Gold: The return to a 2000-year-old trend

An investment thesis into gold as it reaches a historical inflection point

Summary

Gold is considered a precious metal due to its scarcity on the earth's crust. Other precious metals include silver and the metals in the Platinum Group Metals. The demand for gold is driven by jewellery, investment in bars and coins and central bank demand for physical gold.

Gold is now trading at an all-time high at $2,300/oz. However, in real terms (inflation adjusted), gold price was at its highest in 1980, when it traded at $2,700/oz in today's dollars.

Although gold prices have spiked recently, annual gold production seems to have plateaued at around 110 million ounces. We are currently witnessing the first time in recorded history gold production has stopped growing.

Gold was first used as a coin in 550 B.C. However, there are reasons to believe its use is even more remote as experts on fossil studies have found gold in caves used by the Palaeolithic Man, about 40,000 B.C. I believe we are living in an anomaly since 1971, when the gold standard was broken and it's a matter of time until gold comes back to its original use, in some form or another.

The lack of growth is driven, among other factors, by a lack of mineral gold discoveries. The world hasn't discovered 100M ounces of gold in a year since 2009, therefore miners are depleting reserves year after year.

Due to current market dynamics, and historical factors, I believe investing in physical gold is a good opportunity. Although a recession might make a dent in the gold price, history has shown us that gold prices recover quickly.

Onlygold. Macrotrends. Gold prices from 1792 to 2024.

Introduction

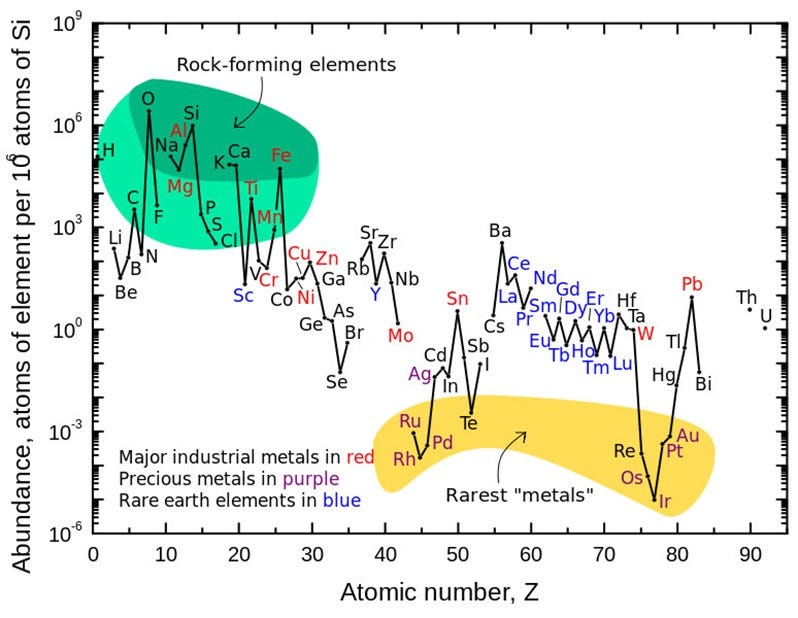

Gold is the most malleable and ductile metal. It is a good conductor of heat and it's the third best conductor of electricity, albeit it's too scarce to replace copper. It is inert and not affected by air or most reagents, hence gold found in shipwrecks is found intact. Gold is in fact resistant to most acids and does not corrode under normal conditions, making it a noble metal. It is nontoxic for human consumption. Gold is the seventh most dense metal and one of the most scarce on the earth's surface. The only metals which are perhaps scarcer are the Platinum Group Metals as shown in the table below.

As the image above shows, the U.S. Government has changed gold prices only four times from 1792 to the present. Starting at $19.75 per troy ounce in 1792, raised to $20.67 in 1834, and $35 in 1934. In 1972, the price was raised to $38 and then to $42.22 in 1973. Since then, the price of gold has fluctuated freely.

U.S. Geological Survey.

Over 50% of the world's gold is used for jewellery. India and China make up most of this demand. In fact, they each demand around 4 times the amount of gold jewellery than the US, the third largest market for jewellery. The second largest factor in gold demand is investing, often in the form of bars and coins. These are normally either indirectly bought through an ETF or bought through a physical gold trust. The investors in these ETFs or trusts hold rights over the gold held by these entities. However, gold can also be bought physically and be delivered to the consumer, either at a vault or at its home. The third largest driver in demand comes from central bank orders. Central banks hold physical gold in their own vaults, or in other countries' central bank vaults. Central banks use gold as a store of value, to facilitate international trade, to maintain financial stability, to enhance creditworthiness and to hold it as part of their foreign exchange reserves. And finally, the last driver of physical gold is technology and industry. However, this last application has been declining due to the high price of gold and the high incentive to replace it with cheaper metals.

