

Platinum Investment Council. Demand for platinum, thousands of ounces.

In the internal combustion engine of a car, an auto catalyst turns gaseous hydrocarbons, carbon monoxide and oxides of nitrogen into water, carbon dioxide and nitrogen. This process, enabled by the unique properties of palladium and platinum, is the main driver in the demand for auto catalysts, as this lowers greenhouse gas emissions. The two tables below show the demand for internal combustion engine vehicles (left side table), electric vehicles and plug in hybrids (right side table). The data shows that demand for internal combustion engine vehicles is increasing, nearing 90 million vehicles per year. Demand for plug in hybrid cars has beaten expectations as shown on the right-side graph. These are both positives for PGMs as internal combustion engines employ auto catalysts. Electric vehicles however have seen demand growth slow down and growth rates are below previous estimates.

Anglo American Platinum. 2023 results presentation.

Supply dynamics

The supply of palladium hit an all time high in 2019 with over 7 million ounces mined and 2.6 million ounces recycled. However, since then miners have reduced production or put mines into care and maintenance. Therefore, mining supply has fallen to around 6.3 million ounces in 2023, a 10% decline since 2019. Major mining expansions owned by the main PGM miners have been delayed or cancelled as prices have remained stagnant. Anglo American Platinum, the largest platinum producer, has plans of laying off 17% of the workforce. Sibanye Stillwater has announced its going to cut 2600 jobs in South Africa and Impala is reducing workforce at its mine in Canada.

SFA Oxford.

Palladium production is singlehandedly dominated by a single Russian company: Nornickel, with a 43% market share. The other operators have their main assets in South Africa and Zimbabwe. That said, Impala owns a mine in Canada it acquired in 2019 and Sibanye owns a mine in the United States. Given the high barriers to entry of mining and the concentrated mineral endowments of PGMs, this market has ended up being constructed as an oligopoly.

Statista. Palladium market share by company, 2022.

As shown in the table below, production is highly concentrated among a few regions: South Africa, Russia, Canada, and the United States produce 90% of the world´s PGMs.

U.S. Geological Survey, 2022. Kilograms.

