Ero Copper Update: Raising Price Target

Increases in copper & gold prices and a new mine coming online merit a rerate of the stock

Introduction

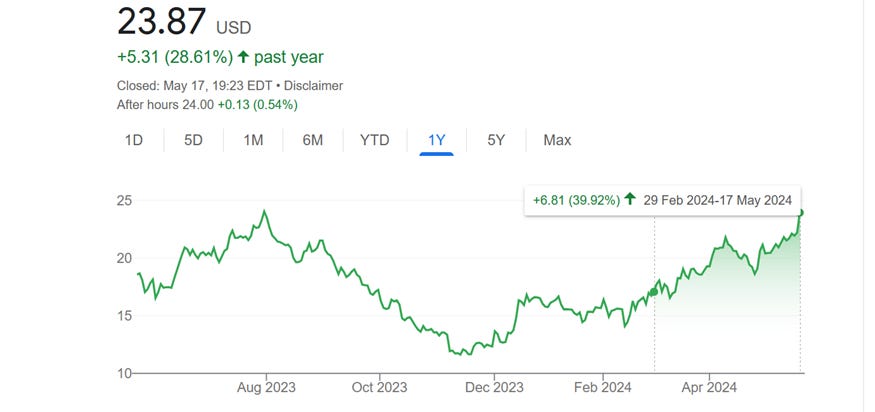

I published my first report on Ero Copper on February the 29th, since then the stock has gone up 39.92%. Ero released its results for Q1 2024 on May the 7th, I apologize for not doing an update earlier, I am working on the gold report nonstop. In fact, today´s update will be short, unlike my first update on Ero. I listened the conference call for investors that Ero held with analysts. It was positive to see that none of the analysts were concerned with the net income loss. In fact, through their questions I inferred that they have a very long-term vision on Ero, since most of the questions were about the new Tucuma project, nickel exploration, the gold mine and copper mine expansions.

Summary

· Record Gold production due to higher gold grades and mine expansion.

· Gold costs below guidance.

· 2024 gold guidance: 60k-65k ounces and $1,050 AISC.

· New shaft in construction at Caraíba (ready in 2026) will be the second deepest in South America and will access very high-grade copper and extend the life of the mine.

· Lower production due to lower copper grades in Q1 but management expects higher grades throughout the year and therefore lower costs.

· 2024 copper guidance: 59-72k tonnes vs 43,857t they produced in 2023.

· First production at Tucuma by beginning of Q3 2024 and commercial production (80% of capacity) by the end of Q3 2024.

· Tucuma at 97% completion.

· Zero loss time injuries at Tucuma and rainy season behind us.

· Extremely high exploration potential at northern part of the Caraíba property, ore bodies available. Possible new plants to extract those in the long term.

· I am raising price targets in all three copper price scenarios.

