Financial analysis on 71 shipping stocks

Deep dive into the shipping industry and the stocks I own

Summary

· In this report I have done financial analysis on 71 companies that are involved in the shipping and offshore drilling business.

· I have also done an analysis on the shipping industry for those of you not familiar with the sector. The analysis also includes the market dynamics of the different segments of the shipping business.

· In my personal account I hold large investments in Okeanis Eco Tankers (NYSE: ECO) (OL: OET) and in Star Bulk Carriers Corp (NASDAQ: SBLK). I hold them mainly for their stable dividend policies, their strong business fundaments, and favorable market dynamics. I also hold shares in Ensco Plc (NYSE: VAL) (Valaris) through a stake in Mongolia Growth Group (CVE: YAK). Okeanis is my largest holding and the one I have the most conviction in.

· In an account that I manage I have invested heavily into the following shipping stocks: Navios Maritime Partners L.P. (NYSE:NMM), Safe Bulkers (NYSE: SB), Star Bulk Carriers Corp (NYSE: SB), Avance Gas (OL:AGAS), Danaos Corp (NYSE: DAC), Navigator Holdings (NYSE: NVGS), d’Amico (BIT: DIS), Tsakos Energy Navigation (NYSE: TEN) and Ensco Plc (NYSE: VAL) (Valaris). Ensco shares are held through a stake in Mongolia Growth Group (CVE: YAK).

· In another account I manage I also have invested money in other offshore drilling firms and crude tanker firms, but they are minor investments.

· If you are interested in knowing more about shipping, I highly recommend you subscribing to Value Investors Edge (VIE) in Seeking Alpha, a service provided by J Mintzmyer. VIE has achieved a 43.4% annualized return since 2016, which is extraordinary. I am also a subscriber. You can click this link to get a promo on the subscription, it only lasts until Sunday. I do not get paid by J or anyone to write reports or recommend them, I am just a very happy subscriber to VIE and I wish to share it with you.

Total return of Okeanis since its IPO. Koyfin.

Structure of the report

First, I have done an analysis on the sector as a form of introduction. A few subscribers to the blog told me that they are not familiar with the shipping industry, so I thought it was a good idea.

Secondly, I analyze the orderbook of each shipping segment. The orderbook gives us an idea of the number of ships that will be coming online during the short term. This way we can know whether there will be a shortage or oversupply of ships. This is important since it’s an important factor driving the day rates that shipping companies earn on each ship.

Thirdly, I will analyze the shipping and offshore companies I have decided to put in the report. This analysis will mainly consist of two parts: Analysis of those shipping companies I have found the Net Asset Value (NAV) of, and those companies of which I have not found the NAV.

Finally, I will write a conclusion about the report.

Introduction to shipping

The prosperity of society rests critically on trade, where each supplier, whether at the individual or state level, must specialise in satisfying the needs of others to satisfy its own.

The desire to trade is an inherent condition of human beings and a driving force for progress. Although mankind has traded for centuries, it is fundamentally with the development of capitalism and globalisation that it has reached its maximum activity. Globalisation, enhanced by the technological advances that we have witnessed in recent decades, has resulted in the entire planet becoming a market. The consequences of these factors are the development of a complex, deflationary system of cooperation and social relations between anonymous individuals, and entities in which the oceans are the main highways.

It is at this point that maritime trade claims its importance, the control of the seas has historically revealed who is the world power at each historical moment. Therefore, understanding maritime routes and the flow of goods is critical for the understanding of the global economy. After all, no matter how much technological innovation and sophistication there is, the essence of maritime trade is to connect supply with demand, to move goods from one point to another.

For all these reasons, in the following pages I will try to outline briefly the peculiarities of the sector, and those features that any investor who decides to invest in this industry should consider. To do so, I will begin by detailing a series of general characteristics and then focus on the sub-sectors that most interest us. The main segments in shipping (and types of vessels) are: Dry bulk, containerships and oil and oil derivatives tankers. However, there are also smaller subsegments like car carriers.

Sector characteristics and general principles

If I had to highlight one characteristic of shipping, the main one would be cyclicality, which results in high volatility. Maritime transport shows an economic model of perfect competition in which there are few barriers to entry (facilitating the creation of cycles), even more so in recent years when rates have been very low. However, there are barriers to exit given that before getting scrapped, ships are often acquired by other companies, or firms get taken over. Therefore, shipping is often considered a commoditised service, where the only competitive advantage is cost.

In terms of cycles in the shipping industry, we can find three types: 1. The short, seasonal cycle within a year. 2. A long cycle that would fit more with Kondratiev's K-wave cycles, more affected by long-term macroeconomic trends. 3. The shipping cycle of each segment. These shipping cycles are not uniform in terms of their duration, nor in the depth of their phases, which are typically boom, bust and stagnation. It should also be noted that due to the specialisation and proliferation of subsectors, each shipping subsector has acquired its own cycle, that does not always correlate with the rest of the industry's subsectors.

Shipping cycles have a Darwinian component, in which the outcome is the purging of the least efficient firms that have made the worst business decisions. Kirkaldy suggests that a new cycle is triggered by an economic boom or a random event such as a war or pandemic. During these economic booms, which tend to be brief, prices soar and send signals in the form of high returns on capital. These returns attract new capital, leading to a considerable increase in orders for new ships, generating a surplus in ships. Once the oversupply reaches the market, the day rates (revenue per ship per day) collapse due to an overabundance of supply, initiating the slump phase. After the slump phase, the market stagnates until the overcapacity has been purged.

However, shipping cycles are not only due to strictly economic reasons, but there is also an important psychological factor at play. Business decisions are taken by specific individuals, who do not have all the information available to them. And even if they had all the information available to them when making a decision, they would be impacting and modifying the situation by making a decision themselves. Therefore, this leads to reflexivity, as investors do not base their decisions on reality, but rather on their perceptions of reality instead. The actions that result from these perceptions have an impact on reality, or fundamentals, which then affects investors' perceptions and thus prices.

Now, let us add to this premise the classic prisoner's dilemma, in which individuals engage in perfect competition with multiple small suppliers (fragmented market). These individuals chase their own best interest without considering that every other person will act with the exact same attitude. This leads to cycles. In fact, Cufley already pointed out that predicting booms and busts of the shipping day rates is not possible, and it seems that historical data proves Cufley right.

