Buying Bravo Mining (CVE: BRVO)

Deep dive into one of the largest PGM projects and an update on the market

Summary

· I have bought shares in Bravo Mining (CVE: BRVO). I have invested the same amount into Bravo as I own in Generation Mining. I believe these two firms are the best investments to speculate in the prices of palladium, platinum, and rhodium prices. This is true in terms of quality of management, quality of deposits, valuation, and geopolitical risk.

· The valuation outlined in this report was done thanks to a two hour chat I had with the entire management team at Bravo. I want to thank them for taking the time of reaching out to me and talking with me. I have not been paid by them in any shape or form. As I point out in my “About” tab on my blog, I do not get paid by anyone except the voluntary contributions of the paid subscribers, for which I am extremely grateful. I want to thank these subscribers as well for their generosity.

Introduction

On March the 14th I drafted a report (link) on palladium, platinum and every miner and junior developer of these metals worldwide. Since then, prices for both metals are flat, and my main pick Generation Mining is down slightly.

If you are new to this investment thesis, I highly recommend you reading the first report I wrote on Platinum Group Metals.

However, the thesis on this investment remains as solid as it was back then. There are supply deficits for both metals, and demand is stable. That said, as I mentioned at the end of that report on March: “I wouldn’t be surprised if we see some more blood in the market before the sector turns into a bull market.” And I continue to believe this statement is true.

We are yet to see more supply curtailments from the big palladium and platinum miners. Yes, we have seen some reduction in supply from miners outside Russia. But this reduction in supply has not impacted prices. Furthermore, speculators and investors continue to pile in into shorting both metals, particularly palladium.

I have now decided to buy shares of Bravo Mining, a company that owns the Luanga project in Brazil. Luanga is one of the largest palladium and platinum deposits in the world, and it will be one of the largest mines worldwide for these metals, once it is in production.

Glossary of terms

Update on Palladium and platinum

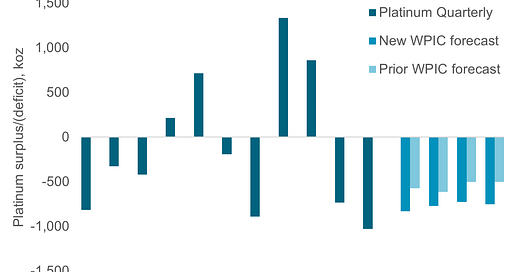

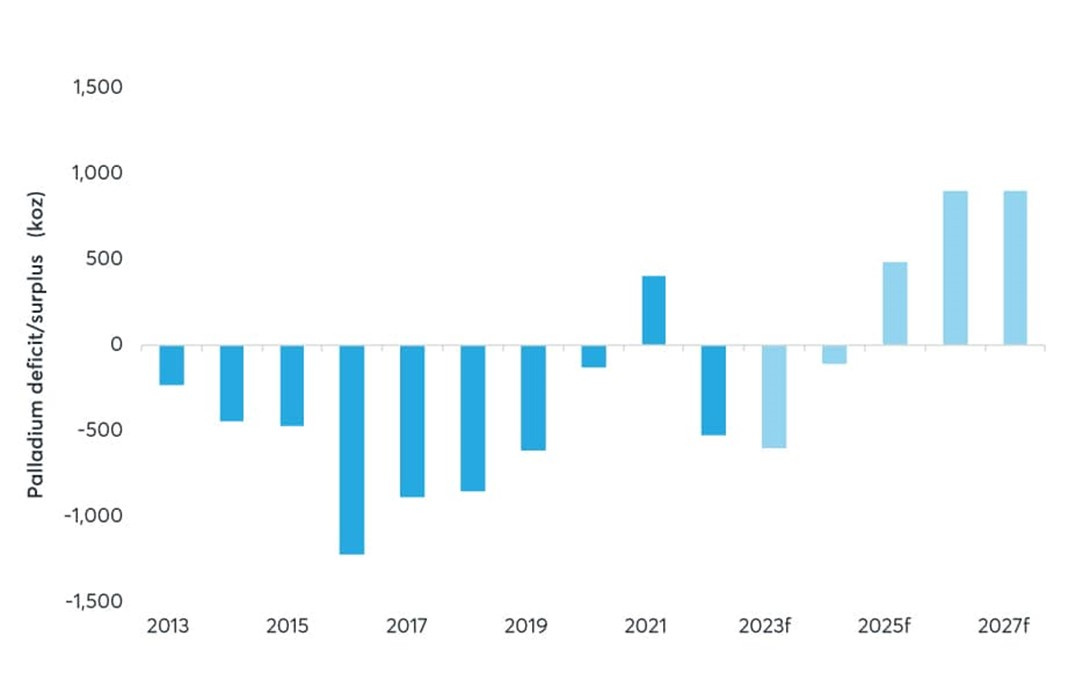

For those that do not remember the report, here is what I wrote on March about the deficits for these metals:

