Ero Copper update on earnings results

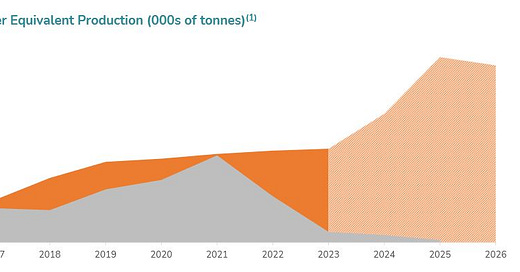

The market is not pricing in the imminent increase in copper output

I published a report last week on Ero Copper. Since then, the stock has dropped around 1.5%. Yesterday Ero went down 1.47% probably expecting weak results for the year of 2023, which were published after the market close. Today the stock price has fallen almost 5%. The expected weak results might have been justified due to the production report published on the 21st of February, announcing that production of copper was below guidance. However, production was 43,857 tonnes vs a guidance between 44,000 and 47,000 tonnes, just 0,3% under the lower end of the guidance. The reason for the lower production was an unplanned downtime of a week in the Caraíba mill expansion, part of Ero´s core copper operation. However, the expansion was achieved by year end and the NX mine has produced a record amount of gold at a lower cost.

Balance sheet

Diving into the financials, current assets have dropped 50% mainly due to $450M in capital expenditures which have been destined for the mill expansion, exploration, and the development of the Tucuma project. However, the company still has a working capital of over $25M and undrawn revolving credit facilities of $150M, leaving them with ample capital to work with going forward. Current debt has increased 30%, however almost all of it due to an increase in accounts payable due to trade suppliers. This type of debt is preferable when operating such a capital-intensive business as its interest free, it shows suppliers trust the business and it shows Ero has a high level of bargaining power.

Ero Copper. 2023 results. Balance sheet.

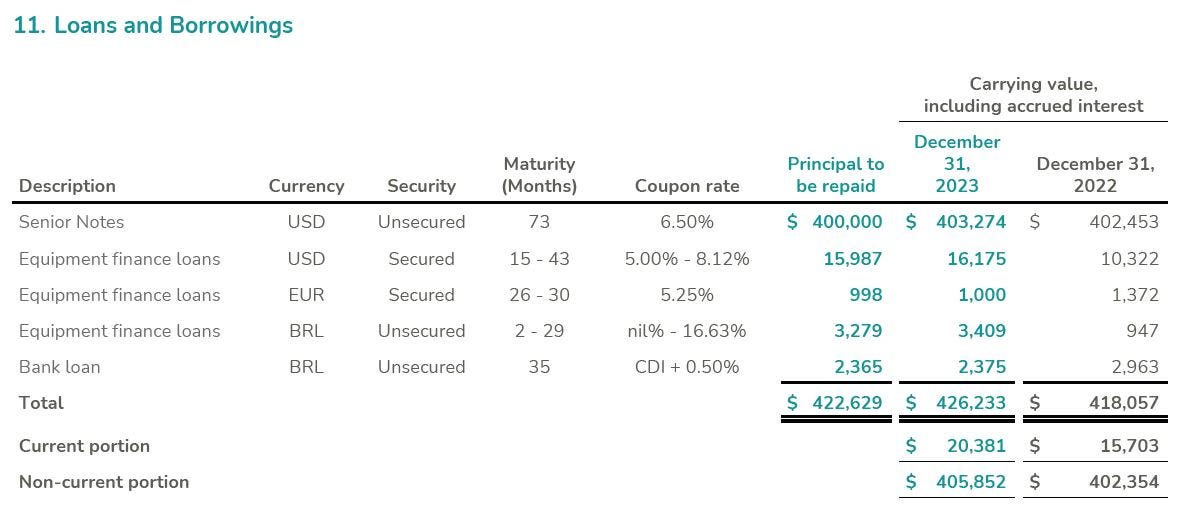

Regarding non-current debt, which can be seen in the table below, the $400M in long term loans and borrowings bear an interest of 6.5%. This is a lot lower than the interest charged to other medium sized miners that issue debt at 8% interest and upwards. To set an example, Codelco, the largest copper miner in the world and one of the lowest cost producers, recently issued debt at around 6.5% even though they should have access to much lower costs of capital given their size and dominant position.

Ero Copper. 2023 results. Loans and borrowings.