Balance sheet

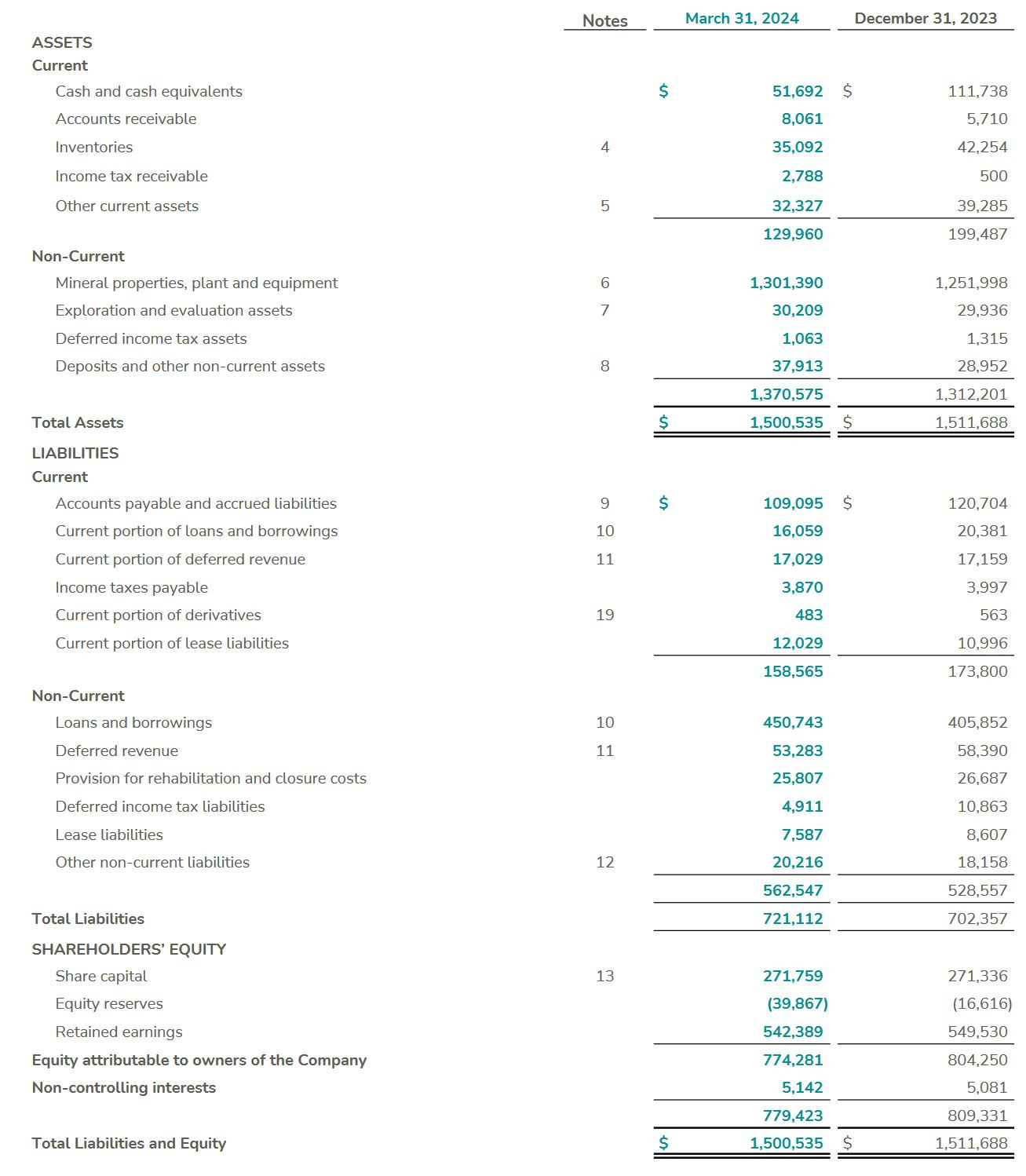

The balance sheet has not changed much except for a $50M increase in long term debt in the form of a Senior Credit Facility, which bears an interest on a sliding scale at a rate of SOFR (Secured Overnight Financing Rate) plus 2.00% to 4.50% depending on the Company’s consolidated leverage ratio. Cash is down as the company has spent $107M in CAPEX for Tucuma. There is nothing to worry about here, since the company is more than able to cover interest expenses and its main portion of debt ($400M) carries a 6.5% fixed rate and matures in 2030.

Ero Copper. 2024 Q1 results. Balance sheet.