“When it comes to the balance of the palladium market, the sector has been facing significant deficits since 2013. This was exacerbated by the inelastic supply of the mining sector and an increased demand from auto catalysts, bars, and coins. Several studies indicate that beyond 2025 this may turn into a surplus, however I believe otherwise due to 2 main factors.

The first factor is problems in Russian supply. The French Institute of International Relations has stated that the Russian mining “industry is hindered by obsolete infrastructure, insufficient investment, and a shortage of qualified human resources. The situation may be further exacerbated by the war in Ukraine.” This is confirmed also by Rusal, a Russian miner, also the second largest aluminum producer in the world, which recently stated “the company may potentially face difficulties in the supply of equipment, which may lead to the postponement of investment projects.” In fact, Nornickel is expecting PGM production to be at a 5 year low in 2024. The second reason I believe a surplus is unlikely, is due to supply problems in South Africa. The country has been facing power shortages since 2007 but these have been worsening into 2023 as Eskom, the largest utility in South Africa, has supply problems. I believe these power shortages will inevitably result in mine closures due to lack of electricity, or increase in energy costs for PGM miners, which use large amounts of electricity. As a result of these two factors, I believe the palladium market will be in deficit for years.

Metals Focus, WPIC research. Palladium market balance.

Platinum on the other hand, hasn´t had the same supply deficits as palladium, it has in fact experienced a surplus in 2021 and 2022. However, in both years the market had a significant increase in platinum recycling and a decrease in demand, due to investors consuming less platinum bars and coins. Going forward the market is expecting a deficit, in fact Nornickel is expecting a deficit in the platinum market at least until 2030. Considering the world produced just over 7 million ounces of platinum (including recycling) in 2023, the deficit is sitting at over 10% of world supply, or 878,000 ounces. The same goes for palladium, albeit the deficit is sitting at around 500,000 ounces or just over 5% of world supply (including recycling).

Metals Focus, SFA Oxford. Platinum market balance. Thousands of ounces.

Mining supply of both palladium and platinum have been decreasing since 2021. This fall in production combined with significant deficits, will eventually push prices up as demand remains stable. PGM mines will continue to deplete, close, or go into care and maintenance, further exacerbating the deficits. Considering Sibanye is the only large miner with significant PGM projects in development, these deficits may take decades to solve in the supply side. On the demand side, these deficits are unlikely to be solved with lower consumption as PGMs are difficult to substitute, due to their unique physical properties.”

So, what is new?

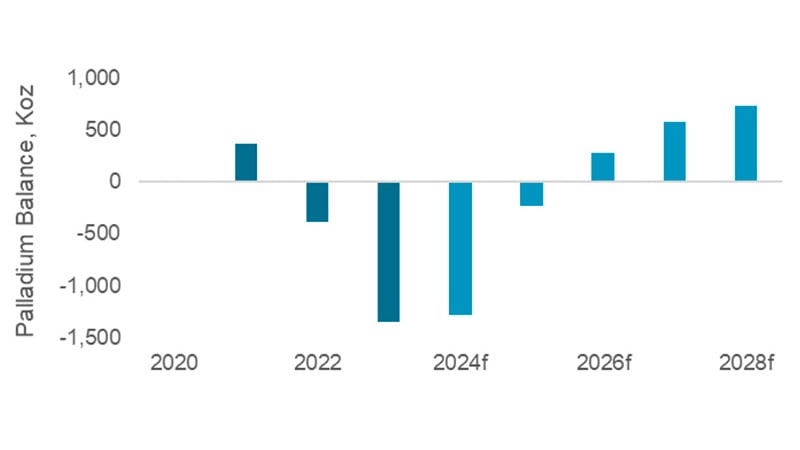

Well, it turns out I was right, palladium is now predicted to continue being in a deficit. The World Platinum Investment Council (WPIC) has updated these graphs, and in 2025 we will continue facing deficits and they have reduced the surplus for 2026 and 2027. I must admit it feels good to be right, but I still believe they are too optimistic in predicting these surpluses.

