Ero Copper: Significant upside even if copper expansion doesn´t come through

Tier 1 copper miner in the making

Summary

Ero copper is a copper and gold producer in Brazil. Its MCSA mining complex has 2 of the 5 largest copper mines in Brazil. The copper market has improved over the last five years, with prices being up over 40% in that period.

The company is one of the only copper miners worldwide planning on doubling output over the next few years. Even with current output their stock price shows over 100% potential in upside.

Capital allocation has focused on bringing the Boa Esperanza (Tucuma) project into production and on a nickel exploration program.

The company has now turned a corner; they have a liquidity position of over $300M and just announced a $111M financing to fund the new copper expansion. Ero will be doubling copper production by 2025.

At current stock pricing, I believe Ero is an asymmetrical bet with significant upside potential even if they do not deliver on the promise of doubling copper production.

Ero Copper Investor presentation.

Introduction

Ero copper is a copper and gold producer in Brazil. Its MCSA mining complex has 2 of the 5 largest copper mines in Brazil. Considering they have one of the lowest all-in sustaining costs (AISC) of the entire industry and their near-term production increase, the Board has a unique opportunity to create shareholder value. The company has been very conservative over the last few years, stablishing a price floor for copper sales to guarantee the construction of the new copper project, and having a conservative balance sheet relative to peers. They announced in November a financing deal to secure the funding for the new copper project and other ventures, therefore no unwanted dilution is expected from now on.

Ero copper at a Glimpse

ERO owns 2 copper mines in the MCSA mining complex with a very low copper cost: cash costs of $1/lb and AISC of $2/lb approximately (copper trades at over $4/lb). In the last 10 years copper price has not gone below $2/lb, therefore ERO can operate with profits at all points of the economic cycle. ERO owns the NX gold mine which produces gold at a cost of $1000/oz (gold trades at over $2000/oz), which is low cost for industry standards, albeit NX produces just 50,000 ounces per year.

Ero Copper Investor presentation.

The company has a remarkably high growth profile, they plan to increase their copper production by about 100% between now and 2025 thanks to their new Boa Esperanza mine, which has an IRR of 41.8%, far superior to its competitors. Furthermore, in terms of CO2 emissions, they are in the 4% of the least polluting mines in the world.

Ero Copper Investor presentation.

The table below shows a comparison of some of the lowest cost copper producers in the world, ERO is on the same line as them or even produces at a lower cost than peers. In terms of production, it is one of the only ones that plans to increase production by 100% between now and 2026 (only Teck and Ivanhoe plan to increase production as much but the latter operates in the DRC, a worse district than Brazil). Other producers such as Freeport, Lundin and Hudbay are going to reduce production or maintain it.

Eight Capital, company reports.

The table below shows that Ero copper is the only producer in the comparison that has an EBITDA margin of 60-65% and plans to increase production by 100%. Furthermore, production in the new mine has a long life, estimated until 2042, which should allow it to repurchase shares, pay dividends, expand the Furnas project with Vale and/or open a nickel mine that they are now discovering through successful exploration.

Ero Copper Investor presentation.

Market Trends

It is well known that copper has done well over the past 5 years, albeit prices are not at the $5/lb from early 2022. However, at current prices new production is not incentivized, particularly outside low-cost projects, often located in some parts of America (Arizona, Chile, Peru or Brazil) and Africa. Therefore, to sustain current copper production or increase it, higher price discovery is needed.