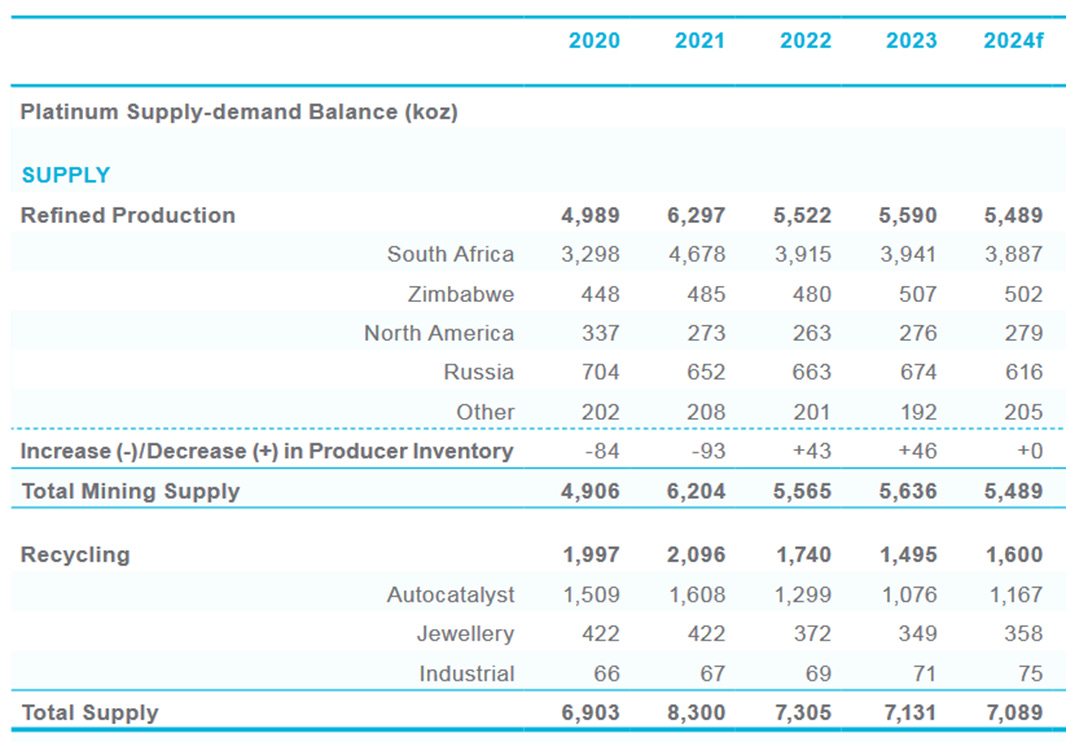

Platinum supply had its peak in 2021 as the table below shows, with 8.3 million ounces combining mining and recycling supply. This figure has since fallen to 7.1 million ounces. Cuts in production have mainly taken place in South Africa, although the fall in auto catalyst recycling has also been significant.

Platinum Investment Council. Platinum Supply.

The main producers of platinum are Impala, Anglo American and Sibanye, all of which have their main operating mines in South Africa and Zimbabwe. Although these operators have old mines in general, most of them have long mine lives. This enables them to continue producing millions of platinum ounces without having a pipeline of projects to develop. The only exception being Sibanye, which owns a pipeline of PGM projects in South Africa and Canada.

Statista. Platinum market share by company, 2022.

Market Trends

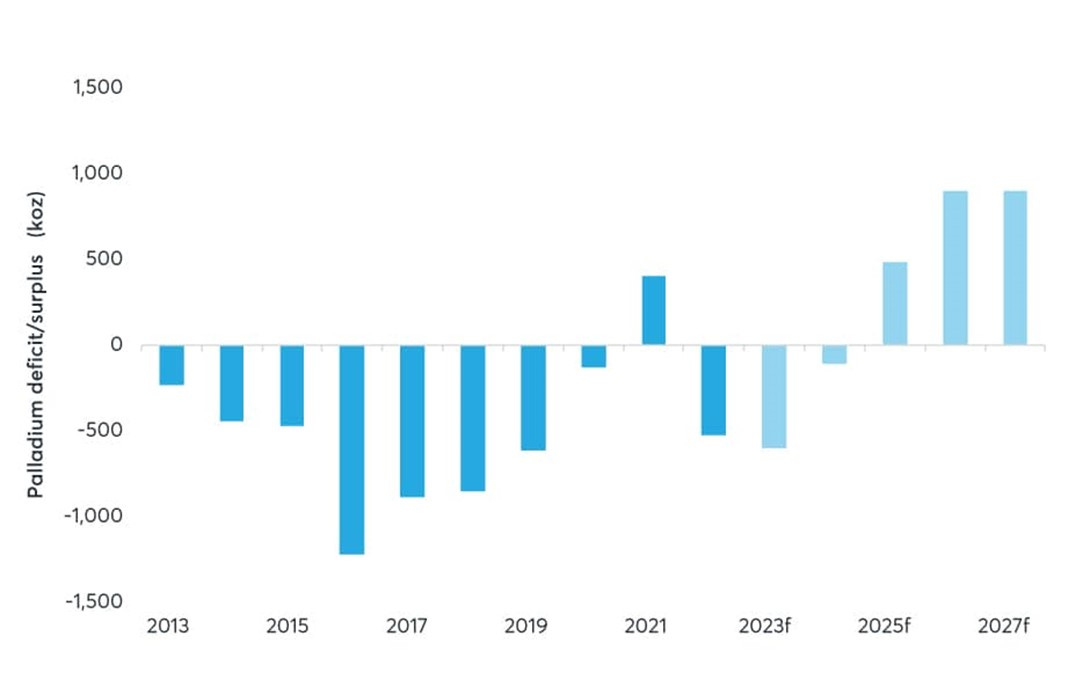

When it comes to the balance of the palladium market, the sector has been facing significant deficits since 2013. This was exacerbated by the inelastic supply of the mining sector and an increased demand from auto catalysts, bars and coins. Several studies indicate that beyond 2025 this may turn into a surplus, however I believe otherwise due to 2 main factors.