Ship risk dilemma

Another of the disjunctives that can be observed in the sector are the conflicting interests between shipowners and cargo owners. They are the two sides of the same coin where, depending on the moment of the cycle, one of the two will emerge as the winner to the detriment of the other. Since equilibrium is impossible, the balance will always be in favour of one or the other. But it is worth remembering that the victory of one will be the germ of its future defeat, since if shipowners obtain extraordinary profits from the increase in freight rates, this will lead to an overabundance of supply. Therefore, the dynamics will reverse, depressing prices in the form of lower shipping rates and making the owner of the goods to be transported the winner. To minimise these dynamics, participants can choose to hedge their risks by entering long-term contracts called charters, otherwise being exposed to the market directly is considered spot.

Shipping markets

Regarding the main markets or business sectors, we would firstly find the shipyards in charge of construction and maintenance. Secondly, the companies that operate the fleets (shipowners). Thirdly, the companies that rent the services offered by the shipping companies for the transport of goods (charterers). Fourthly, the second-hand market for ships and finally the scrapping market. All these markets are aided by a series of auxiliary industries such as analysis companies, brokerage firms, etc.

Supply and demand

As in any cyclical sector, the key is to understand the dynamics of supply and demand, and how mismatches between the two lead to transport cycles being reflected in prices. These mismatches can be due to both internal industry factors and external shocks. It will be the transport price that will influence the decisions of market participants (mainly shippers and shipowners). These firms will have to make their decisions based on current prices, either reactively or in anticipation of future market eventualities. The key question is: Where will the world be when the new ships are delivered (supply)? As a general principle, in the maritime sector, supply will always find it difficult to match demand due to the time it takes to build a ship (lag time of about 2-4 years) and therefore leads to irregular cycles.

Demand

· World economy: The sector tends to keep pace with world GDP growth. Demand is essentially driven by population growth, the global population getting wealthier (ever decreasing poverty rates) and the liberalisation of the economy.

Maritime trade: This accounts for 75% of world trade, with the most traded commodities being oil, iron ore, coal, and grain. Trade will also be impacted by changes in the composition of demand. For example: A country moving from an agricultural economy to a manufacturing economy, will demand different goods.

· Distance: Maritime routes are constantly changing, with the key factor to study being ton-miles.

· Random shocks: Eventualities outside the industry such as wars, pandemics, implementation of protectionist measures, etc.

· Transport costs: Maritime transport is deflationary by nature and any technological advance helps to make it cheaper. Its important to remember that goods will only be transported if the cost is acceptable.

Supply

· Fleet: It will be important to make an analysis of the different types of vessels available, as the sector has been demanding more specialised vessels in cases in which the heterogeneity of capital is increasingly complicated.

· Fleet productivity factors: The use ships are given, speed, laid-ups, waiting times in ports, laden-ballast proportions.

· Shipyard capacity and scrapping capacity: Depending on the moment of the cycle one will be more buoyant than the other; when rates are high, the economic life of a ship, however old it may be, is extended, with no withdrawals and the shipyards will be full of orders. However, when the cycle turns, the opposite effect usually occurs.

· Freight earnings where the cost of fuel will play an essential role.

Costs

The costs of the industry can be divided into the following categories:

1. Operating cost: Within this category would fall expenses related to crew, including wages, insurance, pensions, or repatriations. The trend in crew size has been decreasing over the last few years due to mechanisation and automatization. Also included in operational costs are the daily maintenance of the vessel, especially the daily routines of engine and auxiliary equipment, as well as possible breakages of parts and spare parts. Another expense to be included would be insurance. With the typical insurance item being structured in two-thirds for insuring the boat and one-third for third party liability insurance. Finally, general expenses for registration, administrative, communications, port charges and other expenses are included.

2. Periodic maintenance: This refers to inspections, normally every 2 years and a special one every 4 years to determine the seaworthiness of the vessel. In older vessels, a significant expense is required since certain parts and improvements will have to be changed, to be able to pass the inspection.

3. Cost of the voyage: These usually represent 40% of the total cost, including items such as: Fuel, port taxes, canal crossings, tolls, or tugboats. Fuel oil is clearly the most important and at the same time the most variable of all and can determine the entire cost structure. At the same time, fuel oil can also change or provide incentives to improve the efficiency of ships, as happened from 1970-1985 when the price of fuel oil rose 950% in that period.

4. Capital costs: Essentially interest payments, dividends, and debt servicing.

5. Loading and unloading.

LTV and NAV

Another characteristic of the sector, due to its low returns on capital, is its high level of indebtedness. One of the metrics used is the loan to value (LTV), i.e. the percentage of asset value represented by debt, which is usually between 30-70%.

As for the metrics for analysing companies, the fundamental concept is the Net Asset Value (NAV), i.e. the value of the assets after discounting the debt, which is theoretically the value that would be obtained if the company were liquidated, normally analysed one year ahead. However, this is a metric that is hard to quantify as ships within a company have different features and ages. And therefore, they are worth different market values. NAV is a lot more accurate than book value.

Sources of financing

Shipping is a sector that has different and versatile financing sources. The list of financing sources for the shipping industry include: Bank financing via ship mortgages, new construction financing, mezzanine debt, capital markets financing, convertible debt, corporate debt, IPOs, MLPs, SPACs, at the market offerings (ATM) and finally other sources such as operational leasing, private equity, securitisation or financial leasing.

Regulatory framework

As in any sector, shipping is subject to a series of regulations that should be taken into consideration. The main legislating body is the International Maritime Organisation led by the United Nations. There are also multitude international treaties that develop maritime law. Legislative development in recent years has been directed towards environmental issues and pollution. In 2020 IMO2020 came into force, a regulation limiting the sulphur content of fuel oil consumed.

In addition, in 2023, the EEXI and carbon intensity indicator (CII) regulations became a reality. These regulations restrict CO2 emissions, forcing companies to make important operational decisions. These decisions include reducing speed to pollute less, which will affect supply, scrapping old ships because they are economically unviable, installing scrubbers on old ships, or renewing the fleet with eco-type ships.

It should also be noted that in the shipping sector (often) no taxes are paid. Companies tend to avoid taxes by registering under the sovereignty of a flag of convenience. Domiciling themselves for tax purposes in countries with zero taxation, such as Liberia, Panama, or the Marshall Islands. In Simon Bergstrand's words: Flags of convenience are flags of states whose government does not seek registration as a necessary process to impose its sovereignty, and thus its control, but as a service that can be sold to all those seeking to escape their taxation, or other consequences of being under their own flag.