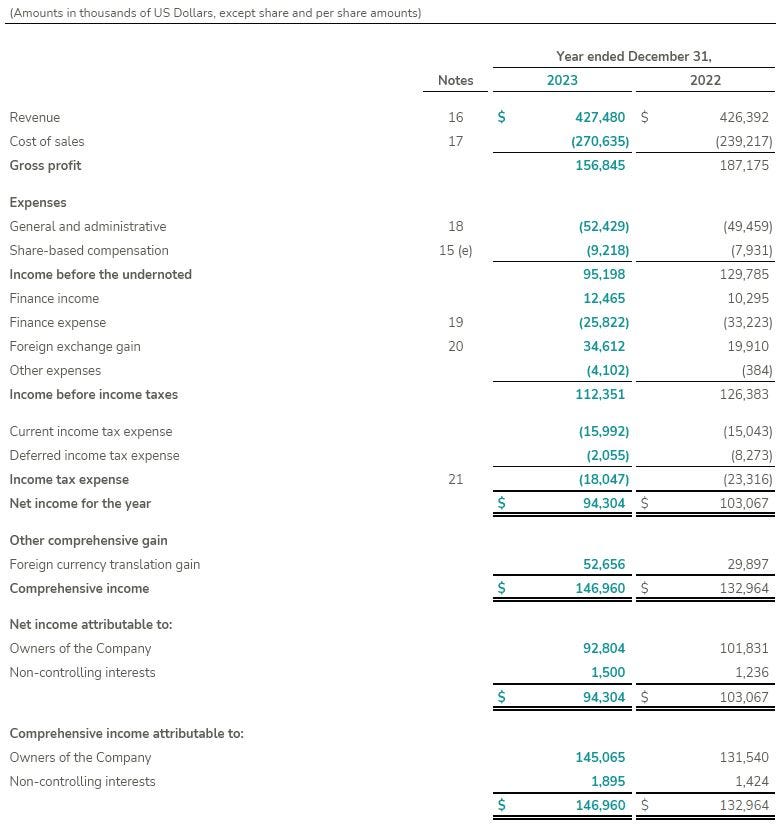

Earnings

Even though copper output was lower than expected, earnings have remained stable. This has mainly been due to record high production of gold and lower costs in the NX gold mine. However, cost of sales has increased by 12.5% as salaries have increased by 20% and depreciation and depletion have risen by 46%. The only other remarkable items in the income statement were the lower interest expense and a 75% increase in foreign exchange gain. This foreign exchange gains were made on USD denominated debt in Brazil and gains of derivative contracts on copper contracts and foreign exchange.

Ero Copper. 2023 results. Income statement.

The main negative side of this release is the fact that the average number of shares outstanding has increased from 92 million shares to almost 95 million, a 3% increase. This issuance of shares was made to partially finance the Tucuma project. That said, the company was able to deliver $94M in net income in an environment with a stagnant copper price, lower copper output, lower copper grades at its mine and the necessity to spend hundreds of millions in the Tucuma project.

Conference call main points.

100,000 copper production expected in 2025.

Lower copper grades were expected.

Increase in copper price realized.

Tucuma is within guidance capex.

Last piece of equipment needed at Tucuma is already on the way of being delivered.

Commercial production (80% of capacity) to be achieved in Q3 2024.

Ore at Tucuma is already ready to be processed.

60% of workforce for Tucuma is already contracted.

Nickel exploration is underway and land package is being expanded, grades found are as high as 7% nickel and management talks about a generational sized deposit in the works.

Brazil as a mining jurisdiction

A few subscribers have let me know that they are intrigued by the quality of Brazil as a mining jurisdiction, so I would like to take the chance to explain it in this update. Mining has been going on in Brazil since the early 18th century, therefore it has a long history of mining and its laws have been evolving since then. Infrastructure and mining expertise have been developing since then.

United States Geological Survey. Mineral reserves in Brazil.

Brazil is very well endowed with mineral resources as proven in the table above. They have 17% of the worlds rare earth reserves, 18% of the worlds iron ore and 16% of the world´s nickel. Incidentally all these metals are fundamental to electrification and technology going forward. Brazil is also the world´s 9th largest oil producer, 3rd largest iron ore miner and the 8th largest producer of nickel.

Energy is a fundamental part of mining, in fact mining consumes 3.5% of the entire world energy consumption. In this regard Brazil generates 53% of the entire electricity in South America. More importantly, around 80% of the country´s electricity supply comes from renewable sources, which is critical for the mining industry going forward.

The permitting process in Brazil is straightforward. However, capital markets have yet to fully developed as most miners operating in Brazil trade in stock exchanges in Canada, Australia, United States, and the UK mainly.

Conclusion

I still view Ero copper as an asymmetrical bet. The company still holds very low-cost copper and gold operations with good infrastructure even if management can’t deliver the growth expected in the Tucuma project. However, the company has reported that Tucuma is 90% complete as of February 2024 and therefore we should expect production in H2 2024. In fact, the guidance for 2024 for copper output is of 59,000 to 72,000 tonnes vs the 43,857 they produced in 2023. Even if they fall short of that guidance the growth will be significant. Furthermore, capital expenditure guidance is in the range of $300M to $350M, much lower than the $450M spent in 2023. A lower capex combined with higher copper and gold output, should provide Ero with much better financials going forward, therefore I believe the market´s pessimism yesterday and today was unwarranted. The thesis remains intact.

On a side note, next week I will be publishing a report on platinum group metals and a full comparison of all the PGM projects in development I have been able to find. I hope you find it interesting. And as always, any feedback is welcome in the comments, or you can send me a message on Substack or through my twitter account @AAGresearch.

I want to thank my girlfriend Yeimy, who has helped me a lot at home while I was researching this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Strong article again!