Metals Focus, WPIC research. Palladium market balance.

Regarding platinum, the WPIC is now predicting even larger deficits.

These deficits come as “2024 has seen actions taken by the South African platinum group metal (PGM) miners in response to the low PGM basket price, with more restructuring initiatives announced, most recently during their financial results briefings. Plans include slowing ramp-up schedules, project deferrals and mines/shafts being closed or placed on care and maintenance. The aggregated mid-point of producer guidance has reduced by 5% between 2025f and 2028f.” The WPIC points out.

Metals Focus, SFA Oxford. Platinum market balance.

Bravo Mining

Management

The Executive Chairman & CEO of Bravo is Luis Azevedo, a geologist and lawyer who worked as a manager in Western Mining Corp (acquired by BHP) and he has also worked as a director for Barrick Gold for two years. He has also worked for Harsco Metals & Minerals, a provider of solutions & services for the steel and metal industries.

The track record of Azevedo also includes being the Founder, Executive and Non-Executive Director of various companies including ASX listed Avanco Resources (sold to ASX listed Oz Minerals in 2018), TSX listed Rio Verde Minerals Development Corp. (sold to B&A Mineração S.A.in 2013) and Avanco, which was acquired by Oz Minerals Ltd for a 120% premium (A$418 million) in 2018. Most importantly, Azevedo owns a whopping 48% of Bravo. Which is unusual considering Bravo trades for $165M or C$230M.

Other members of the management team have a great track record too. Anthony Polglase (Lead Director) and Simon Mottram (President) helped Azevedo in building Avanco from pre-IPO into production. Each of them owns around 1% of Bravo.

Stuart Comline and Stephen Quin (Independent Directors), each own just under 1% of the company. Both have good track records as well. It is worth noting that Comline was Chairman of TSX listed AfriOre Ltd, when the company was sold to Lonmin PLC, a PGM producer, in 2007 for C$444 million.

Heinrich Müller (VP Technical Services) is highly experienced in PGMs. Importantly, he has considerable work experience in South Africa, what I consider the Saudi Arabia of PGMs. And he also has experience in PGMs in Brazil as he worked at the Pedra Branca project prior to the project being owned by ValOre Metals. It is rare to find someone that has experience in PGMs both in Brazil and South Africa.

Interestingly most of the management team and board members have worked together before on different companies. Therefore, they know each other very well. Other members of the management team like Pauli Ilidio De Brito (VP Exploration) or Alexandre Penha (EVP Corporate Development) also have a good track record, and have a wealth of experience working in Brazil and in the mining industry.

Main shareholders. Bravo Mining investor presentation.

As you can see in the chart above, 55.8% of the firm is owned by the board, management, and employees. An additional 30.4% of the shares are owned by institutions. Therefore only 13.8% of the stock is left for retail investors.

The project: Luanga

Luanga Project map. Bravo Mining investor presentation.

The Luanga project is in the Pará state, in northern Brazil. The infrastructure is great as Luanga is surrounded by paved roads and has a railway and airport nearby. There are a couple of power lines crossing the project as well. They have the rights to use the railway, 10km away. And they also have the right to export through the San Luis port. The project has 6 months of rain a year, and they have more than enough water rights to operate the mine.

The project is highly accessible. There is a four-hour flight from Sao Paulo to Carajás and from there it is a 45-minute drive to get to the project.

The area is very mining friendly. Vale has massive iron ore operations, and a lot of the local population depends on mining. Those villages that still depend on farming are looking forward to Luanga being operational, in the hope that they can improve their standards of living.

Bravo has a lease on the CETEM lab in Rio, which helps the company getting the results from drilling and other analysis faster.

Comparison with other projects

Data for several PGM projects. Resource studies, own estimates.

In the table above you can see data for several PGM projects. Bear in mind that these projects only have resource studies done on them, no economic study has been done that I know of. I have only chosen projects without resource studies since Bravo has not done an economic study yet. Therefore, I believe it would only be fair to compare them to other companies that are on the same stage.