Orderbook and rates

Before diving into the orderbook of each shipping segment, there is something I would like to mention. The shipyard business is extremely tough, competitive, and capital intensive. It has many barriers to entry and exit.

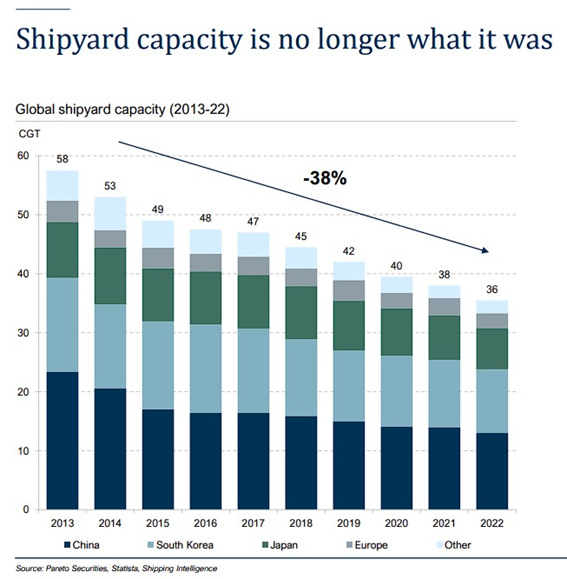

Shipyard capacity. Pareto, Statista, Shipping Intelligence.

In fact, shipyard capacity has ben decimated in the past 10 years. Low returns on investments combined with high capital intensity and lack of profitability, has pushed a lot of shipyards out of business. Furthermore, the terrible short-term demographics in South Korea and Japan and the bad long-term demographics in China will mean even more shipyards close due to lack of qualified labour.

Even China whose government considers shipping a critical industry has seen the output decimated and the near term looks bleak at best.

China orderbook. Fearnleys.

As a result of all this I am very bullish in the shipping sector in general. And I believe it could deliver extraordinary returns in the following decade.

Container ships

Container ship orderbook. Alphaliner.

The global Container Ship orderbook is bound to set a record in Q3 2024. Even before September is fully accounted for, Alphaliner has registered over 130 vessel orders, exceeding a total of 1.8 Mteu. However, in orderbook to fleet ratio, we are far away from the peak in the mid-2000s.

Containership charter rates. Marhelm.

Shipping rates for containerships are up significant over the past 5 years, particularly since the lows in 2020. However, after the Covid restrictions, shipping rates exploded higher and have since declined substantially. This increase in rates led to large orders in 2020 and 2021. This new inflow of ships may keep rates low for a prolonged period of time, but in the past months there has been a strong recovery.

I believe the containership sector will remain strong and that is why I hold some names in the account I manage. However, since the only one that pays good dividends (MPC) trades at a very high price relative to NAV, I hold no containership stocks my personal account.

Dry bulk

Dry bulk order book. Clarkson Shipping Intelligence.

Dry bulk has one of the most compelling order books in the shipping industry. As you can see the ratio of orderbook to fleet is almost at an all-time low. Therefore, we cannot expect any significant amount of dry bulk vessels coming online in the next few years.

Baltic Dry Index. Investing.com.

The Baltic Dry Index is an index of average prices paid for the transport of dry bulk materials across more than 20 routes. As you can see, prices paid to dry bulk shipping firms have remained stagnated for a long time. The exception was in 2022 after the invasion of Ukraine but it was very brief.

Just like in commodity investing I like to see low prices before investing, as I know that they are cyclical industries. This is why one of my personal picks (SBLK) is a dry bulk firm. I believe that chances are that they will pay stable dividends into the future as the sector recovers.

Crude and chemical tankers

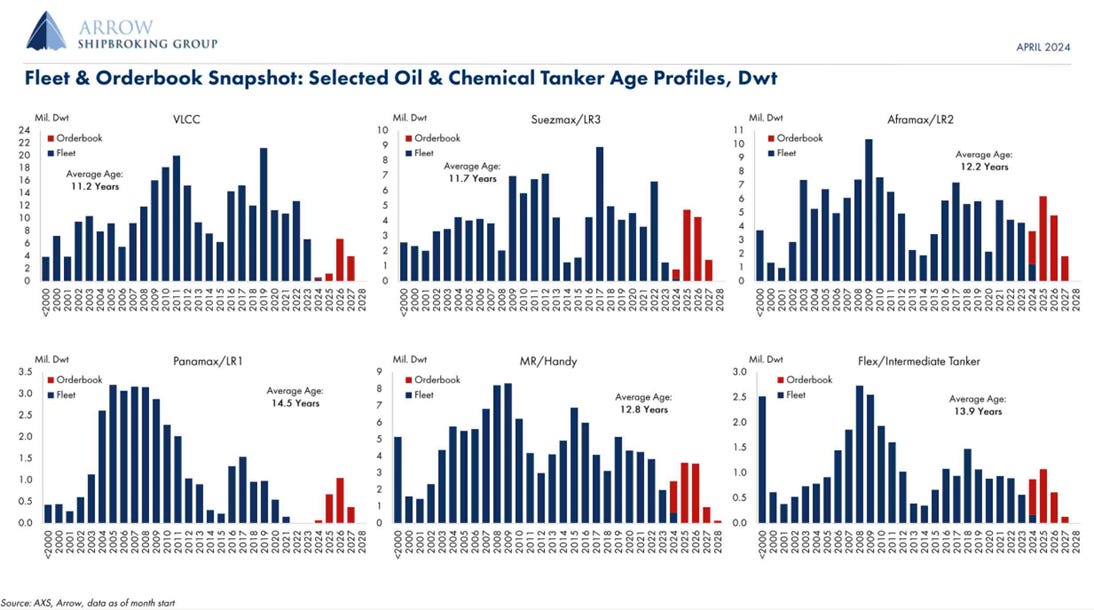

Fleet and orderbook for crude and chemical tankers. AXS, Arrow. April 2024.

I believe tankers and dry bulk have the most compelling orderbooks. Most types of tankers have historically low orderbooks and with shipyard capacity decreasing and shipyards being fully booked, I believe we will see very strong rates for tankers going forward.

Tanker orderbook. Fearnleys.

In the case of tankers, not only the order book is small relative to the size of the fleet. But the fleet is also aging, and a lot of those vessels will be scrapped in the following decade or two. This is the icing on the cake for this market, as it will allow the industry to remain in shortage of vessels for longer.