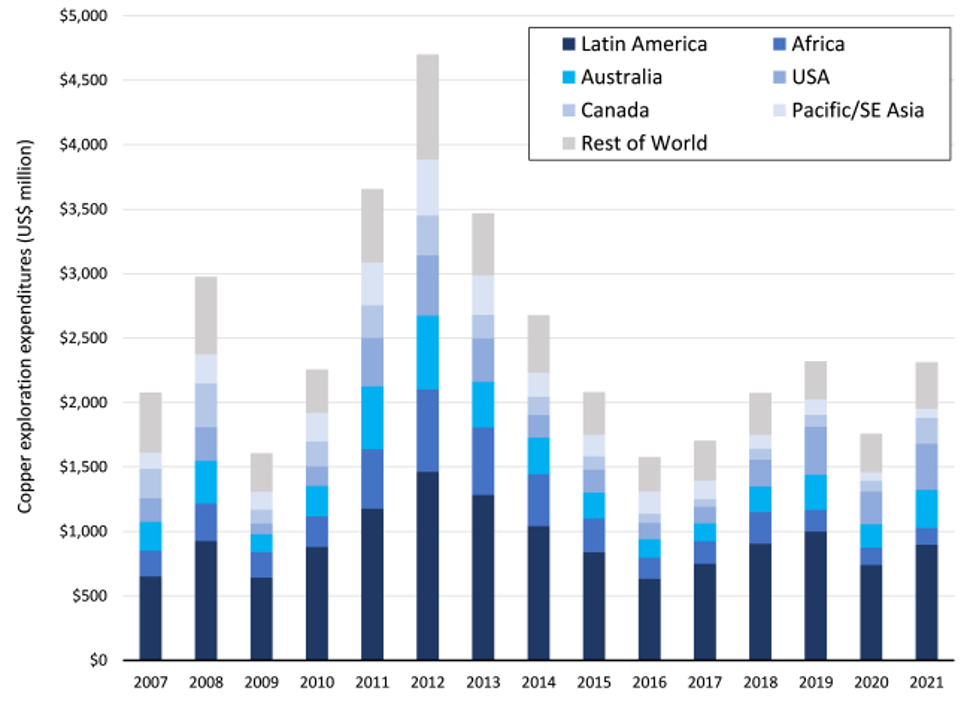

To exploit a copper mine, exploration geologists must explore throughout the world to find economic ore bodies. Although exploration is a costly activity and returns are rare (only one in several thousand discoveries are economic), it is strictly necessary to be able to pursue mining: without exploration there can’t be any mining. This image below shows that copper exploration has decrease or remained stagnant for a long time, partly due to copper prices not incentivizing new copper production, this limits future supply as new mines aren’t being explored.

Company reports.

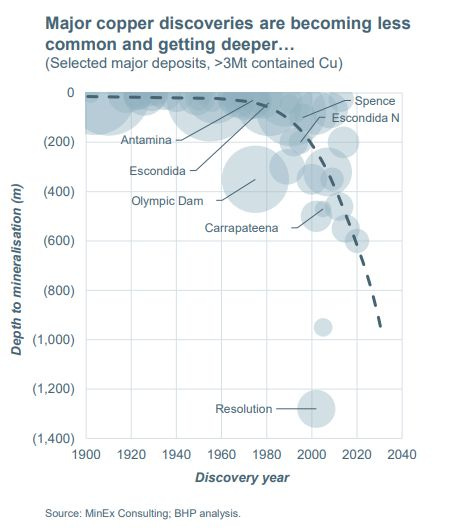

Furthermore, as the image below demonstrates, no new copper deposits are being discovered, so although copper exploration budgets are not near all-time low, copper discoveries are nowhere to be seen. This is worrisome for large copper miners with depleting reserves, but its good news for copper investors and up-and-coming copper miners, that can benefit from the shortage this lack of discoveries will bring. To add even more excitement to this thesis, some of these discoveries are being made in areas where its hard to permit, particularly Canada and the USA. The Resolution Copper deposit in Arizona was discovered 30 years ago and its permits have not been issued yet. Nowadays it can take on average 20 years to build a copper mine, from exploration success to the first copper concentrate being poured. Therefore, even if today a massive deposit was discovered, it would not get built until 2043.

S&P Global Market Intelligence.

As can be seen in the image below, copper mines are becoming deeper, this means higher exploration costs (diamond drills are expensive but the deeper the hole becomes, it adds complexity and cost), higher technical difficulty to build and exploit (higher chances of the mine having difficulties in operations) and less environmentally friendly (due to more energy and materials being needed to extract the ore). This all means that copper mines are becoming more difficult to find and more expensive to explore and operate. Therefore, the incentive price to exploit these mines also rises. A good example is Filo del Sol, recently discovered by Filo Mining in Argentina, a deposit located deep under the rock surface and located at the Andes Mountain range in Argentina, therefore infrastructure is poor, it’s difficult to access, ore has to be treated on site and exports are expensive and complex, as the refined material has to be taken from several thousand metres above sea level to a port.