The first factor is problems in Russian supply. The French Institute of International Relations has stated that the Russian mining “industry is hindered by obsolete infrastructure, insufficient investment and a shortage of qualified human resources. The situation may be further exacerbated by the war in Ukraine”. This is confirmed also by Rusal, a Russian miner, also the second largest aluminum producer in the world, which recently stated “the company may potentially face difficulties in the supply of equipment, which may lead to the postponement of investment projects”. In fact Nornickel is expecting PGM production to be at a 5 year low in 2024. The second reason I believe a surplus is unlikely, is due to supply problems in South Africa. The country has been facing power shortages since 2007 but these have been worsening into 2023 as Eskom, the largest utility in South Africa has supply problems. I believe these power shortages will inevitably result in mine closures due to lack of electricity, or increase in energy costs for PGM miners, which use large amounts of electricity. As a result of these two factors, I believe the palladium market will be in deficit for years.

Metals Focus, WPIC research. Palladium market balance.

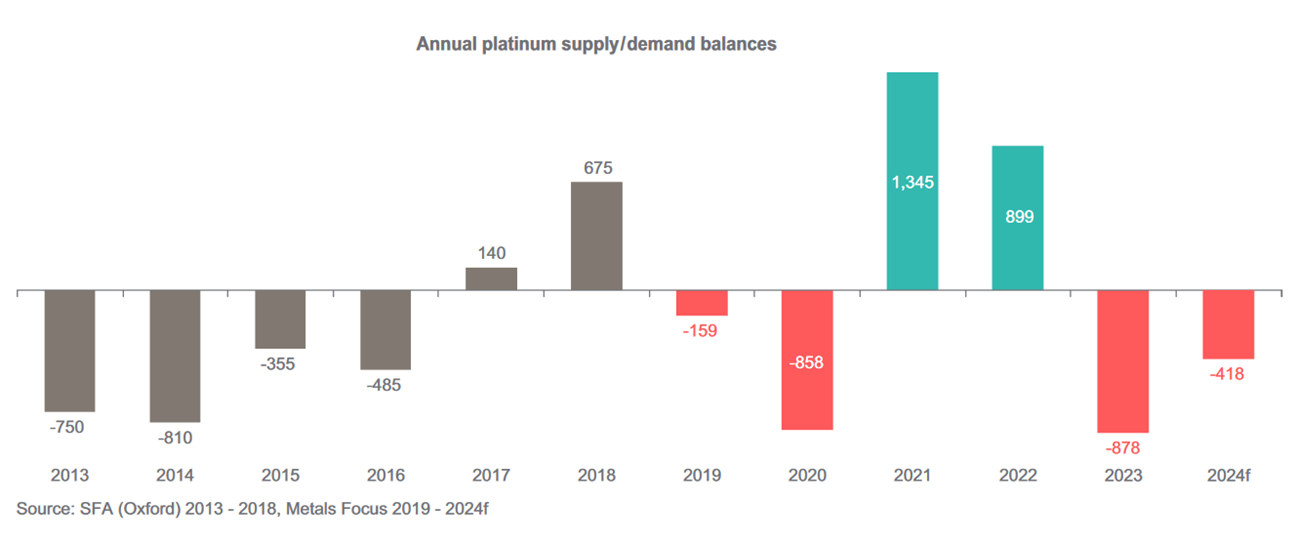

Platinum on the other hand, hasn´t had the same supply deficits as palladium, it has in fact experienced a surplus in 2021 and 2022. However, in both years the market had a significant increase in platinum recycling and a decrease in demand, due to investors consuming less platinum bars and coins. Going forward the market is expecting a deficit, in fact Nornickel is expecting a deficit in the platinum market at least until 2030. Considering the world produced just over 7 million ounces of platinum (including recycling) in 2023, the deficit is sitting at over 10% of world supply, or 878,000 ounces. The same goes for palladium, albeit the deficit is sitting at around 500,000 ounces or just over 5% of world supply (including recycling).

Metals Focus, SFA Oxford. Platinum market balance. Thousands of ounces.