Brief history of gold and money

The first reported appearance of gold dates to the year 40,000 B.C. This discovery was made in Spanish caves which are believed to have been used by the Palaeolithic Man. However, due to the remoteness of the archaeological discoveries of gold, there is still a debate about the first-time gold was used. The first gold mine is believed to have been in today's Georgia, dating back to the 3rd or 4th millennium B.C. And the oldest artefacts made of gold were found in Bulgaria dating back to the 5th millennium B.C. There have also been records of gold use or gold mining in Ancient Egypt, 4th millennium B.C. West Bank, Babylon, and New Kingdom (Egyptian Empire) to name a few. Gold is also mentioned several times in the Old Testament.

The first recorded coin made of gold dates to the 1st millennium B.C. This coin belonged to the Kingdom of Lydia, in modern day Turkey. From that moment onwards, gold coins became common almost everywhere that civilization developed. Civilizations such as those in Ancient China, Ancient Rome, the Mali Empire, Ancient Greece and Ancient India (3000 B.C.) used large amounts of gold for coinage, jewellery and store of value. Since then, gold has been used as coin, although silver and copper coins were used for smaller purchases. In fact, during the Middle Ages metals were also used as coinage, albeit supply was lower due to the rise of Islam which cut out sources of gold coming through northern Africa. During modern European history gold and silver remained the preferred type of currency. This was partilly possible because in the 16th century the Spanish discovered the largest deposits of silver discovered until that point. This created a buoyant supply of money throughout Europe and elsewhere for a few centuries. In fact, these silver discoveries coincided in time with the first stock exchange and later with the tulip mania, both having Amsterdam as its epicentre. Today it can surprise no one that the large increase in money supply, from two large silver discoveries may have possibly led to the tulip mania, the first recorded financial bubble.

R/ancientrome.

The graph above illustrates the tendency of rulers to constantly debase their own currency, even in at a time when they maintained a silver or gold standard. In Ancient Rome, silver coins went from having a 97% silver purity in 150 B.C. all the way down to 2% at around 300 A.D. This shows the importance of keeping bars of pure silver and gold in private storage. As governments might want to lower the value of the currency, we still hold the value of the metal intact. Having gold and silver in divisible forms is also important in my opinion as it makes payments easier. Nowadays there are thin gold bars that can be divided into 1 gram nuggets and silver coins of all sizes and shapes.

Paper money has been tried on several occasions throughout history. The Chinese state in the year 1024 started making paper money backed by the state. Some form or another of paper currency was used in China until the 15th and 16th century. At the beginning of this policy the paper was convertible into metals, but convertibility was suspended in the 12th century. The currency often had to be replaced due to high inflation caused by excess printing. This paper money ended around the 16th century, being replaced by silver.

Other efforts to make paper money later appeared in Sweden in 1661 at Stockholms Banco. However, the bank printed more banknotes than could be backed up by collateral and in 1667 the bank was liquidated, and its owner sentenced to life in prison.

The last meaningful effort to create paper money were the Assignats. A paper money that circulated in France during some years of the French Revolution. These were issued first in 1789 to pay for French debt, which was in the precipice of default. Assignats lasted until 1796, by that year over 45 billion francs had been issued, causing the currency to lose its credibility and value.

Gold and silver have been used until very recently. Silver coins were used in the US until 1965, although it is considered legal tender in 11 states even today. The dollar was backed by gold until 1971, however 3 states (Louisiana, Utah, and Texas) recognize both gold and silver as legal tender today. Other countries like Britain left the gold standard in 1931. Countries more dependent on silver like Spain continued to issue silver coins until 1933.

Since the US left the gold standard in 1971, the US dollar has lost 88% of its value, using inflation as measurement. I believe this to be the nature of state backed paper currency as rulers are tempted to print ever more paper. I believe that since all paper currencies have failed in the past, it is reasonable to believe the same will happen this time around. Which is one of the reasons that motivated me to write this report. I think investors should be warned of what's coming so they can prepare. That said, there is no escaping inflation: owning gold with the upcoming inflation or hyperinflation won’t make you rich, it will just make you lose less. As Milton Friedman brilliantly said: “The only way to avoid inflation is spending all your money and not having any. And even then, your upcoming payday check or dividend will be worth less than before”.