VLCC tanker aging. Banchero Costa Research.

In fact, historically rates have been very much correlated with economic growth as you can see below. During the economic boom in the 2000s rates exploded upwards and collapsed after the 2008 crisis. Some years later, with the government stimulus now in place, rates recovered.

Crude tanker rates 2004-2018. Researchgate.

However, since the invasion of Ukraine rates have risen significantly. These kinds of shocks affect the shipping industry very much as I mentioned in the introduction.

Crude tanker rates 2018-2022. Argus Media Group.

More recently crude tanker rates have continued to rise thanks to strong fundamentals and strong oil demand.

Crude tanker rates 2022-2024. Fearnleys.

The strong crude tanker market is part of my thesis on ECO. Their fleet is all made of up VLCCs and Suezmax vessels.

Regarding product tankers, their orderbook remains very attractive as you can see in the first image of this section. Their rates have been very volatile in the past 5 years but since 2022 they have remained very strong. That´s is why I also have money invested in product tankers through an account I manage. I will dive into them later on.

LNG tankers

LNG orderbook. GlobalLNGhub.

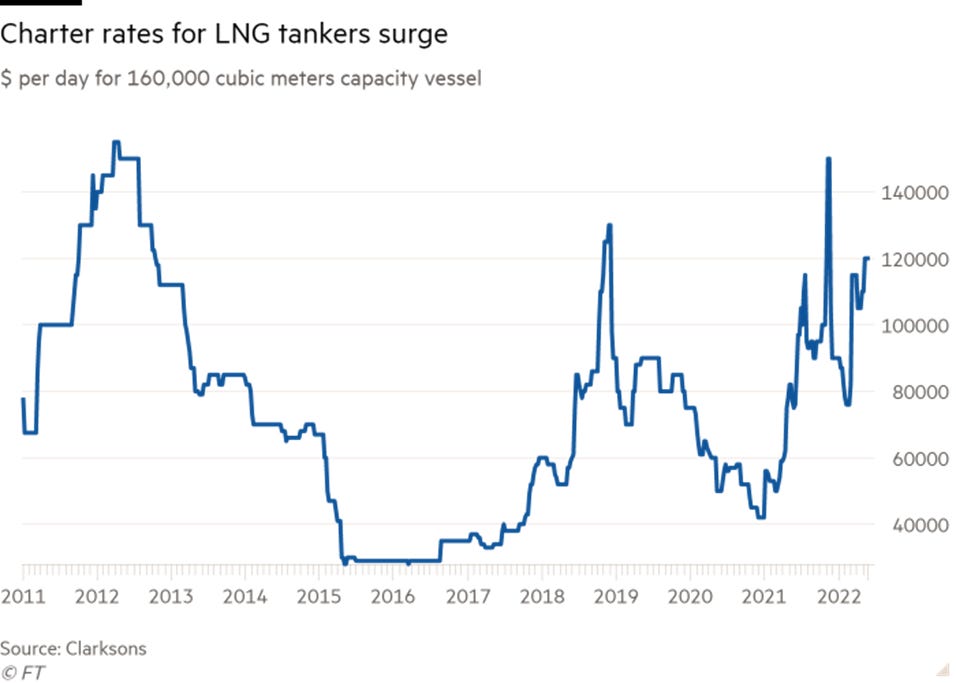

The orderbook for LNG looks terrifying to me as the orderbook is 50% of current fleet. Rates for LNG vessels rose sharply after the invasion of Ukraine but have since plummeted.

LNG tanker rates. Clarksons, FT.

The conflict in the middle east could bring some good news for the LNG sector as Israel is the 30th largest producer of natural gas in the world and Iran is the 3rd largest. However, I am not sure this will benefit the carriers. That said, producers may reap some benefits.

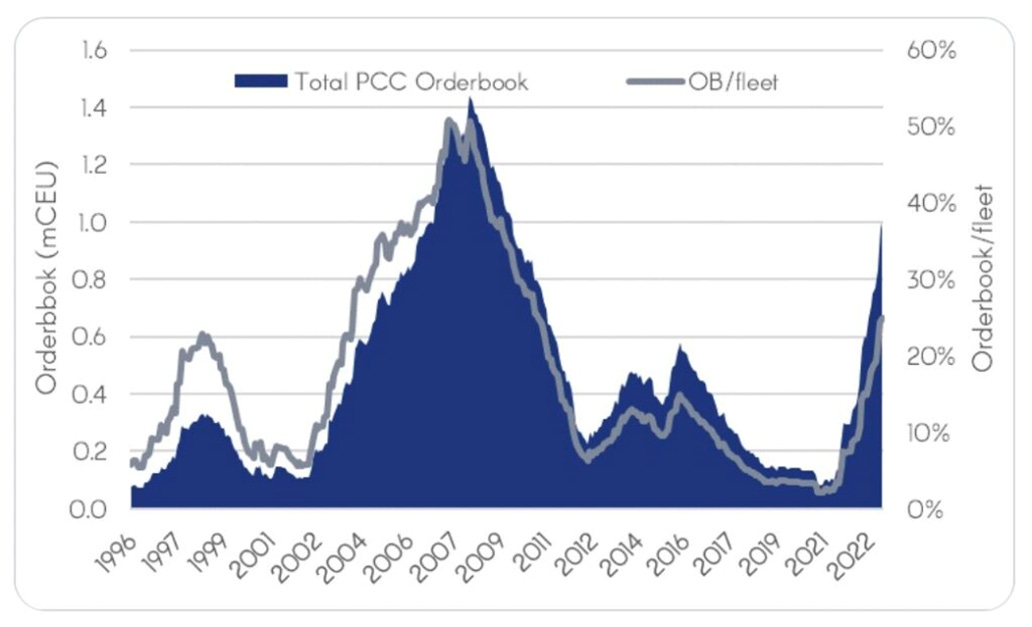

Car carriers

Car carriers orderbook. Gersemi Asset Management.

Car carriers have performed exceptionally well since 2020. However, with a growing orderbook to fleet ratio and protectionism looming over the exports of cars from China, I think the sector may face a setback in the short term.

However, as cars continued to be produced in countries far apart from their consumer, I believe it has a bright future in the long term.

Financial Analysis of Shipping Companies

Shipping companies with NAV data

Data for oil tanker firms. Company fillings, Jefferies. September 2024.

Above you can see data for oil tanker firms. The most important metrics are LTV and NAV as I have mentioned before.