MinEx Consulting, BHP. Depth of copper mines.

The image below shows the copper grades of worldwide copper mines from the 1990s to the forecast in 2030. The 75% fall in copper grades implies that the use of sulphuric acid in copper extraction from the ore has risen significantly, hence increasing the C02 emissions from almost all mines. Also, the mining techniques have not changed much in many decades: trucks are still being used to take ore from the open pit to the mill, therefore with lower grades this means more trucks and gasoline are being employed at mining sites to produce the same amount of copper. More truck use and more acid mean less environmentally friendly mines and more costs for miners.

Bloomberg. Copper grades.

The chart below shows copper refining capacity by country in thousands of metric tonnes. It is important to note that even though China runs 80% of the world refining capacity, its mining capacity is nowhere near that, probably closer to 10% of world mining. Countries like Chile, that mine 30% of the worlds copper, export massive amounts of unrefined copper to China and to a lesser extent Japan. This is critical to the copper investment thesis as refineries take years to build and cost billions of dollars to do so. And for these refineries to operate they need enormous amounts of ore; therefore, China is forced to buy huge quantities of ore from all around the world to keep this costly infrastructure running, keeping demand very constant throughout time.

Statista.

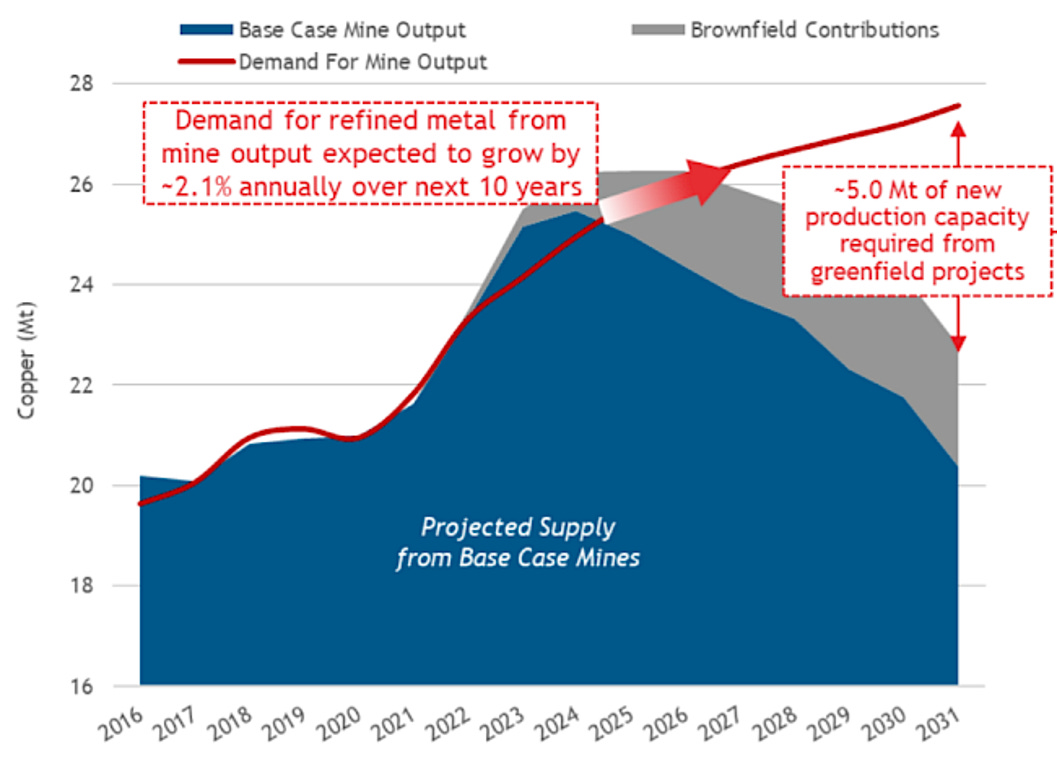

The graphic below summarizes the entire thesis for investing in copper exposure. The blue area represents copper production from existing mines and the grey area represents future mining from brownfield operations. By 2031 it is expected that shortage in supply will represent 5 million tonnes, or 20% of current global copper production. To put this in perspective, the Escondida mine in Chile, the world’s largest copper mine by production (twice as big as the second largest mine), produces about one million tonnes of copper per year, so by 2031 the world will need 5 new Escondida mines. To solve this shortage a higher copper price is needed which will benefit miners such as Ero Copper. Billionaire copper miner Robert Friedland (owner of Ivanhoe Mines) estimates copper prices need to reach $15,000/t to incentivize new production, so an almost 100% increase is needed from the $8,000/t it now trades at.