Demand dynamics

As the graph below shows, for the past 40 years, changes in demand for gold have very much been dominated by central banks. From 1992 to 2009 central banks, especially in Western countries sold a lot of gold. Just as an example, my home country's central bank, the Bank of Spain, sold almost 134 tonnes of gold in 2007. Since 2009, central banks have been accumulating gold in massive quantities.

Metals Focus, Refinitiv, World Gold Council. Central bank demand for gold.

In fact, central banks in India, Turkey, Russia, and China have been stockpiling gold in record quantities. China for example imported over 100 tonnes of gold in January 2024 alone.

Bloomberg

This trend can be easily seen in the chart below, which shows that up until 2009 central banks were net sellers of gold. Since then, global demand for gold has rarely been below 4,000 tonnes per year.

LBMA, Reuters, World Gold Council. Gold demand 2003-2012.

In fact, the only year gold demand has been below 4,000 tonnes was 2020, when the COVID crisis hit, and consumers dropped their spending on jewellery drastically. Jewellery makes up around 50% of the world demand for gold, 50% of which comes from China and India. In the past decade or so investor demand for gold seems to have plateaued. This is probably due to the relative state of peace in the world and low interest rates which incentivized investors to invest into stable, cash flowing businesses and into bonds that increased in price incessantly. Now with rising interest rates, geopolitical risk, depreciating bonds and currency risk, I predict investors will seek gold once again. In fact, the import level from China I mentioned before proves my point.

World Gold Council. Gold demand 2010-2023.

Furthermore, inflows into gold Chinese ETFs and funds are increasing rapidly. This has created an interesting dynamic since ETFs in Europe and North America are seeing outflows. Therefore, the only conclusion one can guess is that gold is flowing out of the Western world and going into China. Western investors ought to ask themselves who is at the right side of the trade in this case.

ETF providers, Shanghai Gold Exchange, World Gold Council. Flows into Chinese gold funds.

Supply dynamics

World Gold Council. Supply of gold.

As the chart above shows, total gold supply (mining and recycling) has plateaued. It is noteworthy that recycled gold is 30% lower than its record high in 2009 despite record high gold prices. There are two main reasons for this: the first being that there is no distress selling going on, unlike in 2009 when consumers sold a lot of gold containing goods. With the fiscal support both in Europe and North America for consumers and business in the post pandemic period, there is little incentive for gold selling from consumers. Secondly, jewelry stocked by consumers was flushed out in the period between 2008 and 2012, limiting the available supply for recycling. Therefore, the risk of the market being flooded by recycled gold is very unlikely.

Metals Focus.

Many investors may now be worried that gold miners may flood the market with new gold production, now that prices are at all-time highs, at least in nominal terms. However, their margins have compressed almost proportionally in the same period as the chart above shows. This is driven by higher energy prices, lower gold grades, higher employee compensation and higher capital expenditure. Not to mention that gold mining has an exceptionally long cycle, it takes decades to open a gold mine in Europe or North America. And in other countries where gold permitting is more straightforward, miners risk other obstacles like nationalization. As an example, Kyrgyzstan seized control of the giant Kumtor gold mine from Centerra Gold in 2021.

S&P Global Market Intelligence

For gold miners to produce gold they need to conduct exploration activities in the first place. In the chart above it is shown the number of ounces discovered each year in terms of millions of ounces. Considering the world produces almost 120 million ounces of gold per year, it is worrisome that 120 million ounces of gold have not been discovered in a year since 2009.

S&P Global. Barrick Gold.

The graph above illustrates the same idea except this time its measured in major gold discoveries per year. What's truly worrying about this trend is that the gold firms are spending billions of dollars per year while finding almost no gold. Considering the world has about 2,000 million ounces of total gold reserves underground, the world has around 16 years of gold left to mine. Therefore, I believe the gold mining industry will either disappear in 16 years, or gold price will rise so much that gold exploration activities will increase, leading to more discoveries. The latter case is the more likely case as gold mining has been going on for thousands of years.

One could say that the low hanging fruit has already been discovered in gold mining and future deposits are going to be lower grade, located deeper underground and with more complex metallurgy. Metallurgy is often an overlooked factor for mining investors, but it is critical to achieve high gold recoveries. Gold recoveries are a critical factor in the making of an economic gold deposit.