Data for shipping firms. Company fillings, Pareto. September 2024.

Similarly, you can see data for other shipping names above. Although this time there is also EV/GAV which is also an important metric. You may notice that the two data sets report different NAVs for the same companies. This is simply because NAV is somewhat subjective, and it will vary depending on the moment it is calculated and the market value of the ships it takes into consideration, among other factors.

Oil tanker shipping companies with NAV data

Financial data for crude tankers. Company fillings.

The company with the highest average historical gross and operating margins is Okeanis. The firm with the highest average historical net margin is Frontline. However, Okeanis has a much better balance sheet. Okeanis also has a better PE ratio and a slightly better dividend yield.

I am fully aware that dividend yields are a dangerous measure to compare firms. That is why I have also analysed the dividend history of each firm in this report.

In this case, Okeanis has had a more stable dividend policy, and they have increase dividends at every chance they have had.

Okeanis also has a great management team. It has been a family company for over 3 generations. Current CEO Ioannis A. Alafouzos is a graduate from the University of Oxford. And his family owns 56.88% of the company.

In the case of Frontline, John Fredriksen owns 35.55% of the firm. But his track record is not the best. The debacle of Seadrill in 2017 does not paint a pretty picture for his management style.

Of the other firms in the chart, I believe International Seaways is the second best after Okeanis. They have a good management team, a buyback program going on and their balance sheet is formidable. Same goes with Teekay Tankers: Good management and good financials, albeit they are not as good as with Okeanis.

Okeanis also counts with the eco type of ships, and they all have scrubbers. Therefore, their ships pollute less than the rest of their competition. And they are better prepared for tougher environmental rules.

Okeanis has the youngest fleet of the tanker firms I have analysed in this report. This means they will not have to replace their fleet for a very long time. This is not the case with International Seaways as they have an older fleet.

All this said, International Seaways trades at a much lower NAV relative to price than Okeanis. Therefore, I think the International Seaways is a very good choice as well.

Tsakos is also a very good opportunity as it trades at 28% P/NAV, much lower than its peers. One could argue that their management team and high debt implies some risk. However, I think this is unfairly priced in their stock prices. And chances are that they will catch up with its peers.

I would say the least attractive tanker firms are Nordic American and Ardmore. Although they are not attractive for two different reasons.

Nordic American has a bad track record of profitability, and their quick ratio is the lowest among their peers. Whereas Ardmore has a great balance sheet and good margins. But Ardmore has had a massive spike in their stock price (+400% since 2022), while their track record in terms of dividends does not justify it. I think Ardmore would need to improve their policy of returns to shareholders to justify current stock prices.

Clean tankers shipping companies with NAV data

Financial data for clean tankers. Company fillings.

Scorpio has the best average historical gross and operating margins. Their balance sheet is also very good. But I do not trust Robert Bugbee, the president and director of Scorpio. He owns 1.84% of Scorpio.

D´Amico on the other hand is primarily owned by the d`Amico family (60.66% ownership). And they have a very solid balance sheet, just as good as Scorpio I would say. Paolo d'Amico the Executive Chairman of d´Amico has been working at the company since 1971, therefore there are few executives out there who know the industry as well as he does.

Hafnia has very appealing fundamentals as well, but unfortunately, they have been involved this year in an oil spill. And I am not sure what the liability of that event will be.

Most importantly, d´Amico trades at a lower P/NAV than the rest its peers. Therefore, I think it has a good upside and limited downside.

Finally, Torm has excellent fundamentals, and I would love to own some shares of it. But Oaktree Capital Management owns 46.13% of Torm and they have been selling shares recently. I think that if they decide to continue unloading shares of Torm, the share price could be heading lower in the short term.

LPG tankers shipping companies with NAV data

Financial data for LPG tankers. Company fillings.

Dorian LPG has the best average historical gross and operating margins. They also have a very solid balance sheet. However, they have had quite a run these past years. In the past 5 years Dorian is up 210% versus 140% for Avance or 85% for BW LPG.

BW LPG has investments in terminals/infrastructure and their own LPG supply business (Product Services). These assets may be worth a lot more than the market prices in.

Avance Gas has better margins and quick ratio than BW LPG. And Avance has a very young fleet with new vessels coming online in 2025 and 2026. Therefore, they will not have to renew their fleet for a very long time. The only problem I see with Avance is that it is owned by John Fredriksen but since he is not in the management team, I trust that his past mistakes do not impact Avance.

As for Avance Gas, their modern fleet of twelve VLGCs (Very Large Gas Carriers) is being sold. After the closing of this transaction, Avance Gas will then be the owner of four medium sized gas carriers (MGC) capable of carrying full ammonia cargoes, a 12.77% shareholding in BW LPG as well as a substantial cash holding.

Although I do not trust John Fredriksen, his companies: FLNG, FRO, GOGL and AGAS, are considered high quality stocks in the shipping industry.

Most importantly, Avance trades at a lower P/NAV than its peers in this report. Therefore, I think it has a good upside and limited downside.

Dry bulk shipping companies with NAV

Financial data for dry bulk firms. Company fillings.

The best margins among these firms are those of 2020 Bulkers. However, they do not have as much financial data out there as Star Bulk or Belships.

In terms of their latest financial reports (LTM), Star Bulks has the second-best margins after 2020 Bulkers. However, 2020 Bulkers trades at a much more expensive P/NAV than Star Bulk, therefore I believe the latter is a safer option and that is why I own it.

Belships and Star Bulk trade at a similar P/NAV, but Star Bulk has a better balance sheet than Belships. Belships has also had a better run in the stock market than Star Bulk, being the first up 200% in 5 years and the latter 100%.

Petros Pappas the CEO of Star Bulk owns 3.4% of the firm which is great to see. Oaktree also owns share in Star Bulk but only around 6.4%, not as many as with Torm, and I have not seen them selling shares in Star Bulk.

All this said, if you are very bullish for the dry bulk market, I think Himalaya Shipping is your best option. They are extremely leveraged to the dry bulk market as their entire fleet is new. If the dry bulk market performs well, you will see very large dividends as they will give out 100% of FCF.

LNG tanker shipping companies with NAV data

Financial data for LNG tanker firms. Company fillings.

As I mentioned before the LNG orderbook is very unappealing to put it mildly. Therefore, I have not invested in the sector. But if I were to invest, I think Cool Company looks very interesting as they trade at a relatively cheap P/NAV and they have great margins. Golar also looks very interesting as their short-term catalysts seem to be working out lately.