Mining supply of both palladium and platinum have been decreasing since 2021. This fall in production combined with significant deficits, will sooner or later push prices up as demand remains stable. PGM mines will continue to deplete, close, or go into care and maintenance, further exacerbating the deficits. Considering Sibanye is the only large miner with significant PGM projects in development, these deficits may take decades to solve in the supply side. On the demand side, these deficits are unlikely to be solved with lower consumption as PGMs are difficult to substitute, due to their unique physical properties.

Why have PGM prices decreased recently

TradingEconomics.

The supply and demand dynamics of the past few years point towards a bullish setting for PGMs. However, prices have fallen significantly. I believe this price performance has 3 critical reasons.

The first reason can be seen in the table below, which shows investments in commodities as of February 2024. Palladium is by far the most shorted commodity in the market with a long/short ratio of 0.2 and platinum at 0.9. Platinum is sitting more comfortably but the market is still betting against it. These massive short positions have had a significant downward pressure on the palladium price. That said, when these shorts are covered, the pressure on the price will be upward.

CFTC, ICE, Bloomberg, and Saxo.

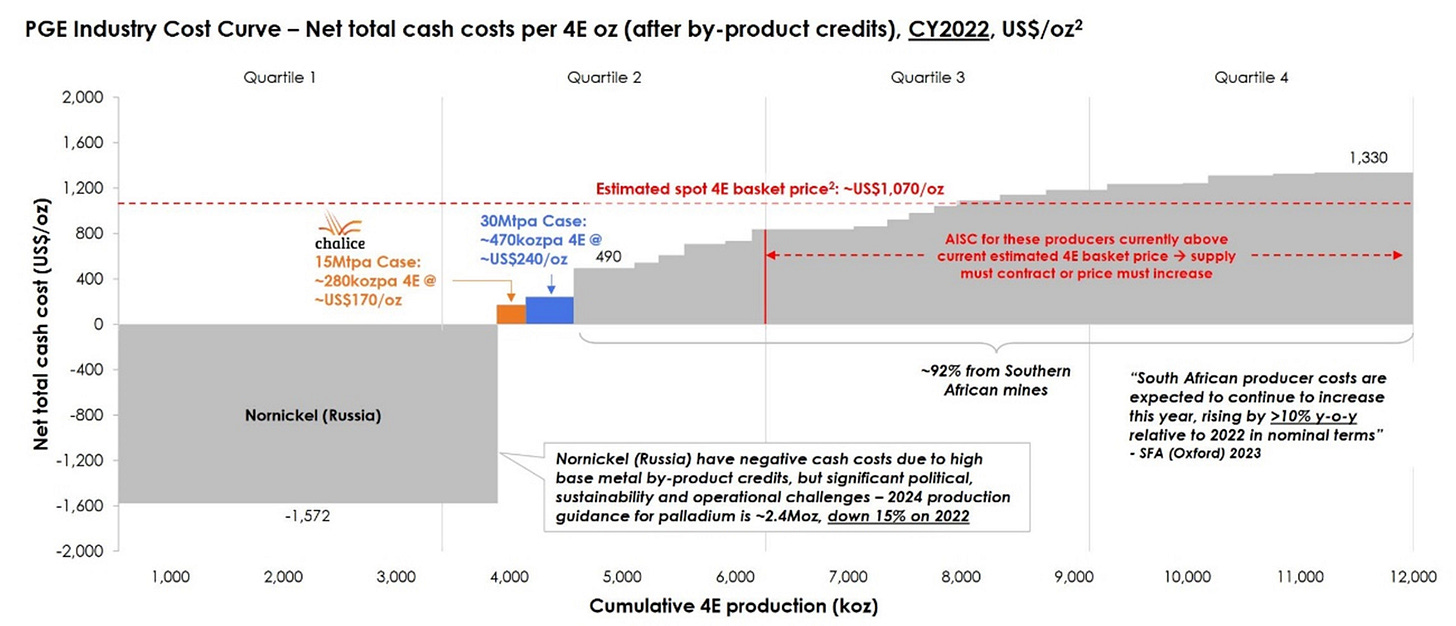

The second reason for price underperformance involves Nornickel, the largest producer of nickel and palladium in the world. The Russian miner produces 43% of the world´s palladium and most of it comes as a byproduct of its nickel operations. The fact that it is mined as a byproduct means that it costs them almost nothing to produce as the chart below shows. This means that Nornickel can sell palladium at any price and yet make a profit on those ounces. However, all Russian miners are facing supplier issues due to sanctions and therefore the operations of their mines are in trouble. Nickel prices have fallen 20% in the past year, and this metal is the main source of cash flow for Nornickel, especially when the PGM market is in a bear market. Therefore, with low nickel and PGM prices, Nornickel is not incentivized to increase production. On the contrary, Nornickel has forecasted that their nickel and PGM production will reach a five-year low in 2024.

Chalice Mining corporate presentation. PGM cost curve.

The third reason I believe PGM prices have decreased so much, is due to the Ukraine war and sanctions imposed on Russia from Western countries. On the one hand, auto manufacturers have diverted their palladium purchases away from Russia, in fact in 2022 Formex Industries already predicted “The Russian sanctions may create a discount on palladium being sold into China”. This may have pushed Russian miners to sell as much palladium as possible, expecting further discounts in the future as sanctions roll in. On the other hand, I believe the Russian government may be using its physical PGM reserves to finance part of the war, dumping their bars and coins into the market. Although this claim is yet to be proven, the Swedish Defense Research Agency already stated in a 2004 report that “Russia thus has the ability to affect world palladium processes by dumping large amounts on the market”.