“Majors’ [miners] reserves peaked at 967M ounces in 2012. But by 2019, just 7 years later, reserves had plummeted 30% to 670M ounces”- Scott Reardon from Dakota Funds. This decrease in reserves is not sustainable as miners will run out of ore sooner or later. Therefore, miners must increase exploration spending or takeover undeveloped deposits to increase reserves. In recent years, the market has experienced significant M&A transactions. Just to name a few:

· Randgold-Barrick Gold (2019)

· Newmont-Goldcorp (2019)

· Agnico Eagle-Kirkland Lake Gold (2022)

· Newmont-Newcrest (2023)

· Agnico-Yamana-Pan American (2023)

However, none of these transactions led to a significant increase in reserves as most of them pursued synergies in their operations. These transactions were not made to develop a transformational project. An example of a different transaction would be the take over of Great Bear Resources, by Kinross in 2022. Kinross bought Great Bear with the idea of developing that asset and increasing reserves. And in fact, Kinross released news on a mineral resource for the Great Bear project in 2023, increasing the reserves at Kinross.

My point being that M&A transactions have rarely involved a miner taking over a gold developer to take a new project into production. And this is critical for the industry to remain in existence.

Gold as the ideal money

John F. Nash (Ideal Money paper). Juan Ramón Rallo (Juan de Mariana Institute).

From my point of view, one of the critical factors in the investment thesis of gold is the idea that it constitutes the closest good to being “ideal money.” This realization came to me using the ideas of Nobel laureate John Nash in his paper Ideal Money and taught to me by Juan Ramón Rallo from the Juan de Mariana Institute. The graph above summarizes the features of this concept.

First, gold is very cheap to transfer and transport. A kilogram of gold takes very little space and is worth around $70,000 today. To set an example, a suitcase could easily fit over 20 kgs of gold, worth $1.4M, enough to live for decades in most countries. This also makes it cheap to store, as a small safe box can fit a large monetary amount of gold. It is also cheap to use as gold is the most malleable metal and easily divisible.

Gold is not easily falsifiable; it is easy to verify if it`s real or not. In fact, back when gold and silver coins were in use, merchants could verify both the authenticity and the purity of the coin just by the sound it produced when being dropped on a table. Nowadays a gold user can drop a coin in a glass of water; if it sinks it is a precious metal, as imitations tend to use lighter metals. Or if the user sees discoloration, it also indicates fake gold.

Gold has demand besides its monetary value. It retains value through its use in jewelry and industrial applications. Its use in technology is widespread, where it is used in several sectors such as: light emitting diodes, printed circuit boards, dentistry, or wireless connections.

Finally, gold is stable in value, both through intertemporal liquidity and intratemporal liquidity. I will explain both below:

· By intratemporal liquidity, we mean how quickly the market price of a good converges to its equilibrium value. If the market price of a good has not converged to its equilibrium, transactions may be made outside of equilibrium: asked price (buy above equilibrium) and bid price (sell below equilibrium) balance). The bigger the difference between both, the lower the intratemporal liquidity. In the case of gold, this liquidity is high given the multiple markets it trades in.

· Intertemporal liquidity means the stability of the equilibrium price across time. The only way to achieve this type of liquidity is for supply and demand to be dependent on each other. However, since we need the ideal money to be easily storable, we also need it to be highly supply inelastic given a change in demand. And due to it being supply inelastic, we need demand to be highly elastic to changes in supply. Gold has intertemporal liquidity and can be observed throughout history. One thousand years ago a gold coin of one ounce could buy a sizable amount of goods. And today one ounce of gold ($2,300) can also buy many goods. Therefore, offering the user of gold purchasing power throughout time.

Nowadays many investors compare Bitcoin with gold in terms of their utility as a store of value. Gold is superior for various reasons:

1. Bitcoin´s supply cannot respond to demand in an efficient manner. If demand for Bitcoin rises, the supply of Bitcoin cannot rise in any proportionate manner. Whereas gold will increase in supply due to increases in demand and price. Although this will take decades as it is very difficult to find and build gold mines, supply will increase sooner or later, balancing out the increase in supply.

2. Bitcoin has no use aside from its monetary utility. Therefore, its price relies solely on its store of value or means of exchange utility and speculative demand.