Earnings

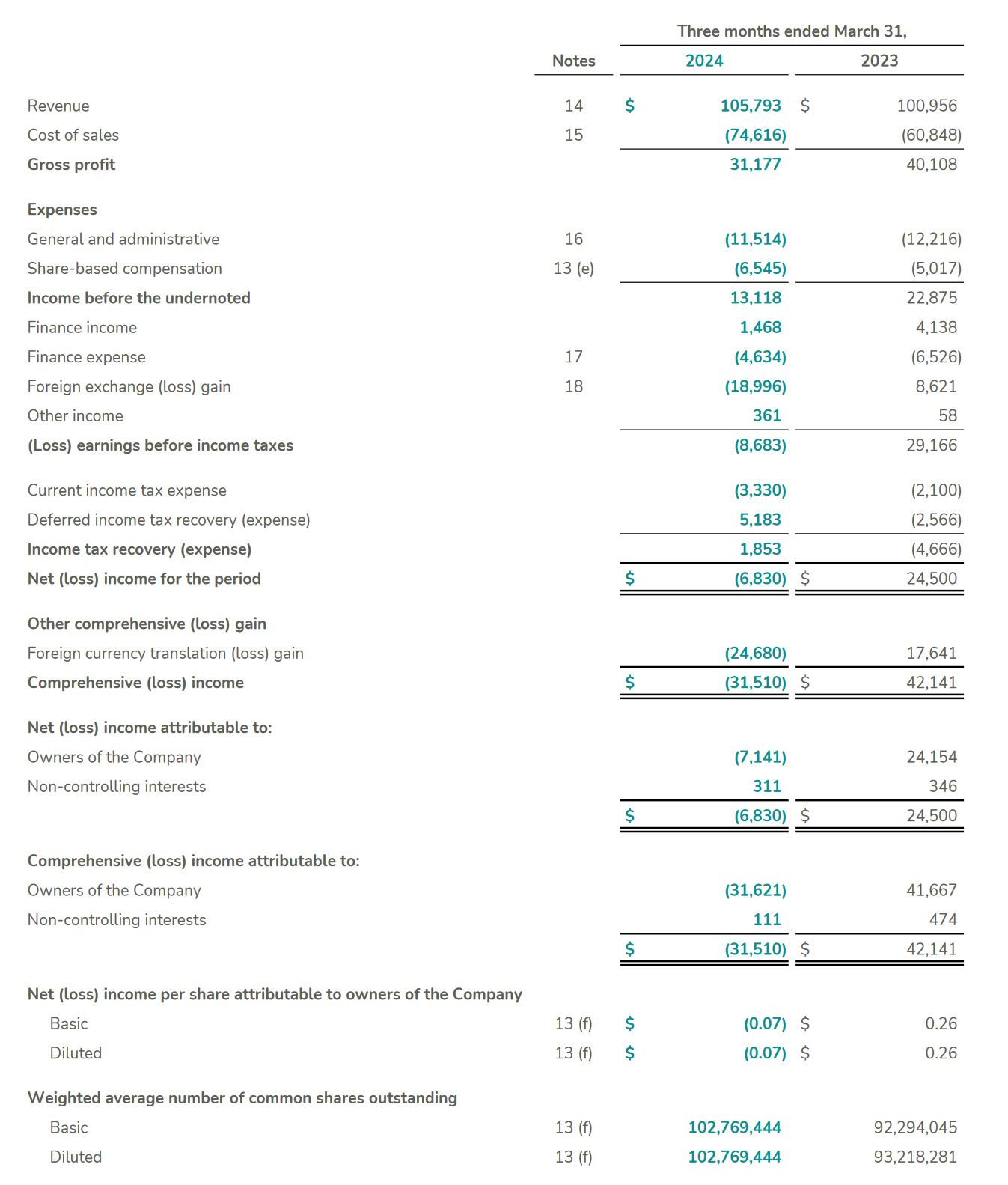

Revenue was up 5% thanks to some sales of copper which had remained in the inventory from Q4 2023. The big surprise here was the foreign exchange losses. This were caused by a 4% depreciation of the Brazilian Real against the USD. This resulted in a loss at the bottom line. As I already reported on my last update: Shares outstanding have increased from 92 million shares to over 102 million. This issuance of shares was made to partially finance the Tucuma project.

Ero Copper. 2024 Q1 results. Income statement.