Comparison across PGM producers

Company reports. My own estimates.

In the table above I have compared all the PGM producers of the world. Due to the bear market, very few producers are making money, that´s the reason only three producers have a PE ratio. Nornickel is also making money at these prices, but since the war with Ukraine the Russian miner has been delisted from Western exchanges, and therefore getting a PE ratio is not possible. The miners with the best economics are African Rainbow Minerals, Anglo American Platinum, Sylvania and Nornickel.

However, African Rainbow Minerals is a very diversified miner, with only 36% of its revenue or EBITDA coming from PGM sales. Sylvania has excellent margins, but their product comes from the processing of tailings at its plants, they do not actually mine PGMs in the traditional sense of the word. That said the company has $70M in net cash and is still profitable at current prices. Nornickel is the miner with the best margins in the PGM business, more so considering PGMs is a byproduct for them and therefore costs them almost nothing to produce. However, the company listed only in Russia and therefore getting exposure to it is impossible, unless you have access to the Moscow Exchange.

The miner with the most leverage to the PGM market is Sibanye Stillwater. This is true because 90% of their earnings come from PGM revenue, and they have a high cost of production as shown in the table above. This means that if there is a significant increase in PGM prices Sibanye stands to reap the most benefits. Although if the opposite happens, leverage can damage them and will cause the company to bleed the most money, therefore the margin of safety is not great.

The firms with the least debt are Sylvania, Impala and African Rainbow. Impala has a low cash cost of production; however, their margins are some of the lowest in the industry, probably because of high capex, which is not reflected in the cash cost Impala publishes. Sylvania is involved in three separate exploration programs, and they are going to invest around $38M into a JV to increase the life of their operations. This will consume some of the net cash of the company, and they may incur in debt or share issuance to fuel this growth.

Overall, I would say that the company that is better positioned is Anglo American Platinum. They have a high exposure to the PGM market, good margins, a low cost of production and they are profitable at current prices. The negative side of Anglo American Platinum is that they lack a good pipeline of projects, and their quick ratio is less than 1. Another good thing about Anglo American Platinum is their high market cap, which can attract institutional investors into its shareholding.

Comparison across primary PGM projects

Company reports, own estimates. Projects in development where PGMs are the main metals.

The table above shows a comparison of all the main projects in the world where PGMs are the main metals. Notice all these projects are not yet in production, they are the pipeline to supply PGMs in the future.