3. The lack of any use for Bitcoin implies it has very little intertemporal liquidity. Let’s set ourselves 1000 years into the future: gold is no longer scarce; however, gold is still a good conductor of heat and electricity, therefore it has value for industrial or technological applications. Gold is also the best metal to protect against nuclear radioactivity, it’s a lot more effective than lead. Bitcoin however has no use outside its monetary demand or speculative demand. This doesn’t mean Bitcoin has a value of 0, perhaps in the very distant future bitcoin will have numismatic value. Not very different from people nowadays that collect Assignats from the French Revolution or bonds from the Mississippi Company Bubble.

4. Bitcoin is very supply inelastic. Let’s imagine Bitcoin was used as a currency like the US dollar is, there would be a constant increase in goods and services, but the amount of Bitcoin in circulation wouldn´t rise proportionately. This would lead to an everlasting deflation: the value of Bitcoin would increase incessantly. This would lead to a decrease in commerce and velocity of money as people would treasure Bitcoin instead of using it to purchase goods and services. Therefore, Bitcoin has no utility as a currency if it were implemented as such given that people wouldn’t use it to buy products. This wouldn´t happen with a gold standard as the increase in the price of gold (deflation) would lead to increases in gold supply, leading to lower gold prices (inflation), therefore balancing each other out.

5. Bitcoin only has utility when there is electricity available. In Venezuela for example power outages are common. In fact, in some provinces of Venezuela gold is now being used as money. Bitcoin is only useful if electricity is available. Not to mention the fact that Bitcoin is sensitive to extreme geological events. For example, at the Carrington Event (1859), a geomagnetic storm hit the Earth. Telegraph systems all over Europe and North America failed and telegraph pylons threw sparks, this would render all electronic apparatus useless. These kinds of events would make all Bitcoin useless, or it would cease to exist altogether. An earthquake that damaged electricity supply could also affect the operations of Bitcoin, which relies on heavy consumption of electricity. None of these events would affect the utility of gold as it requires no electricity for its use.

6. Gold has never been out of fashion. Since its earliest discovery in 40,000 B.C. gold has appeared numerous times through archaeological findings. Bitcoin has been around since 2008, so it doesn’t have a long-term history as a store of value or means of exchange.

7. Cryptocurrency can be more easily stolen than gold. As the graph below shows, the theft of cryptocurrency has skyrocketed. Just in 2014, at the Mt. Gox Bitcoin exchange, over 850,000 bitcoins were stolen. Gold on the other hand, is harder to steal due to the high level of security and scrutiny available at the main vaults and central banks worldwide. Also, gold is very dense and heavy, therefore the logistics to move the gold after a theft would be difficult.

Chain analysis.

8. As of 2020, approximately 3.7 million Bitcoins have been lost, possibly forever (Chainalysis, a forensics company). This limits the supply of Bitcoin available to be used as means of exchange and therefore exacerbates the issue of endless deflation before mentioned. Considering only 21 million Bitcoin can exist, this means over 17% of all Bitcoin may be lost. According to the World Gold Council around 212,582 tonnes of gold has been mined throughout history, of which approximately 201,296 are accounted for as shown in the table below. Due to the anonymity of gold ownership it’s difficult to get exact figures in this regard. However, the World Gold Council states that most of the gold mined in history is still around in some form or another, as gold is almost indestructible. This adds supply and liquidity to the gold market, which facilitates the use of the metal as means of exchange.

World gold council.

9. Bitcoin requires of some kind of internet usage to use. This means it can become a target of government intervention. In fact, in Egypt, Libya, Morocco, China, Ghana, Lesotho, and Sierra Leone some form of ban or limitation on Bitcoin use has been tried or implemented. Although these bans are hard to apply due to the decentralized nature of Bitcoin, it hampers the user’s ability to use it as store of value or means of exchange. Gold can also be subjected to confiscation or ban but due to the anonymous nature of gold and its transactions its very hard to enforce. In 1933 FDR attempted to confiscate gold in the USA, but anyone could have been hidden their gold and the federal government could have done very little to find and confiscate such gold.

10. Finally, there is the issue of price stability. As the first graph in this report shows, the price of gold has been remarkably stable since 1792. This price stability adds trust and safety to gold users when used as store of value or means of exchange. In contrast, Bitcoin price has been extremely volatile since its very beginning. Although price is at all time highs, this volatility diminishes the utility of Bitcoin as store of value or means of exchange.

Investopedia.

According to Nash the ideal money is one that presents an invariance in absolute value, its equilibrium price is stable and in addition, any disturbance of balance is quickly corrected. Therefore, the ideal money as described by Nash does not exist in reality, but gold is the closest good in existence in my opinion.