From the studies above the ones that really brought my attention were the ones owned by Bravo, Podium and Stillwater. Bravo and Stillwater own the largest deposits in terms of palladium equivalent (PdEq). However, Stillwater has most of its value in its nickel, copper, cobalt, and chrome resources, not in PGMs. Therefore, I do not think it has a lot of leverage to PGM prices. Podium is interesting, but just like Stillwater it only has an inferred resource, not indicated, therefore the level confidence in the resource is not as high as with Bravo.

These projects are the main PGM deposits worldwide not owned by a PGM miner. Therefore, Bravo probably owns the best project worldwide, not only for its great metallurgy and size, but also because of its high leverage to PGM prices, and the fact that it is a very shallow deposit.

I also considered including Southern Palladium in the table due to the massive size of their deposit. But they have already done an economic study on their project so it would not be a fair comparison. Also, Southern Palladium has its deposit in South Africa, a jurisdiction I do not think is worth investing in. The company also has some very large impairment expenses on its income statement, around $5M per year. The notes on the financial statements do not explain much about this expense. I have emailed the company to get some explanation, but they have not answered back.

Valuation

Luanga project valuation. Own estimates.

From my chat with the management team at Bravo I have created the valuations you see above.

I have valued Luanga on several parameters and scenarios. These vary from an initial CAPEX of $700M to $800M and an AISC that ranges from $600/oz PdEq to $900/oz PdEq.

For the calculation of the NPV I have taken several assumptions which are think are sensible:

· A production per year of 500,000 ounces of PdEq.

· A 6% royalty on the project. This royalty will probably be reduced to 5% but I wanted to be prudent.

· 20-year mine life.

· 10% discount rate.

When looking at the model for Luanga please bear in mind that in Spain we use dots and comas for the opposite uses than in the English-speaking world. In the rest of the charts (and reports I have published), I have been able to make it more friendly towards English speakers. But in the model for Luanga, it was more difficult due to the large sums. So, for example if you read 4.000.000.000 that means 4 billion.

If you consider that Bravo has $26M in net cash and that it trades for $165M or C$230M in market cap, the company is cheap. Even in the worst-case scenario: CAPEX of $800M and an AISC of $900/oz PdEq, Bravo would have a positive NPV at a $1100/oz price of PGM (PdEq).

More importantly, my model does not consider the revenue from rhodium and nickel sales. Therefore, it is safe to assume I have been too prudent. But I much rather be safe than sorry.

Since I had my chat with management in April, the company has continued to drill and has found some high-grade copper and gold. Therefore, Luanga is getting even bigger than I might have anticipated.

Conclusion

As a result of my analysis, I conclude that Bravo Mining has the potential to become one of the largest and most profitable PGM mines worldwide. Even if it was not surround by infrastructure (which it does), it has enough size to justify the construction of infrastructure to access and operate the asset.

Bravo has a management team and an asset of excellent quality; therefore, I think it would be realistic to think they may be able to bring this project into production. However, my expectation is that at some point in the cycle they will get taken over, before they reach production or FID.

In fact, I think Bravo may be even a better opportunity than Generation Mining, although I have the same amount of money invested in both.

The next big step for the firm will be to publish its economic study, for which I believe they are fully funded. Therefore, I do not expect any dilution until then.

Any feedback is more than welcome in the comments, or you can send me a message on Substack, or through my twitter (X) account @AAGresearch.

As always, I want to thank my girlfriend Yeimy, who has helped me a lot while I was writing this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Disclaimer: I assume no liability for any and all of your actions, whether derived out of or in connection with this information or elsewhere, and you hereby warrant and represent that any and all actions that you take or that you may take at a later date in connection with this information shall remain your sole responsibility and, in case, I shall not be held liable for any such actions.

Expectacular artículo. Enhorabuena. Habrá que seguirla de cerca. Un saludo

Thanks for a great article Alberto. Just on the electricity issues in South Africa, I live in SA. We have been without electricity cuts (what we call load shedding) for 200 straight days now. It's not to say we will never have them in future, but this has cost our economy billions and people are fed up. There is a big push for alternative sources such as solar/wind/hydro with all sorts of initiatives happening throughout the country.

Personally I believe demand for PGM's will come from the motor vehicle sector as pure EV (BEV) is going to take a lot longer to phase in and be accepted - and sure, this will be different from country to country. It seems like more people are opting for hybrids (which require PGM) and also lots of R&D into hydrogen (also require PGM as far as I'm aware) - this is purely my own opinion, and not backed up by the kind of research you do, so please take with a grain of salt :)