Company reports.

The overall market outlook seems positive, mostly on the back of the lower supply. Demand growth is set to be all but outstanding, but even small increases have the potential to further tighten the market. Albeit copper prices are near “peak-cycle” prices, copper miners are not earning enough to support more mine builds.

Own infrastructure with high added value and insider ownership

Ero Copper Investor presentation.

Water consumption in mining is a genuine problem. In Chile, the government forces mining companies to build a desalination plant for their consumption, that costs $100M per plant. In Arizona policy makers are planning a desalination plant in Mexico and are going to build an aqueduct to Arizona. In Australia, the drought also affects mining and forces many firms to build desalination plants too. As shown in the image above, Ero copper has solved this problem because it has an aqueduct that directly connects its mill with a dam, this aqueduct is the exclusive property of Ero copper. It also has an electrical line that connects it with the hydraulic generation of this dam, this line is also owned by Ero, this gives it priority access to water and clean energy, without emissions and at very low cost, it is not so exposed to an increase in the electric bill.

The directors of Ero copper own 10%-12% of the company, it is significant if you consider that Ero has $2.5 billion of capitalization. It also has other reference shareholders such as Fidelity with 10%.

Exploration success and ongoing programs

Ero Copper Investor presentation.

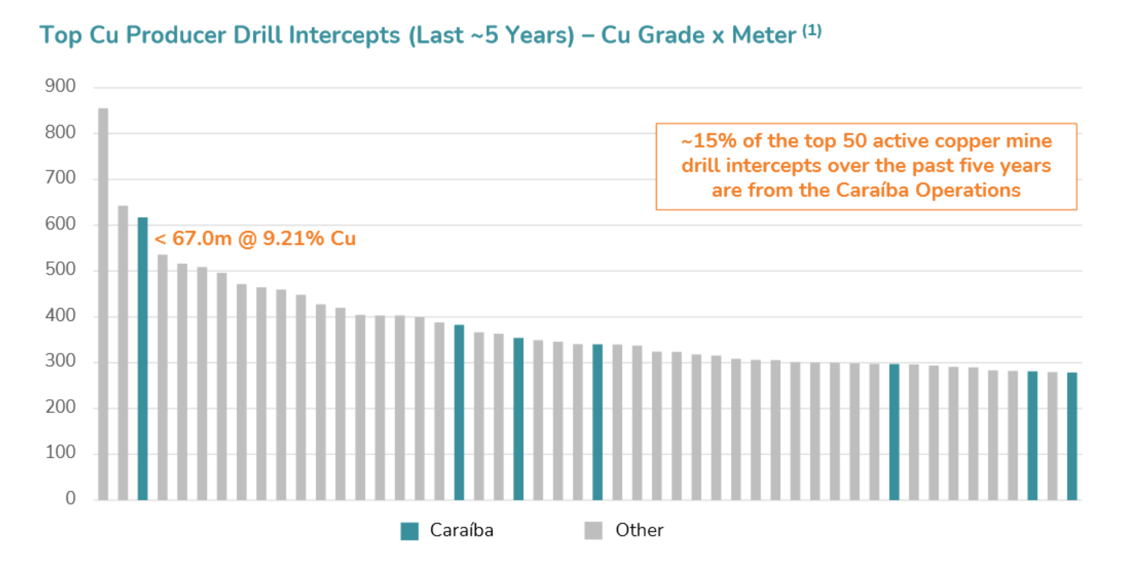

The Carabía operations have yielded 15% of the best copper drill holes in the world in the past 5 years, which shows the high geological quality of Ero´s operations.

The company has signed an agreement with mining giant Vale to get a 60% ownership in Vale´s Furnas iron oxide copper gold project in Brazil, which will increase the pipeline of projects for Ero. This will require a lot of capital from Ero but most of it will go into the ground for exploration, unlike other agreements were the main company (Vale in this case), often earns fees and gets a hefty amount from the sale of the project, which is not the case. Ero is paying for its 60% in Furnas by exploring it and bringing its technical knowledge into Furnas.