Conclusion

I still view Ero copper as an asymmetrical bet, where even if management cannot deliver the growth expected in the Tucuma project, the company still holds very low-cost copper and gold operations with unique and difficult to replace infrastructure. Ero has a management team that has built the business from scratch which proves their skills and know how. Furthermore, the company has reported that Tucuma is 97% complete as of May 2024 with commercial production expected in Q3 2024. In fact, the guidance for 2024 for copper output is of 59,000 to 72,000 tonnes vs the 43,857t they produced in 2023. Even if they fall short of that guidance the growth will be significant. Furthermore, news from the Furnas JV with Vale and new exploration updates on their nickel discovery can be further catalysts for the share price of Ero.

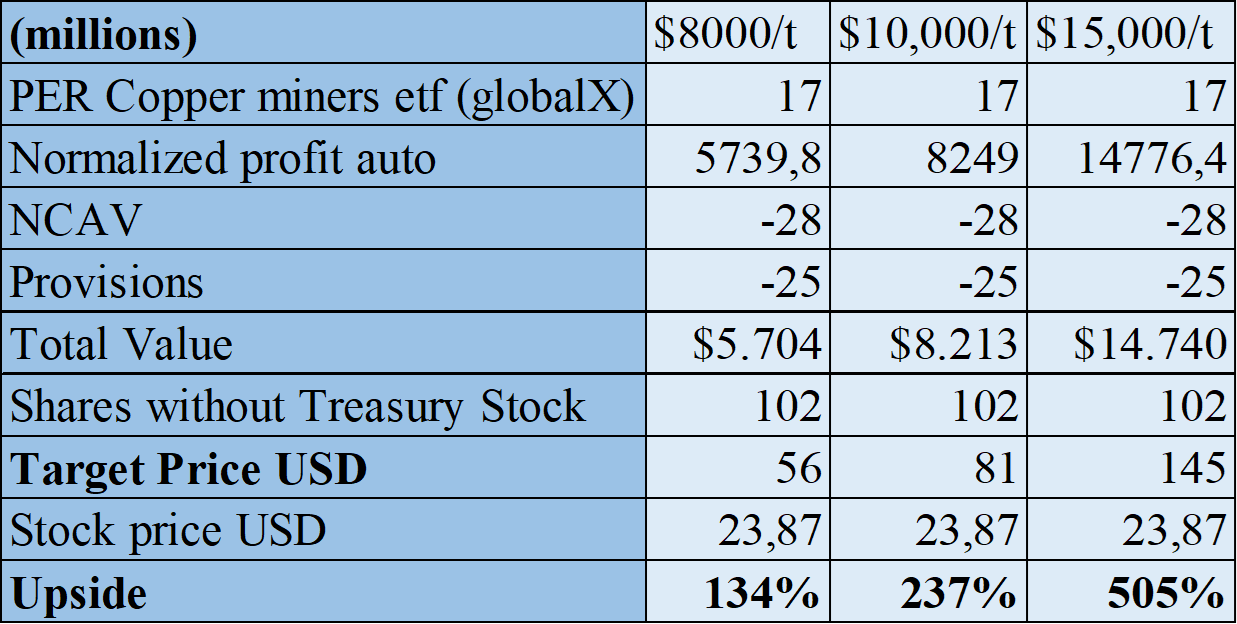

I am raising my price target for Ero Copper, and I am adding a new scenario since copper now trades at over $10,000/t. My price target at current prices would be $81/sh at $10,000/t, I assume Ero will reach this price in 2025 once all their copper operations are running at full capacity. Even if copper tumbles down to $8000/t, the upside is still of 134%. If copper prices reach $15,000/t (incentive price according to the CEO of Ivanhoe, Robert Friedland), we could see multibagger returns for Ero Copper a year and a half from now.

Updated Ero Copper valuation on three separate copper price scenarios.

I want to thank my girlfriend Yeimy, who has helped me a lot at home while I was researching this by myself. This report and this blog would not be possible without her. Thank you.

Any feedback is welcome in the comments, or you can send me a message on Substack or through my twitter account @AAGresearch.

I hope this finds you well,

Alberto Álvarez González.

Alberto, What are your thoughts on ERO at this difficult time?

What os the percentage of the hedged copper? Do they have a maximum selling price for the hedged copper? Thx