Other tanker shipping companies with NAV data

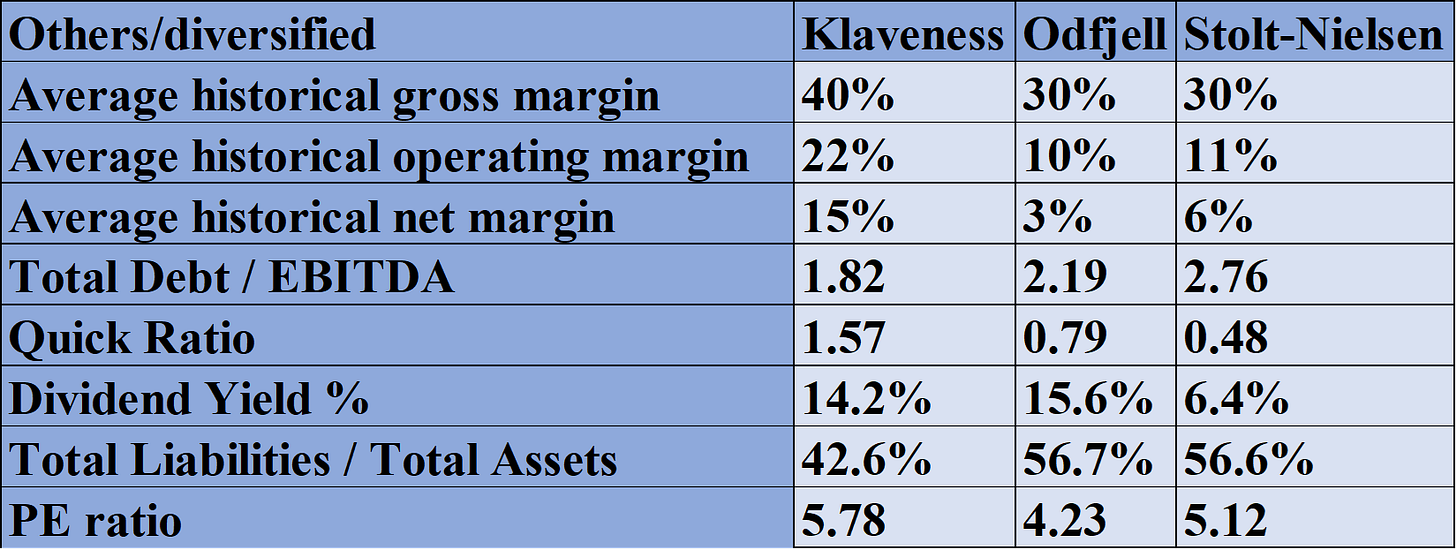

Financial data for other tanker firms. Company fillings.

From the firms above I believe the most interesting are Odfjell and Stolt as they trade for less than 70% of P/NAV. Odfjell is paying very good dividends.

However, Klaveness has much better margins than the other two and has a better balance sheet.

Shipping companies without NAV data

Other tanker shipping companies without NAV data

Financial data for crude and product tanker firms. Company fillings.

From these two firms I think Euronav is the most interesting, albeit Knot has a highest average gross and operating margin. Euronav is profitable, it has lower debt levels and higher net margins. Furthermore, Euronav has a lot of Newcastlemax vessels coming online this year and the next 3 years, therefore it will have a lot of exposure to dry bulk and a younger fleet. Euronav has also had a more stable and growing dividend policy whereas Knot has been decreasing its dividend.

Other shipping companies and diversified parent firms without NAV data

Financial data for other shipping companies and diversified parent firms. Company fillings.

From the firms above the one with the best balance sheet is Teekay Corp, although if I were looking for tanker exposure I would rather own shares in Teekay Tankers and not the parent company.

The other two firms that stand out are Navios and SFL Corp. Navios trades for a very low PE ratio and the market does not appropriately price the market value of its vessels. Furthermore, the management at Navios is increasingly shareholder friendly, which is an improvement from the past years. Angeliki Frangou, the CEO of Navios has built the company from scratch and has 6.15% of the shares. Therefore, I think it is a good opportunity in the market. I recently sold shares in Navios in my personal account, but I still hold it in accounts I manage.

SFL Corp also stands out as it has very strong margins, decent management, and a good track record of paying dividends. Also, SFL has been buying back shares.

LNG tanker firms without NAV data

Financial data for LNG tanker firms. Company fillings.

The only other LNG firm I have found worth analysing, apart from the ones I have found the NAV of is Dynagas. They have strong margins and a decent balance sheet. However, the fact that they pay no dividends while they are profitable does not make sense to me. Also, their website does not give a lot of information that other peers do give, and that is somewhat of a red flag in my opinion.

LPG tanker firms without NAV data

Financial data for LPG tanker firms. Company fillings.

Stealth Gas has lower margins than Navigator, but their balance sheet is stronger. Furthermore, Stealth Gas is buying back shares, which is a positive move towards a more shareholder friendly policy. However, I fear this is too little as the company has ample capacity to pay dividends and buy back shares. Their website is also terrible in terms of the data they provide.

Navigator on the other hand is a very good opportunity. They have stronger margins than Stealth Gas and they pay dividends. They have a good balance sheet and have a very large LPG fleet. They also own 50% in worlds largest ethylene export terminal. And I believe the market does not give Navigator credit for this terminal. I believe the firm could be taken over as its assets are very attractive.

Dry bulk firms without NAV data

Financial data for dry bulk firms. Company fillings.

The historical average margins for dry bulk firms reflect how much pain the sector has endured. To reflect a better picture of the current situation I have added the LTM net margins.

The company with the best balance sheet is Genko. However, their fleet is very old, and they will have to renew it soon. Therefore, I do not think it is a good candidate for dividend investing or capital appreciation. Although if shipping rates for dry bulk continue to rise, it will make all these companies more valuable.

Safe Bulkers is the most interesting of these companies as their current net margin is the highest of the group and they have a strong balance sheet. The age of their fleet is much lower than that of Genko.

I have owned Seanergy, but I recently sold it as I was lucky enough to buy it near the all-time lows.

Diana Shipping is also quite interesting as I believe their dividend policy is sustainable, and the market is not pricing that properly.

Containership and liner firms without NAV data

Financial data for containership and liner firms. Company fillings.

An important note: There are two kinds of businesses in this segment: Lessors and liners.