On the other hand, the company is singlehandedly discovering a nickel project in Brazil which will gather the attention of larger miners, very possibly Vale, but other miners such as Sibanye are also investing in nickel. Even though this project is now cashflow negative, once a bigger miner comes in Ero can make money by divesting, or by earning operating fees from exploring for nickel.

Capital Allocation: The Attractiveness of Growth

Since the company´s IPO in 2017 the board has taken an extremely conservative approach when it comes to capital allocation. The firm has not distributed any dividends whatsoever while also not buying back any shares. The company has gone into debt in a conservative fashion too, often in fixed rate agreements.

On the other hand, the company has become an active player in the copper mining industry with its MCSA mining complex and is now seeking to open the Tucuma mine (formerly known as Boa Esperanza) in late 2024, which boasts an IRR of 41.8%. The company bought the NX gold mine in 2016, back then the mine had no mine life left, but Ero´s expertise has allowed them to continue finding gold to mine and now has a mine life of 6 years, which will be extended considering the track record Ero has.

Ero copper financial statements, own estimates.

In the table above I have done estimates for the potential profit Ero may have once Tucuma has gone into production later this year, these estimates assume both copper projects produce on the lower end of guidance (45,000t of copper and 50,000 ounces of gold). Considering in 2021 Ero achieved a net profit of $200M without Tucuma operating yet, Ero achieving $300M net profit with both mines operating is very realistic. What is truly spectacular is the net profit achieved by Ero in the scenario of a $15,000/t copper (the incentive price according to Robert Friedland) price, in which case they may get a bottom line of around $800M, which as the table below shows, boasts a potential upside of over 700% in stock price from current levels.

Ero copper financial statements, own estimates.

Conclusion: Significant Potential, But with Associated Risks

ERO is in a truly unique position in the mining industry, having a healthy balance sheet, a pipeline to increase production both in the short term and long term, an exceptional management team that has created a world class copper producer in less than a decade, very hard to replace infrastructure, low emissions production and a near term increase in production to take advantage of upcoming copper shortage.

The company has hedged some of its copper production with a price floor. This has worked very well in the current environment given the stagnant price and momentary weakness in the copper market. However, if this policy goes on for too long, they might not have the possibility of reaping the full benefits of the copper shortage. Albeit the company has said that this policy is momentary, being used to secure the funding for the Tucuma project, which should come into production in the coming 12 months.

The company operates solely in Brazil, which offers a very secure political and legislative environment to operate and permit new mines. However, currency risk is still an issue for operations there and in 2021 and 2020 the company faced significant impact on its bottom line due to currency losses. On the other hand, the management at Ero has since been successful facing this risk and in 2022 they increased net income thanks to foreign currency translation gain.

I view ERO as a highly asymmetric bet. If the Tucuma project goes into production, there is substantial upside potential, although if they do not achieve it, the company still has its low cost, high margin Carabía operations and NX gold mine. The company has too an exceptional management team which is rare in the mining industry. Ero has an ongoing nickel exploration program which is likely to attract a larger partner which will bring funds to ramp up the program. On the other hand, the Furnas project with Vale will require a lot of capital from Ero, albeit most of it will be destined for the growth of the project, which is positive given that a potential bidder for Ero, will be interested in a high growth company for the upcoming copper shortage. My current ‘fair value estimate’ is $51.00/sh (221% upside), but I believe there could be even further upside, perhaps to $130+/sh if the copper market improves, as it should for the shortage to disappear and to supply copper for the growing demand worldwide.

Any feedback is welcome in the comments, or you can send me a message on Substack or through my twitter account @AAGresearch.

I want to thank my girlfriend Yeimy, who has helped me a lot at home while I was researching this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Hey, great article Alberto! A few questions:

1) How did you arrive at the $4400 cost per tonne for copper and $1000 for gold?

2) The COPX ETF js currently trading at 13x earnings, is the 17x you used the historical average?

3) It seems that ERO is usually valued on an EV/EBITDA or P/NAV ratios, did you consider those?

Thanks!

Great investigation, I'm proud of you and excited about what's coming