My portfolio and one of the accounts I manage

Introduction

I have been investing since I was 14 years old, now I am 27. In 2017 I was lucky enough that I found out about uranium, and between 2017 and 2020 I went all in in 10 or 11 uranium stocks. By 2020 I had lost over 50% of my money, but I knew the thesis was even stronger in 2020 than in 2017 so I pulled together all the money I had left and poured it into the uranium stocks I had the most conviction in. By January 2022, the table had turned, and I sold all my uranium stocks for an average return on my portfolio of over 1000%. This enabled me to become a full-time investor.

I am sharing this story because I have noticed a lot of investors nowadays just want to chase the trends, and “want to sell anything that isn't being confirmed with positive price movement” as Calvin Froedge beautifully put it in his Twitter. Therefore, I wanted to tell you the story of how I made my money, so you know what you are in for: I do bets on things that are being sold heavily while the fundamentals are getting more attractive. Since I buy things that are getting sold, the natural thing is that I lose money in the short term, something many people will not be willing to endure.

Today I will be sharing the weights of my portfolio. I am not happy with being this diversified, so you can expect me to sell some of my stocks in the short term to invest more in the ideas I have the most conviction in. I will also be posting the portfolio I manage for another person, albeit I manage several portfolios.

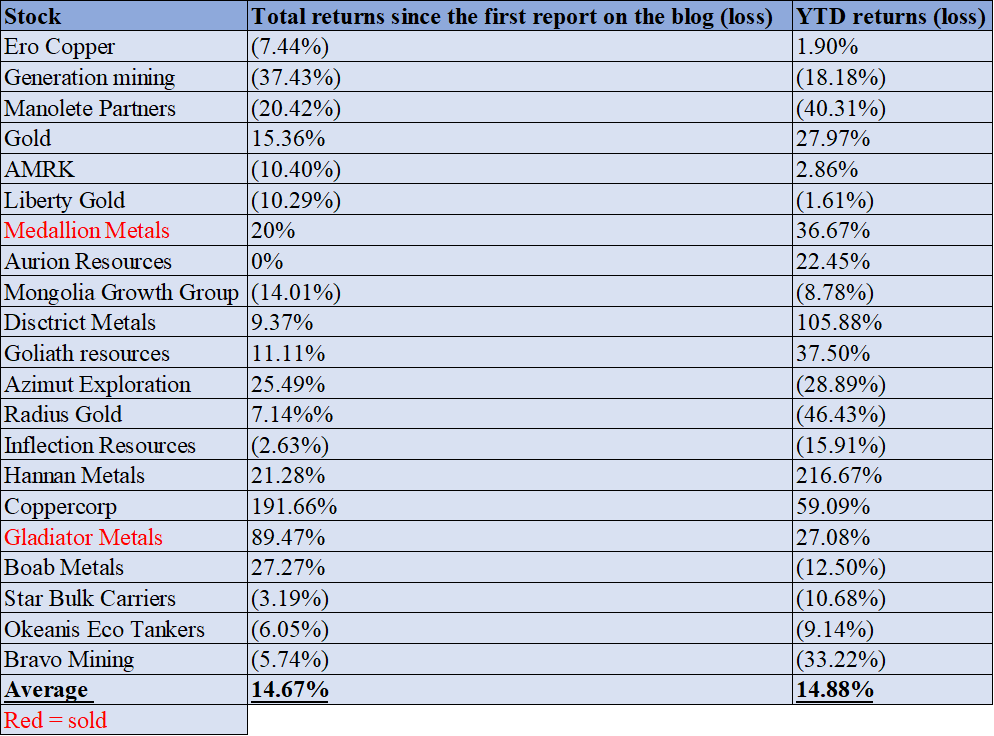

Blog picks

Returns of my picks posted on the blog.

This year has been surprisingly good, as I did not expect many of the picks from the portfolio to behave well until a few years ahead. The best performer has been Coppercorp, and the worst performer has been Generation Mining.