Each company has used different metal prices as their assumptions in their economic studies, and therefore a comparison across them is difficult. However, it is easy to see the largest PGM project, with the highest NPV, is Platreef, owned by Ivanhoe Mines. This project also has some of the best economics among its peers and low initial capital relative to its NPV. However, Ivanhoe Mines obtains most of its income from copper mining, therefore, Ivanhoe will not give investors a lot of leverage to PGM prices. The negative side of the Platreef project is that it has a remarkably high payback period at almost 8 years.

The project with the highest IRR is Crocodile River, owned by Eastern Platinum at 117.7% IRR. However, the company has used a rhodium price of $8000/oz for its study, which now trades at $4000/oz, therefore the IRR and NPV at current metal prices may be much lower. I believe Bravo Mining also hosts a good PGM deposit, however they are yet to publish an economic study and therefore has not been included in this report.

In my opinion, the company that owns the best overall project is Generation Mining. For me they tick all the right boxes: Generation has an experienced management team, a lot of shares are owned by insiders, it has good infrastructure nearby the Marathon project, it has a high IRR at 25.8%, it has a low cost of production at $813/oz of palladium equivalent, it is located in a safe country (Canada), it has a long mine life at 15 years and it has a very short payback period at 2.3 years.

Below I have done a deeper study on Generation Mining. Through a linear regression on the data of their economic study, I have found out there is a 99% correlation between NPV and palladium prices. This shows that the project has massive leverage to PGM prices and the NPV can be predicted through palladium prices, which is what I have done in the table below. Currently palladium prices sit at around $1000/oz and even at this levels Generation Mining has an NPV of $165M, much higher than the $57.2M market cap it trades today.

Generation Mining, own estimates.

Furthermore, Generation Mining owns 9M shares of Moon River capital, which trades at around C$1 per share, which equals $6.6M of value. And they have $11.1M in net cash including the last financing. So, for a market cap of $57.2M, shareholders are getting $11.1M in net cash, $6.6M in publicly traded securities and $165M in NPV of the Marathon project at current prices. So, its trading at around a 70% discount to my fair value estimate. On top of this, insiders own over 8% of the company and Sibanye Stillwater owns around 18%.

Kerry Knoll, the chairman of Generation has been chairman of Pine Point Mining (sold to Osisko Metals), CEO of Glencairn Gold (sold to B2 Gold), co-founder of Thompson Creek Metals (sold to Centerra) and Wheaton River Minerals (merged with Goldcorp). Therefore, he has a successful history of creating great assets which become targets of larger miners.

To start the Marathon project the company needs C$1,112M, C$898M net of equipment lease and preproduction revenue. However, they have secured C$240M from Wheaton precious Metals for a royalty on 100% of their gold and 22% of platinum. This way Generation Mining will keep most of the PGM leverage and all the copper exposure. Generation has also achieved C$540 through a finance facility from several banks. Therefore, they are really advanced in their financing progress, and they have done so without diluting shareholders.

Comparison across secondary PGM projects

Company reports, own estimates. Projects in development where PGM is a byproduct or secondary metal.

Miners like Nornickel produce vast amounts of PGMs and yet their main metals are not PGMs, but metals like nickel, iron, or copper. Therefore, it seemed appropriate to find all the copper, nickel, or iron projects out there with significant PGMs in their reserves, the results are shown in the table above.

In terms of NPV the most significant project is Crawford owned by Canada Nickel at $2,500B NPV and a good IRR at 17.1%. However, Canada Nickel only has 3.1M ounces of PGMs+gold in their deposit, therefore it does not offer much PGM exposure.

The best deposit of this table is Gonneville, owned by Chalice. They have a very high IRR at 26%, they have a low cost of production, and it is in Western Australia. This province is one of the best mining jurisdictions in the world, as it is in a Western Country but has straightforward permitting. They have 15.8M ounces of PGMs+gold in their deposit so they have a significant exposure to a rise in PGM prices. That said, none of the projects in this table will have a higher leverage to PGM prices than those in the first table, where PGMs are the main metals, like Generation Mining.