One last noteworthy factor to mention is that money is not imposed as a top-down approach in society, it is always bottom-up. Therefore, any currency that is imposed autocratically upon people is doomed to fail sooner or later. In fact, the first gold coins were issued not as an autocratic rule, but to add utility to a good that was already being used as a means of exchange for products. As a result of this, the past 50 years of paper money are in my opinion just an anomaly in history, and I believe soon we will return to sound money. In fact, “fiat” is derived from Latin and means “let it be done”. Paper money wasn't initially used because consumers found it useful, but because a government ordered it to be created.

FRED, Macro Trends, Dakota Funds.

The graph above shows the monetary base in the US and the gold price since 1971, when the gold standard was broken. In the past, gold prices have correlated with the monetary base. However, since quantitative easing started after the financial crisis in 2008, the correlation has been broken. The divergence between both is now massive. In fact, as of 2023, gold trades at a 60% discount to its 37-year average versus the US dollar. If we can agree that gold is indeed money, and the US dollar is debt then this following statement holds true: gold price measures the degree to which paper currencies (debt) have lost value through money printing and dilution. As a result of this, gold is trading at a massive discount to its value considering all the printing and dilution that has been going on.

Conclusion

In conclusion, I believe investing in gold is a very attractive opportunity even with gold trading at all time highs in nominal terms. This metal is facing several tailwinds. These are the main tailwinds for gold:

· Central banks are purchasing gold at a rapid pace.

· Lack of gold discoveries, limiting supply.

· Depletion of gold reserves at a rate of 120 million ounces a year.

· Higher costs for miners, tightening supply.

· Ignorance of the true nature of gold by investors, which makes the market misprice it.

If you see the situation in gold the way I see it, then the question that remains is how to get exposure to this metal. As Rick Rule from Sprott says “if you believe a metal will go up in price, the first thing you should do is buy the metal.” I fully agree with this philosophy. In this regard there are several ways to buy gold: buy it physically and get it delivered to your home, buy it through a custodian which will keep your gold in a safe somewhere, buy shares in a physical gold ETF or buy gold futures in the open market. As a fan of history myself, I would opt for the first option. The reason being that in 1933 Franklin D. Roosevelt seized almost all gold owned by Americans at a fixed price. If this was done in 1933 when the respect for private property was superior to nowadays, one can only imagine what the government might do today. Therefore, I believe buying physical gold and having it delivered to your home or a place you consider safe is the best option. I would suggest comparing fees across several brokers before doing so.

Some investors may believe investing in large to medium miners will give them a lot of leverage to the gold price. While this last statement may hold true, those investors are ignoring the fact that miners will undertake massive amounts of capex to replace diminishing reserves, reducing profits. Not to mention that an increase in energy prices and employee compensation is already increasing all in sustaining costs for miners, as shown before in a graph in this report. Therefore, I believe that the strategy to get the most leverage to the gold price is threefold: firstly, I believe in buying small miners that just started production or are about to start production and have very long mine lives. These firms will become the number one target for large miners when they realize reserves are about to deplete. Secondly, I believe in buying the best gold developers out there. These are the ones that show the best economics in their feasibility studies and have good management teams. Thirdly, I believe in investing in gold brokers, traders, and custodians as a less risky way to buy exposure into gold assets. I will cover all three of these opportunities in a future newsletter as this one already reached 13 pages and I do not wish to take any more of your time.

For those that do not want to dive too deep into the thesis, I believe investing in physical gold and a gold miners ETF will suffice. There are several options in the gold ETF universe, which I can cover more deeply in a future newsletter. In the meantime, I would recommend an ETF that includes junior gold miners as well as gold royalty and streaming companies. Royalty companies have an exceptionally good business model, albeit their leverage to gold price is somewhat lower than junior miners or gold brokers.

To sum it up, I believe investing in gold is of critical importance to maintain the level of an investor's purchasing power. I believe gold has been used as money for thousands of years as evidence indicates and since 1971, we have been living in an anomaly that will sooner or later end. This historical context combined with gold production facing a precipice in 16 years, offers investors a crucial opportunity to purchase gold exposure. The way you choose to do it depends upon you, but I believe that buying physical gold is the way to start if you have not done so already.

I want to thank my girlfriend Yeimy, who has helped me a lot at home while I was researching this by myself. This report and this blog would not be possible without her. Thank you.

Great !!! You always surprise me. Congratulations.

Interesting (hi)story! Thanks for the article!