I will not do much commenting in this report as I have posted updates on each stock on blog posts, or in the group chat on Substack.

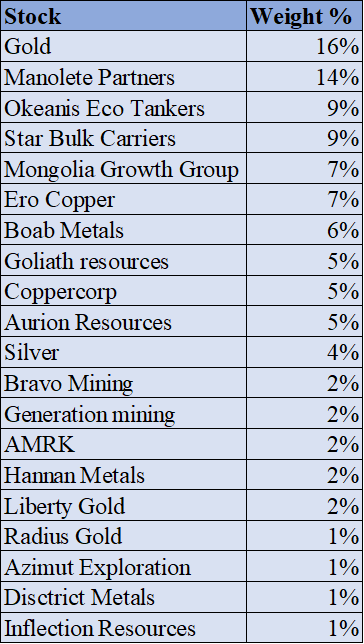

My portfolio

My portfolio.

I own twenty stocks in my portfolio, all of which have been covered in the blog. I also own some options, but they are so small that they are not relevant to the portfolio composition. The top ten stocks make up 77% of the portfolio, but in the future I want concentration to be much higher.

My returns since January 2023.

I am up around 45% since January 2023, when I opened my account at Interactive Brokers. However, please bear in mind that in this account I do not hold my gold and silver, therefore it is not precise as to the performance of my net worth.

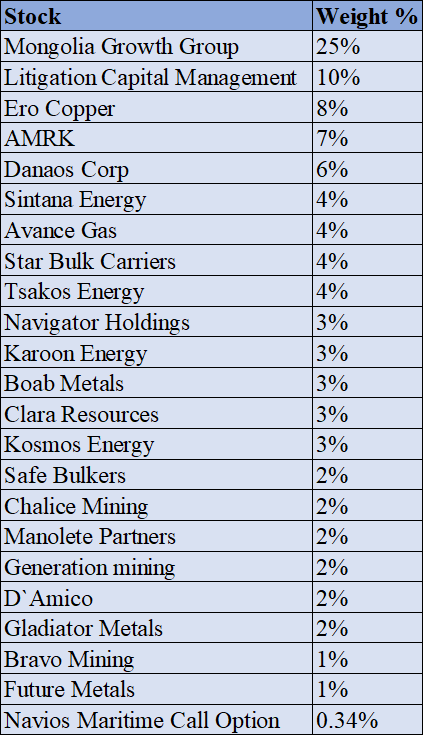

One of the portfolios I manage

Stocks in one of the portfolios I manage.

In this case I can´t show you long dated returns since I just moved this account to another broker, and deleted the account in the former broker. Year to date this account is down around 10%. However, in 2023 the returns were around 50% thanks to some shipping stocks performing very well.

I still have a lot of cash to deploy in the account I manage. But in my personal account I am fully invested, so I wanted to ask you: Are you interested in me writing about the stocks owned in the account I manage? Like Litigation Capital Management or Sintana Energy? Or would you like me to stick to the stocks I own in my personal account?

Let me know your answers in the comments of this blog post please.

Any feedback is more than welcome in the comments, or you can send me a message on Substack, or through my Twitter (X) account @AAGresearch.

As always, I want to thank my girlfriend Yeimy, who has helped me a lot while I was writing this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Disclaimer: I assume no liability for any and all of your actions, whether derived out of or in connection with this information or elsewhere, and you hereby warrant and represent that any and all actions that you take or that you may take at a later date in connection with this information shall remain your sole responsibility and, in case, I shall not be held liable for any such actions.

I would love to hear about the stocks in your managed account and why you manage it differently than your own. Does the owner give you guidance that leads to different choices? Is it simply market timing and when you were investing? Why the difference?

Great read as always, Alberto. Thank you. I’d prefer that you stick to the stocks you own as you have limited time to cover them. I’d prefer to read the ones you have the highest conviction in.