Containership owners (also referred to as owners, charter-owners, and containership lessors) own containerships and lease, or charter, them out to liner companies. The proportion of global fleet capacity provided by containership owners/lessors increased from around 16% in 1995 to approximately 54% by the end of 2018 – which is broadly where it remains today. For example, Global Ship Lease (GSL) is a containership owner, leasing ships to container shipping companies under industry-standard, fixed-rate time charters.

Liner shipping companies (also referred to as lines, liner operators, carriers, and containership operators) are logistics service providers responsible for the seaborne, and often also inland, transportation of containerized goods; they negotiate freight rates with shippers themselves, or with third parties such as freight forwarders/consolidators. Liner companies either operate ships that they themselves own, or lease (charter) vessels from containership owners. In the context of this business, liner operators are most commonly referred to as charterers.

For those investors seeking to invest in very large companies, containerships offer them quite a few options. Firms like COSCO, SITC, Matson or Maersk have multibillion dollar market caps. However, since I do not find Chinese companies appealing due to lack of accounting standards, I think the first two options are not interesting. Maersk has a better balance sheet than Matson but somewhat lower margins. However, I am not a large cap investor as there are fewer opportunities there, so I will let you judge for yourself.

The firm with the best gross and operating margins is Danaos Corp, however some of the margins have been affected by the appreciation of some their investments, particularly in Zim. Therefore, I would say the firm with the best gross and operating margins is Global Ship Lease. However, I believe investors are growing impatient as Global Ship Lease is not raising their dividends.

The firm I think is the best investment opportunity is Danaos. Not only they have strong margins (excluding extraordinary items), but they have the strongest balance sheet and the lowest PE ratio among the group.

If you are very bullish on containerships, then maybe Zim is your best option. They are very exposed to the spot market, and will give out pretty much all FCF in dividends. However, I believe Danaos is the best play here although I just recently sold it for a large profit. However, I still hold a large amount of shares in Danaos through an account I manage

Small shipping firms without NAV data

Financial data for small shipping firms. Company fillings.

Most small firms in shipping have severe corporate governance issues. However, since a lot of them trade below net cash and below net current asset value (NCAV), a lot of investors are interested in them.

The companies that have gathered the most interest are Imperial Petroleum and Castor Maritime. However, both have diluted the companies beyond recognition, and their management teams are sometimes in conflict of interest when doing transactions. That said, Imperial Petroleum would be the only one I would be interested in buying shares of, as the management team has become a bit more shareholder friendly.

This said, given that you can buy shares in the highest quality shipping firms in an environment that is highly favourable towards shipping, I see no reason to own this small firms that are commonly referred at as “ShitCos” (Pardon my French) given their terrible management teams. You can buy great companies like Okeanis or Star Bulk for their dividends, and enjoy the market dynamics of the shipping sector and its tailwinds. Or buy firms like Navios or Tsakos that trade for a fraction of their NAV.

Therefore, I see no point in owning these small firms. Nevertheless, a lot of users asked me to add them to the report and so I did.

Car shipping firms without NAV data

Financial data for car shipping firms. Company fillings.

The two main car carrier firms in the stock market (that I know of) are Hoegh Autoliners and Wallenius Wilhelmsen. Wilhelm Wilhelmsen is one of the parent companies of Wallenius Wilhelmsen.

I have owned both Hoegh Autoliners and Wallenius Wilhelmsen in my personal account and in those accounts which I manage. But they have had a great run in the stock price, and there might be near term headwinds. These companies rely on consumers in Europe and America demanding cars which are manufactured overseas. And both in Europe and America there is the threat of tariffs on said cars. Therefore, there might me some turmoil on the short-term stock price action of these firms.

In the long term I think these firms will perform very well as cars will continue to be manufactured far away from the end consumer. However, the short term of these firms does not look great.

Small shipbuilding firms without NAV data

Financial data for small shipbuilding firms. Company fillings.

Just like in dry bulk, shipbuilders have had a tough time in the past years. That is why their average margins are terrible and I have included their current LTM net margins.

I think the most interesting company is Marco Polo Marine. Their current net margin is the second highest and they have the strongest balance of the group.

However, due to the very high capital-intensive nature of this industry I do not want to own them in my portfolio.

Offshore drilling firms without NAV data

These firms have been very tough to analyse, since I have had to make a lot of assumptions in their valuations and their book values are meaningless.