Conclusion: Considerable Potential, But the Timing is Difficult

Palladium and platinum are in a situation where demand for these metals is stable or increasing and supply is decreasing. Miners are laying off employees and delaying investments in exploration and pipeline projects. Considering Sibanye is the only major miner with a significant pipeline of projects, its going to take years or decades for the deficits in these metals to be solved.

Therefore, both metals are poised for higher prices. The question then is how to get exposure to this thesis. If one believes PGMs are going higher, the first idea that comes to mind may be investing in the physical metal. This can be done by contacting a broker that sells physical PGMs like palladium bars or coins. But if you are only interested in speculating in the metal prices, a fund like Sprott Physical Platinum & Palladium Trust can be a good option. Although I’m sure there are other ETFs or trusts available, Sprott is a trusted issuer of ETF products, I’m not sponsored by them, this is just my opinion.

After buying some physical PGMs, I would look into buying some of the best miners and projects out there. If I was looking for margin of safety, I would choose Anglo American Platinum as it will give any investor sufficient leverage to PGMs, with little downside. However, Sibanye Stillwater has a higher leverage to a rise in PGM prices due to higher production costs. Also, Sibanye has an interesting pipeline of PGM projects that can go into production in some years. Miners like Impala or Anglo American Platinum have little to no pipeline of projects. That said, their mines have a long life ahead.

Further down the line, I believe that projects in development offer the most leverage to the PGM prices. In this sense I would only buy the best of the best, starting with Ivanhoe Mines thanks to their Platreef PGM project and following by Generation Mining with their Marathon project in Ontario. Although in terms of risk and reward I think Generation Mining is the better positioned. I believe this is true because it is more of a pure play PGM stock, and the stock price has dropped 70% since its peak in 2021. This has put Generation Mining at an attractive valuation relative to peers, and it offers investors massive leverage to a rise in palladium and platinum prices.

I believe investing in PGM explorers at this point of the cycle makes no sense. Explorers will offer little to no exposure to the PGM market unless they find an economic deposit, which is highly unlikely.

In conclusion, I believe investing in the PGM market right now is a matter of “when” not “if” the metal prices go up. It’s inevitable that the deficits will result in higher PGM prices due to sustained demand increases and lower supply. When prices go back to its peak, or possibly beyond, we will see outstanding performance, especially by miners and developers. I believe that PGM prices will not find any equilibrium due to the lengthy and costly process of opening PGM mines, making it impossible for miners to react in a timely manner. Therefore, I believe prices will continue to skyrocket and plummet in cycles, as they have done until now. That said, this same investment thesis was true months ago and yet palladium and platinum stocks have continued to drop. Therefore, I wouldn’t be surprised if we see some more blood in the market before the sector turns into a bull market.

Any feedback is welcome in the comments, or you can send me a message on Substack or through my twitter account @AAGresearch.

I want to thank my girlfriend Yeimy, who has helped me a lot at home while I was researching this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Excellent article. Agree. Very bullish on the commodity space with the greatest upside in the platinum group metals. The market cap of all platinum produced in a year along with recycling, only about 7 1/2 million ounces, is just $7.5 billion US. For palladium let’s call it 8,000,000 ounces of Supply with recycling and a market cap under $9 billion. The platinum group metals are not only industrial and precious but they are strategic. As you point out in your article, Supply is challenged and there are insignificant inventories other than perhaps what China has accumulated and what is held by Russia although the best thinking is Russia has significantly reduced its platinum group metal inventory . I fully agree with the generation mining analysis. The stream financing from Wheaton precious metals is very significant since Randy, Smallwood, CEO of WPM are the premier mine financing company that do intense, intense due diligence. I believe they have less than 30 projects that they currently are streaming, and it is a great testament to generation. Further, jamie, levy, CEO of generation is absolutely first class and of the highest integrity as is the entire team. at the end of the day whether generation proves to be a palladium project or a copper project is not yet clear but the upside is very significant. Thanks for the article.

Great article and very little interest in PGMs gerallaly. Have you not looked into Tharisa THS.lse? They are based in South Africa but have a new Karo mine due to come online in Zimbabwe. Karo capex has been delayed due to the current low prices for PGMs, although majority has been invested now. current market cap of £226m and PE of 3.