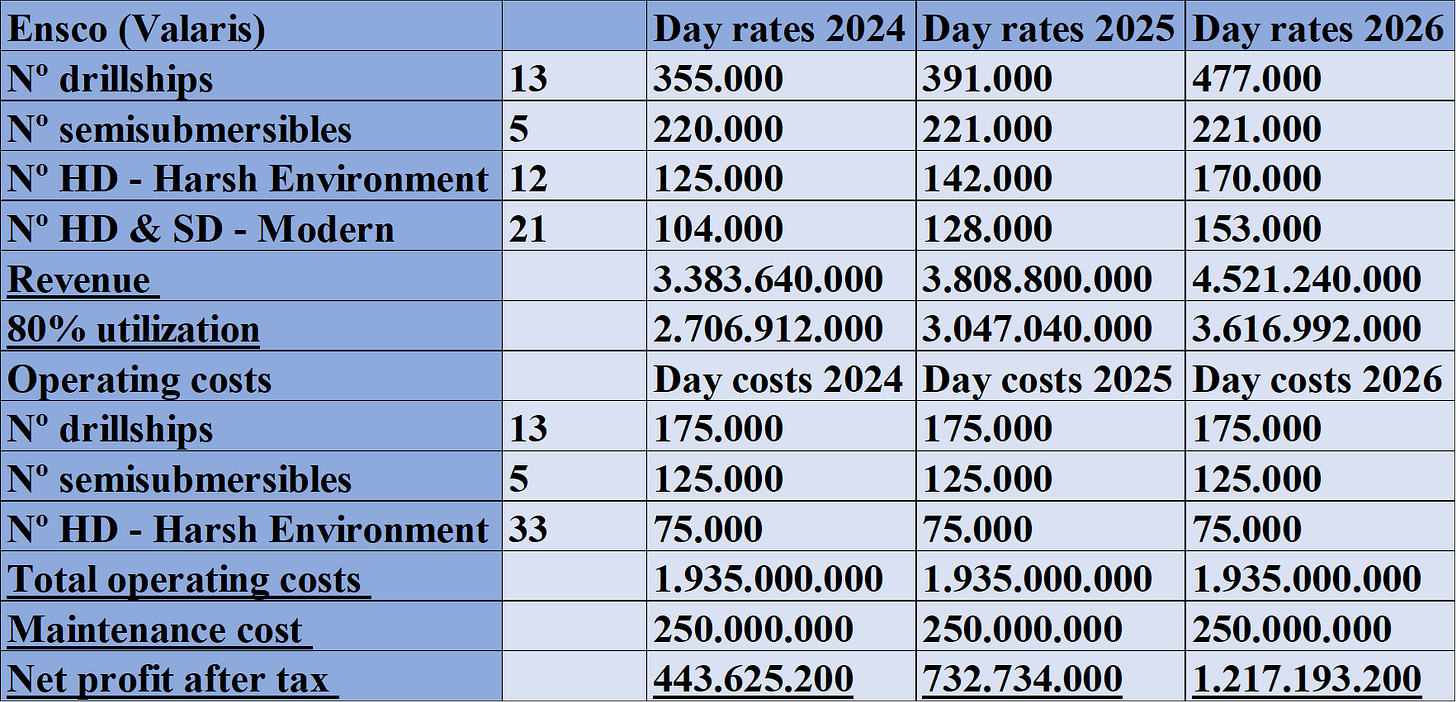

The assumptions I have are based off the data I have gathered on Ensco (Valaris), and I have applied these assumptions to the drilling firms I find the most interesting.

The assumptions are the following:

· All firms will have the same day rates and operating costs per day as Ensco.

· Maintenance cost of $250M per year for Ensco. I have extrapolated that number into the models of the other firms depending on the number of vessels.

· 15% income tax.

· To chose which companies I model I have chosen those with the best margins and balance sheet: Ensco (Valaris), Noble and Seadrill.

I am sure that in these assumptions I have made mistakes, and they are overly simplistic, but valuation is an art, not a science. So, for me that is enough to know whether a company is cheap or not. I do not require of very precise numbers. That said, I am looking forward to any advice and feedback on how to improve my future analysis, whether it be of drilling firms or other companies.

Financial data (income) for drilling firms. Company fillings.

Just like with dry bulk or shipyards, the offshore drilling sector has gone through some very difficult years. This is reflected in the income margin data.

This said, from the charts above and below this text, it is clear to me that the strongest players in the industry are Ensco (Valaris), Noble and Seadrill. All of which I have valued according to the assumptions I mentioned.

Financial data (debt) for drilling firms. Company fillings.

This said, its also clear that the weakest company of all is Transocean, which seems to me its headed towards bankruptcy unless day rates go even higher.

When looking at the models please bear in mind that in Spain we use dots and comas for the opposite uses than in the English-speaking world. In the rest of the charts (and reports I have published), I have been able to make it more friendly towards English speakers. But in the models, it was more difficult due to the very large sums. So, for example if you read 400.000 that is 400 thousand.

Valuation for Ensco (Valaris). Company fillings, own estimates.

I estimate that for 2024 Valaris should earn over $440M. For 2025 it should earn $732M and for 2026 it should be around $1,217M. It now trades with a market cap of $4,000M so its trading at around 3.3 times what it will earn in 2026.

Valuation for Seadrill. Company fillings, own estimates.

I estimate that for 2024 Seadrill should earn just under $400M. For 2025 it should earn $514M and for 2026 it should be around $780M. It now trades with a market cap of $2,750M so its trading at around 3.5 times what it will earn in 2026.

Valuation for Noble. Company fillings, own estimates.

I estimate that for 2024 Noble should earn just over $700M. For 2025 it should earn $926M and for 2026 it should be around $1,415M. It now trades with a market cap of $6,340M so its trading at around 4.48 times what it will earn in 2026.

The valuation gap of Seadrill and Valaris relative to their market caps is pretty close. However, Anton Dibowitz, the CEO of Valaris own $12M in stock of the firm, whereas Simon Johnson, the CEO of Seadrill owns no shares in the firm. For me this is an immense difference in terms of how management approaches the company. That is why in my personal account, and in the account which I manage I own shares in Valaris, albeit I own them indirectly through Mongolia Growth Group.

Conclusion

The shipping industry has strong tailwinds that will favour it in the next few years. The main tailwind being the lack of shipbuilding capacity which is creating a bottleneck that is very difficult to solve: The world needs more ships than its capable of making. Considering it takes years and millions of dollars to build shipyards, this shortage will not disappear anytime soon. Another tailwind may be geopolitics, which is already playing a significant role since very few ships can now cross the Suez Canal. All these factors are increasing day rates for shipping firms and will continue to do so.

This industry is very unknown for most investors and therefore it makes it ripe with investment opportunities. And many firms in this industry pay no income taxes, therefore more money can be reinvested or returned to shareholders, this makes it a great place to invest in a world facing ever growing tax rates.

In conclusion, I think the shipping industry and its firms should have a place in everyone´s portfolio, including mine. Although right now I am only invested in shipping firms for its dividends to cover my everyday costs, I have been very heavily invested this past 2 years and I have made a lot of money. I continue to be heavily invested in this industry through an account I manage.

I want to thank Manuel, a friend and a subscriber to the blog who has taught me a lot about shipping throughout the years.

Any feedback is more than welcome in the comments, or you can send me a message on Substack or through my twitter (X) account @AAGresearch.

As always, I want to thank my girlfriend Yeimy, who has helped me a lot while I was writing this by myself. This report and this blog would not be possible without her. Thank you.

I hope this finds you well,

Alberto Álvarez González.

Disclaimer: I assume no liability for any and all of your actions, whether derived out of or in connection with this information or elsewhere, and you hereby warrant and represent that any and all actions that you take or that you may take at a later date in connection with this information shall remain your sole responsibility and, in case, I shall not be held liable for any such actions.

Hi, just a few comments regarding LNG sector.

-This sector is very dominated by longer TC contracts, hence the high orderbook is not necessarily that dangerous. Cool Company trades in the spot market and can be affected more than this than for example Flex LNG who has longer charters, where you can expect more steady dividends. However I read your investment strategy, and I agree that this sector is probably not 500% potential at the moment.

-Golar LNG is not really an LNG shipping company but an FLNG operator, although they own 1 LNG carrier. They are more in the upstream sector, which cools down the gas for transportation. Fun fact: they sold all their carriers to Cool Company.

Great article, very interesting read and thank you for sharing.

Amazing work. Congratulations!!!